- AUD

- CAD

- CHF

- EUR

- GBP

- HKD

- JPY

- NOK

- SEK

- USD

- NGN

Luxury Real Estate Europe

Exclusive Homes Sales Europe

Our Featured Exclusives

Explore our luxury homes for sale from all over Europe

Completely renovated hotel with 27 rooms in the best location of the thermal resort of Heviz!

- Beds: 27

- Baths: 30

Just Listed

Luxury properties from across Europe

Exceptional 7 bedroom luxury villa with spectacular sea views in a unique location

- Beds: 7

- Baths: 8

- Garage: 1

- 500 m²

Luxury Villa 3+1 Near To The Beach Yeni Boğaziçi North Cyprus

- Beds: 3

- Baths: 4

- 500 m2 m2

Welcome to EuropeanProperty.com: Luxury Real Estate in Europe

At EuropeanProperty.com, we’re delighted to extend a warm welcome to all discerning real estate enthusiasts. If you’re in pursuit of Europe’s finest luxury real estate, prime properties, and high-end residences, you’ve arrived at the perfect destination.

Discover Europe’s Luxury Real Estate

Our exclusive listings showcase Europe’s most exquisite properties, including magnificent mansions, contemporary homes that define modern luxury living, and pristine land plots awaiting your vision. With a commitment to excellence, we bring you the crème de la crème of European real estate.

Discover Your Drean Luxury Home in Marbella

With its stunning beaches, exceptional restaurants, and world-class shopping, Marbella is the perfect place to call home for those seeking a luxurious lifestyle. And with so many incredible properties on offer, finding your dream luxury villa in Marbella is just a matter of time.

At European Property, we specialise in luxury properties in Marbella and the surrounding areas. You can check the listing of luxury houses and villas on our website or contact us directly for personalised assistance in finding your perfect home. Don’t settle for anything less than the best – start your journey towards luxury living in Marbella today. So don’t wait any longer. Take the first step towards owning your dream luxury villa in Marbella now. Learn more

luxury Berlin real estate

Whether you seek to relocate, buy a second home, or make a sound investment in property in Berlin. Help is on hand to find, buy or sell luxury real estate in Berlin, Germany

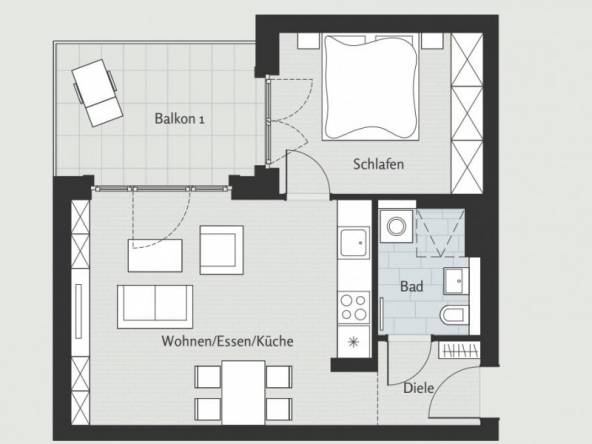

Brand-new Uspcale 2-room apartment for sale at Winterfeldtplatz in Schoneberg

- €560,317

- 1 Bedroom

- 1 Bathroom

Trendy location next to KaDeWe – commercial unit for sale

- €502,298

- 0 Bedroom

- 0 Bathroom

Close to Helmholtzplatz: Tenanted 2-room apartment with balcony in Prenzlauer Berg

- €467,000

- 1 Bedroom

- 1 Bathroom

Luxury Property Finding Service

From period luxury homes to modern off plan developments. Speak to us about your purchase

Search for luxury real estate Europe

From a Mansion in London, a Penthouse in Berlin to a bolt hole in the Balearic Islands we specialise in luxury European real estate

Land For sale Europe

If you seeking land for the commercial or residential project you are in the right place. With a huge network of partners across Europe we can help you source land for sale.

Excellent Plot of land for Development for sale in Loule Laguna Resort Vilamoura

- €19,800,000

- Bed: 0

- Bath: 0

- Land

For those seeking land for sale in Europe, there are numerous enticing options to explore. Some good places to consider for land purchases include:

Algarve, Portugal: Algarve offers beautiful land plots for those looking to create their dream homes with scenic views of the Atlantic Ocean.

Tuscany, Italy: Tuscany’s countryside is a fantastic choice for investing in land for vineyards, olive groves, or building your Tuscan estate.

Costa del Sol, Spain: The picturesque landscapes of Costa del Sol provide opportunities for land investments, whether for development or private estates.

Santorini, Greece: The volcanic beauty of Santorini offers unique land plots with panoramic views, ideal for creating luxury retreats.

