For the international investor, the prospect of buying an apartment in Vienna is not merely about acquiring a residence; it is a strategic entry into one of Europe’s most stable and resilient luxury property markets. Vienna presents a rare synthesis of exceptional quality of life, robust economic stability, and steady capital appreciation. This combination makes it a premier destination for those seeking to diversify their portfolio and preserve wealth.

See Luxury Property For Sale Vienna

Why Vienna’s Property Market Is a Prudent Investment

Vienna consistently tops global liveability rankings, but its allure for the seasoned investor extends far beyond its celebrated opera houses and coffee culture. The city’s property market is defined by a simple yet persistent imbalance: strong, continuous demand from a growing population meets a constrained supply of new, high-quality apartments.

This dynamic cultivates a landlord-friendly environment, underpinning both rental income and long-term asset growth. For those looking to buy an apartment in Vienna, this translates into a secure, blue-chip investment.

Current market conditions only serve to strengthen this case. Recent analysis indicates that demand is intensifying just as new construction slows. Average rents for newly built investment properties are projected to reach nearly €16.00 per square metre in 2025—a significant rise from previous years. Concurrently, purchase prices have seen only modest increases, which enhances the potential for rental yields. In prime locations, these now exceed 3%.

An insightful market report from EHL Real Estate details just how robust the city’s fundamentals are.

A Market Defined by Resilience

Unlike some of Europe’s more volatile capitals, Vienna’s property market is characterised by stability, not speculative bubbles. This resilience is a significant draw for high-net-worth individuals who prioritise capital security. The city’s economic strength, combined with historically low vacancy rates, ensures a consistent and reliable income stream for property owners.

“Vienna offers a unique proposition for global property investors,” notes Nick Marr, founder of EuropeanProperty.com. “It combines the prestige of a historic European capital with the pragmatism of a modern, growing economy. It’s a market that rewards a long-term perspective, consistently delivering value without the speculative risks found elsewhere.”

Key Drivers for Investors

What makes Vienna such a compelling choice for luxury property investment in Austria? Several key factors stand out:

- Strong Rental Demand: A constant influx of international professionals, students, and new residents fuels a very healthy rental market. You will never be short of potential tenants for a well-located asset.

- Limited Supply: Vienna has stringent building regulations and a genuine scarcity of development land, particularly in the central districts. This naturally protects property values by preventing oversupply.

- Economic Stability: Austria’s powerful economy and Vienna’s status as a major international hub provide a secure backdrop for any real estate investment.

Understanding Austria’s Property Laws for Foreign Buyers

Navigating the Austrian legal system can seem daunting at first, but it is, in fact, one of the most structured and secure processes in Europe—designed to protect all parties involved. For an international investor, especially from outside the EU, mastering this framework is the first and most critical step to successfully buying an apartment in Vienna.

The entire process is methodical, progressing from the initial purchase offer (Kaufanbot) through to the final entry in the Land Register (Grundbuch). This is not mere bureaucracy; it is a robust system that provides your investment with a formidable layer of security.

Key Legal Professionals in Your Transaction

Unlike property markets in many other countries, the Austrian system divides responsibilities between two key legal professionals. You absolutely need both on your team. This is not just a recommendation—it is essential for a secure purchase.

- The Notary (Notar): Consider the Notar as the neutral, state-appointed referee. Their role is to draft and certify the final purchase agreement, ensuring it is legally watertight. Crucially, they also oversee the secure transfer of your funds through a protected escrow account, known as a Treuhandkonto.

- The Lawyer (Rechtsanwalt): Your lawyer is exclusively on your side. They are your personal advocate, conducting thorough due diligence on the property, scrutinising every contract before you sign, and representing your interests in any negotiations. Their purpose is to protect your rights, unequivocally.

The Hurdle for Non-EU Buyers

For anyone holding a passport from outside the EU/EEA, there is one additional, non-negotiable step: obtaining approval from the local Municipal Land Transfer Commission (Grundverkehrskommission). Without this authorisation, the purchase cannot legally proceed.

To secure approval, your application must demonstrate a clear “social or economic interest” in the property. Do not be deterred by the official terminology. For a luxury apartment, this could be as straightforward as showing how your investment benefits the local economy, or demonstrating that you plan to use it as a primary or secondary home, becoming part of the community.