See: Land Sales Europe

Our services

Real Estate Blog

Find a host of articles about Luxury real estate, mortgage advice and buyers tips for high end real estate

FAQs.

Luxury real estate Europe

Find luxury homes for sale all over Europe with Europeanproperty.com

Purchasing luxury homes in Europe can be a complex process given the diversity of countries, cultures, legal systems, and market conditions in the continent. Here are some of our frequently asked questions (FAQs) specific to the luxury home market in Europe:

Is it possible for non-EU citizens to purchase luxury homes in Europe?

- Answer: Yes, in most European countries, there are no restrictions against non-EU citizens purchasing property. However, each country has its property ownership regulations, and potential buyers should consult local experts.

Do luxury homes in Europe come with a residency permit or citizenship?

- Answer: Some European countries offer residency permits or citizenship through real estate investment, commonly referred to as “Golden Visa” programs. Countries like Portugal, Spain, and Malta are known for these programs, though investment amounts and conditions vary.

What are the property taxes associated with luxury homes in Europe?

- Answer: Property taxes vary significantly between European countries and even within regions of those countries. Potential buyers should research local tax rates and consult with tax professionals familiar with the specific country.

Where are the prime luxury real estate locations in Europe?

- Answer: Renowned luxury real estate locations include the French Riviera, central London, Marbella in Spain, Lake Como in Italy, and Monaco, among others.

How has the COVID-19 pandemic affected the European luxury real estate market?

- Answer: The pandemic led to varying impacts across Europe, with some areas seeing price dips or stagnation, while others saw increased demand, especially in areas offering larger spaces and privacy.

What is the average price per square meter for luxury real estate in major European cities?

- Answer: Prices can fluctuate widely. For instance, Monaco, London, and Paris typically have higher prices per square meter compared to cities in Eastern Europe. Buyers should consult recent market reports for precise figures.

Are there any special considerations for historical luxury properties in Europe?

- Answer: Yes. Historic or listed properties may come with restrictions regarding renovations or alterations to preserve their historical or architectural significance.

How do I ensure the legitimacy of property titles and avoid potential legal pitfalls?

- Answer: Always work with reputable real estate agents and legal professionals familiar with local property laws and regulations. They can help verify property titles, zoning laws, and other potential issues.

Is financing available for foreign buyers of luxury homes in Europe?

- Answer: While financing is available in many European countries, conditions and interest rates can vary. Some banks might be hesitant to lend to foreign buyers without a strong financial presence in the country.

How does the property purchasing process in Europe compare to other continents?

- Answer: The purchasing process can be different from one European country to another and can vary greatly compared to processes in countries on other continents. Factors such as due diligence, contract structures, and closing procedures can be quite distinct.

- Can I rent out my luxury property when I’m not using it?

- Answer: In most European locations, you can rent out your property, but there may be local regulations and tax implications to consider. Always consult local experts before making a decision.

Luxury European Real Estate

Unveiling a Legacy of Luxury Real Estate Excellence

Since its inception in 1999, EuropeanProperty.com has been an unwavering beacon in the realm of luxury European real estate. With a storied history spanning over two decades, our platform stands as one of the most established and trusted luxury property websites in Europe. A bastion of opulence, EuropeanProperty.com showcases some of the continent’s most exceptional homes, inviting discerning buyers to explore and indulge in the finest living experiences.

Exploring Europe’s Finest Homes

Embark on a journey through Europe’s most coveted addresses as EuropeanProperty.com opens the doors to opulent living. The platform boasts a curated selection of luxury homes that represent the epitome of luxury, elegance, and architectural mastery. From historic castles that whisper tales of centuries past to sleek modern penthouses that redefine contemporary living, each property featured on EuropeanProperty.com has been handpicked to encapsulate the essence of grandeur.

Your Gateway to Luxury Real Estate

EuropeanProperty.com isn’t just a website; it’s a gateway to a world of sophistication and refinement. For over two decades, it has served as the premier destination of Luxury European real estate for those who seek not just a home, but an embodiment of their aspirations. With an intuitive interface and comprehensive search options, navigating the exquisite listings is a seamless experience. Whether you’re drawn to the sun-kissed shores of the Mediterranean or the serene Alpine retreats, EuropeanProperty.com provides a gateway to the most sought-after luxury real estate across the continent.

Curating Opulent Residences Across the Continent

At the heart of EuropeanProperty.com’s legacy is its commitment to curating opulent residences that redefine the concept of home.

Selling a Luxury Home

Selling a luxury property isn’t merely a transaction; it’s an art form that requires an intricate understanding of the market’s nuances. EuropeanProperty.com acknowledges this by providing a range of resources and insights to both buyers and sellers. From staging and presentation to exclusive marketing strategies, the platform offers a glimpse into the world of high-end real estate transactions.

Desirable Locations for Luxury Homes

Europe’s allure is undeniable, with its rich tapestry of landscapes, cultures, and histories. Some of the most sought-after locations for luxury homes include:

Côte d’Azur, France: The French Riviera, where azure waters meet opulent villas, is a timeless destination for those seeking the pinnacle of luxury and sophistication.

Amalfi Coast, Italy: The dramatic cliffs and charming towns of the Amalfi Coast set the stage for coastal properties that are as breathtaking as the views they command. Find luxury real estate Italy

- The Algarve Portugal: Superb luxury Algarve real estate designs including modern contemporary styles luxury villas to high-end Algarve real estate for lovers of Golf

- Berlin Germany: From luxury penthouses to investments for overseas buyers, Berlin has a wealth of luxury real estate.

Marbella, Spain: We source exclusive Luxury homes for sale Marbella Marbella’s Mediterranean allure and exclusive lifestyle are complemented by a diverse range of luxury properties, from beachfront mansions to hilltop retreats.

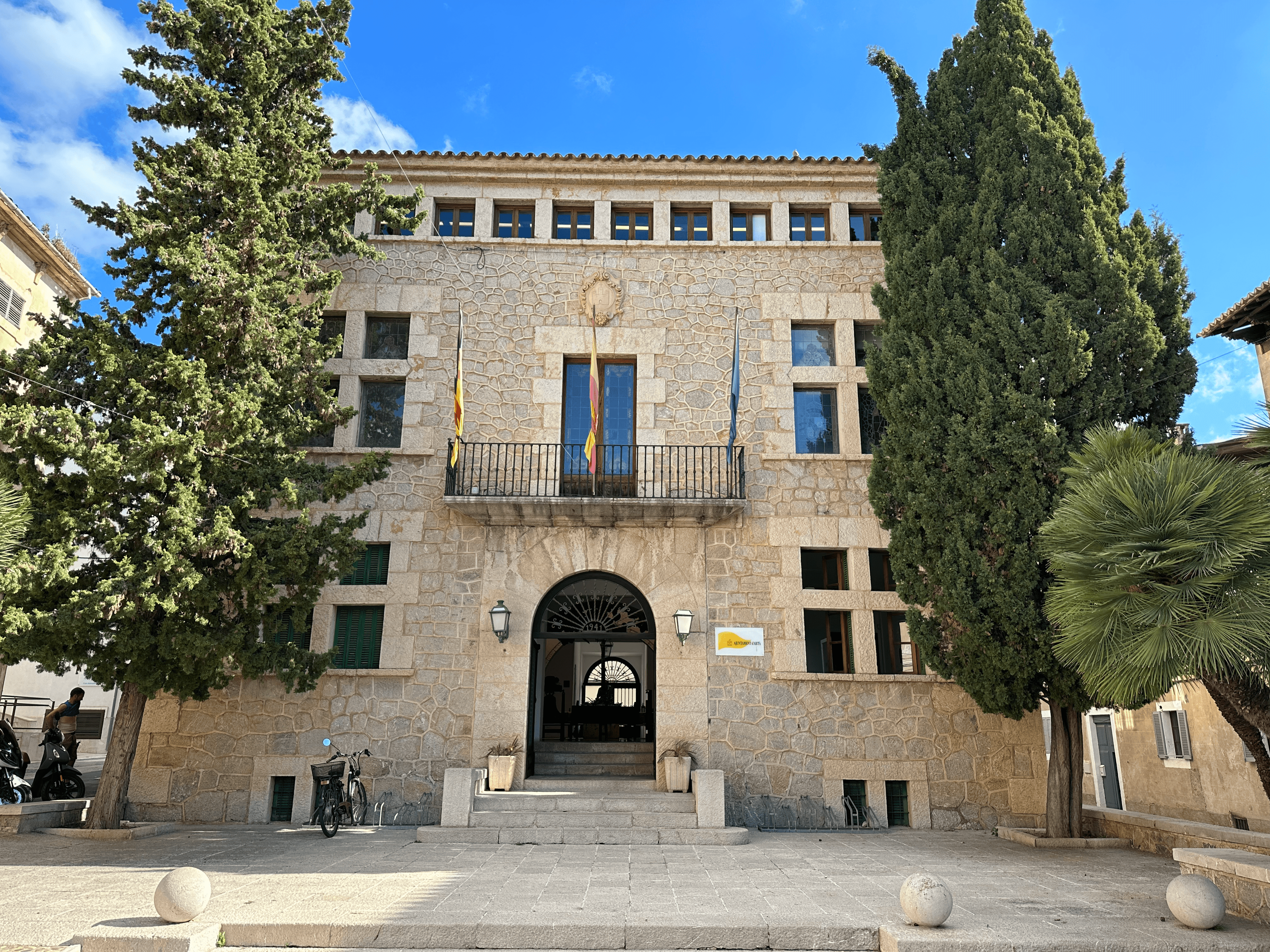

Mallorca, Spain: Known for its diverse landscapes and upscale lifestyle, Mallorca features luxury properties in areas like Palma de Mallorca and exclusive beachfront locations