This approval process is a formality, but a critical one. A well-prepared application, handled by an experienced Austrian lawyer, typically proceeds smoothly, though it can add two to three months to the overall timeline. It is a procedural step, not a barrier for a serious investor.

Your legal team will be instrumental here. They will assemble a compelling file that includes your financial standing, the purpose of your purchase, and any other documents required to satisfy the commission. To get an idea of what is required, you can look at this sample property overview document.

The Power of the Land Register

The true cornerstone of Austrian property law is the Land Register, or Grundbuch. It is a public record that provides absolute, definitive proof of ownership. It also details any rights or encumbrances tied to the property, such as mortgages (Hypotheken) or rights of way.

The moment your name is entered into the Grundbuch, your ownership becomes legally indisputable. It is a system that offers one of the highest levels of property security in Europe, giving you complete peace of mind that your Viennese asset is well and truly protected.

Financing Your Purchase and Calculating Total Costs

When you are ready to buy an apartment in Vienna, the number on the price tag is merely the starting point. Any seasoned investor knows that the final cost includes a range of other fees. These can easily add another 10% on top of the purchase price, so it is vital to factor them in from day one.

Unlike property markets where ancillary costs can be a murky area, Austria’s system is refreshingly transparent. The fees are structured and predictable, which is a huge advantage for international buyers. It allows you to plan your finances with genuine confidence, removing any unwelcome surprises down the line.

Understanding the Key Transaction Costs

Getting to grips with the finances means familiarising yourself with a few key figures. These are non-negotiable; they are a standard part of every property deal in Austria.

- Property Transfer Tax (Grunderwerbsteuer): This is the most significant fee, set at a flat 3.5% of the property’s purchase price. It is a standard government tax on all real estate sales.

- Land Registry Fee (Eintragungsgebühr): To make your ownership official and legally binding, it must be recorded in the Land Register (Grundbuch). The fee for this essential step is 1.1% of the purchase price.

- Legal and Notary Fees: You will need a lawyer for due diligence and a notary to draft the contract and manage the secure escrow account. Expect to pay between 1.5% and 3% of the purchase price, plus VAT, for their services.

Therefore, for a luxury apartment priced at €1.5 million, you should budget an additional €150,000 to cover these essential transaction costs. Seeing the numbers laid out like this gives you a clear picture of the total capital required.

When you are buying property in Vienna, the ancillary costs are just as important as the purchase price itself. Below is a clear breakdown of what you can expect to pay on top of the sticker price.

Breakdown of Typical Property Purchase Costs in Vienna

| Cost Component | Typical Percentage of Purchase Price | Notes |

|---|---|---|

| Property Transfer Tax | 3.5% | A mandatory government tax on all property transactions. |

| Land Registry Fee | 1.1% | For officially registering your ownership title (Grundbuch). |

| Legal & Notary Fees | 1.5% – 3% (+VAT) | Covers contract drafting, due diligence, and escrow services. |

| Estate Agent Commission | 3% (+VAT) | Typically paid by the buyer in Austria. |

| Mortgage Handling Fees | ~1.2% (of loan) | If financing, this covers the bank’s administrative costs. |

| Total Estimated Costs | ~9.4% – 11.8% | A safe estimate to budget for all ancillary expenses. |

Having these figures in mind from the outset ensures you approach your purchase with a complete financial picture, preventing any unexpected strains on your budget during the closing process.

Securing Finance as an International Buyer

While many of our clients prefer to make cash purchases, financing a portion of your property can be a shrewd strategic move. The good news is that Austrian banks are generally open to lending to qualified international buyers. However, their lending criteria are strict, and they favour applicants with strong, clear financial profiles.

For non-residents, you can typically expect a loan-to-value (LTV) ratio of around 60-70%. This means you will need a substantial deposit.

To have a mortgage approved, you will have to provide a full suite of documents, including proof of income, a statement of your assets and liabilities, and, of course, details of the apartment you wish to buy. The key is to present a well-organised and comprehensive financial portfolio. This is where working with a local mortgage adviser who specialises in serving international clients can be a game-changer. They understand the system inside-out and can significantly improve your chances of securing favourable terms.