Geneva, Switzerland: A hub for luxury real estate, Geneva’s financial prowess is matched only by its stunning natural surroundings. Lakeside properties and penthouses offer unparalleled views of the city and the Alps.

St. Moritz, Switzerland: Renowned for its winter sports and high-end amenities, St. Moritz offers luxury chalets and upscale properties in a stunning alpine setting.

- Ibiza, Spain: While known for its vibrant nightlife, Ibiza also boasts exclusive villas and properties that attract affluent buyers seeking both entertainment and relaxation. See our luxury homes for sale in Spain

- London, England: From classic elegance in Kensington’s Georgian townhouses to modern luxury in Chelsea’s penthouses, London’s property market remains a global magnet for discerning international buyers.

- Sardinia, Italy: This Mediterranean island offers exclusive resorts, stunning beaches, and high-end villas, making it a hotspot for luxury property buyers.

- Cap Ferrat, France: This peninsula on the French Riviera is home to opulent villas and offers stunning views of the Mediterranean.

EuropeanProperty.com has not only stood the test of time but has continued to shine as a beacon of luxury and elegance in the world of real estate. With a legacy spanning over two decades, this platform remains committed to curating opulent residences, serving as a gateway to Europe’s finest homes, and guiding buyers and sellers through the intricate world of luxury real estate transactions. Explore, indulge, and experience the epitome of European elegance with EuropeanProperty.com

House Sales Europe

A Comprehensive Overview

The European real estate market has seen its fair share of fluctuations and trends in recent years. Whether you’re a prospective buyer, seller, or just curious about the housing market, here’s an informative guide to house sales in Europe.

1. Diverse Market Trends

- Europe’s housing market is incredibly diverse, with variations in supply, demand, and pricing across countries and cities.

- Northern European countries like Sweden and Germany have witnessed steady price growth, while southern European nations like Spain and Italy experienced more volatility.

2. Impact of COVID-19

- The pandemic has influenced European house sales, leading to temporary slowdowns and disruptions in 2020. However, many regions rebounded strongly in 2021 as vaccination efforts progressed.

- Remote work and lifestyle changes prompted increased interest in suburban and rural areas.

3. Housing Affordability

- Housing affordability remains a challenge in major European cities like London, Paris, and Amsterdam. Prices often outpace wage growth, making it difficult for first-time buyers to enter the market.

- Some countries have implemented policies to address affordability issues, including rent controls and incentives for new homebuyers.

4. Investment Opportunities

- Real estate remains an attractive investment in Europe, offering potential for rental income and long-term capital appreciation.

- Popular destinations for real estate investment include cities with strong economies, tourism, or educational institutions.

5. Green Initiatives

- Europe is increasingly embracing sustainability in housing. Many countries are implementing eco-friendly building standards and offering incentives for energy-efficient homes.

- Green certifications like LEED and BREEAM are gaining importance in the market.

6. Digitalization

- Technology is transforming the house sales process in Europe. Online platforms, virtual tours, and digital signatures are becoming standard.

- Real estate agencies are investing in data analytics to provide valuable market insights to clients.

7. Legal Considerations

- Each European country has its own legal and regulatory framework for house sales. It’s crucial to understand local laws, taxes, and property rights when buying or selling.

- Legal processes can vary significantly, so consulting with local experts is advisable.

8. Brexit Impact

- Brexit has implications for property transactions involving the UK and EU countries. New rules and tariffs may apply, so buyers and sellers should be aware of these changes.

9. Currency Exchange

- If you’re an international buyer or seller, currency exchange rates can impact the cost of transactions. It’s wise to monitor exchange rates and consider hedging options.

10. Future Outlook

- The European housing market is expected to continue evolving. Sustainable, energy-efficient homes and properties in well-connected regions are likely to remain in high demand.

- Economic and political factors will play a significant role in shaping future market trends.

Note: When navigating the European house sales market, it’s essential to conduct thorough research, seek expert advice, and stay informed about local and global factors that can influence your real estate transactions See House Sales Europe