Choosing the Right Vienna District for Your Investment Objectives

In a market as refined as Vienna’s, your choice of district—or Bezirk—is just as critical as the apartment itself. Every neighbourhood has its own distinct character and investment profile. The key is to align your location with your objectives, whether that is maximising rental income or securing long-term capital growth when you buy an apartment in Vienna.

The city’s rental market is a major driver behind this decision. Rents vary significantly by district, but the overall trend is a steady annual increase of around 5%, fuelled by relentless demand and tight supply. With city-wide vacancy rates hovering below a razor-thin 2%, high-quality apartments do not remain on the market for long.

For investors, this translates into solid rental yields, typically falling between 3.03% and 4.43%. This, of course, depends on the property’s quality and, most importantly, its location. It is well worth exploring a detailed analysis of Vienna’s rental market trends to sharpen your strategy.

The Prestigious Inner Districts

For investors who prioritise prestige, stability, and blue-chip capital preservation, the central districts are the undisputed champions. This is the cultural and historical heart of the city, commanding premium prices and attracting the highest calibre of tenants.

- 1st District (Innere Stadt): This is Vienna’s historic core, a UNESCO World Heritage site. Owning a property here is not just an investment; it is a statement. The area is dominated by magnificent Altbau buildings, offering grand apartments with high ceilings and beautiful period features. Rental demand is perennial from top executives and diplomats, ensuring stable, high-end returns.

- 4th District (Wieden): Known for its sophisticated atmosphere and direct proximity to the centre, Wieden perfectly blends historic charm with modern vibrancy. It is especially popular with affluent professionals and academics, drawn by its excellent infrastructure and rich cultural life.

The Vibrant and Trendy Hubs

If your goal is to tap into the dynamic rental market driven by young professionals and creatives, the districts just outside the central Ringstrasse offer compelling opportunities. These areas are known for their lively atmosphere, independent boutiques, and thriving culinary scenes.

The real art of investing in Vienna is matching the district’s personality to your portfolio’s objective. The historic 1st district is a legacy asset, while a district like Neubau is a high-performance engine for rental income. Understanding this distinction is key to a successful acquisition.

- 6th District (Mariahilf): Home to Vienna’s main shopping street, Mariahilfer Strasse, this district is a bustling, energetic hub. It attracts a wonderfully diverse tenant base, from students to young families, all drawn to its central location and endless amenities.

- 7th District (Neubau): Often called the “creative district,” Neubau is Vienna’s answer to SoHo or Shoreditch. Its bohemian vibe, designer shops, and trendy cafés make it exceptionally popular with the city’s creative class, which guarantees consistent and strong rental demand for well-appointed apartments.

Up-and-Coming Districts with Growth Potential

For investors with a longer-term horizon seeking significant capital growth, looking towards Vienna’s developing districts can yield impressive results. These areas are undergoing exciting transformations, with major infrastructure projects and new residential developments creating future value.

The 22nd District (Donaustadt) is a prime example. Located across the Danube, it is home to modern high-rise developments, the UN headquarters, and vast recreational areas. This unique combination of business and leisure is attracting a whole new wave of residents, positioning Donaustadt for substantial future growth as you plan to buy an apartment in Vienna.

From Due Diligence to Handover: The Austrian Purchase Process

So, you have found the perfect Viennese apartment. What next? This is where the famously structured and secure Austrian purchase process begins. Be advised: this is not a market for casual, back-of-the-envelope offers. A written purchase offer, known as a Kaufanbot, is legally binding the moment the seller accepts it. It is absolutely critical to have your lawyer review this document before you even consider signing, as withdrawing afterwards can incur painful financial penalties.

Once your offer is accepted, the real work begins: due diligence. Yes, the physical state of the apartment matters, but for an international buyer, the deep dive into the legal and financial health of the building is paramount. The first and most important task for your lawyer is a meticulous review of the Land Register extract, or Grundbuchauszug.

Think of this document as the property’s official biography. It reveals everything you need to know about its legal status, from existing mortgages to third-party rights or any liens that must be settled before you can take clean ownership. Bypassing this step is a rookie mistake that no serious investor should ever make.

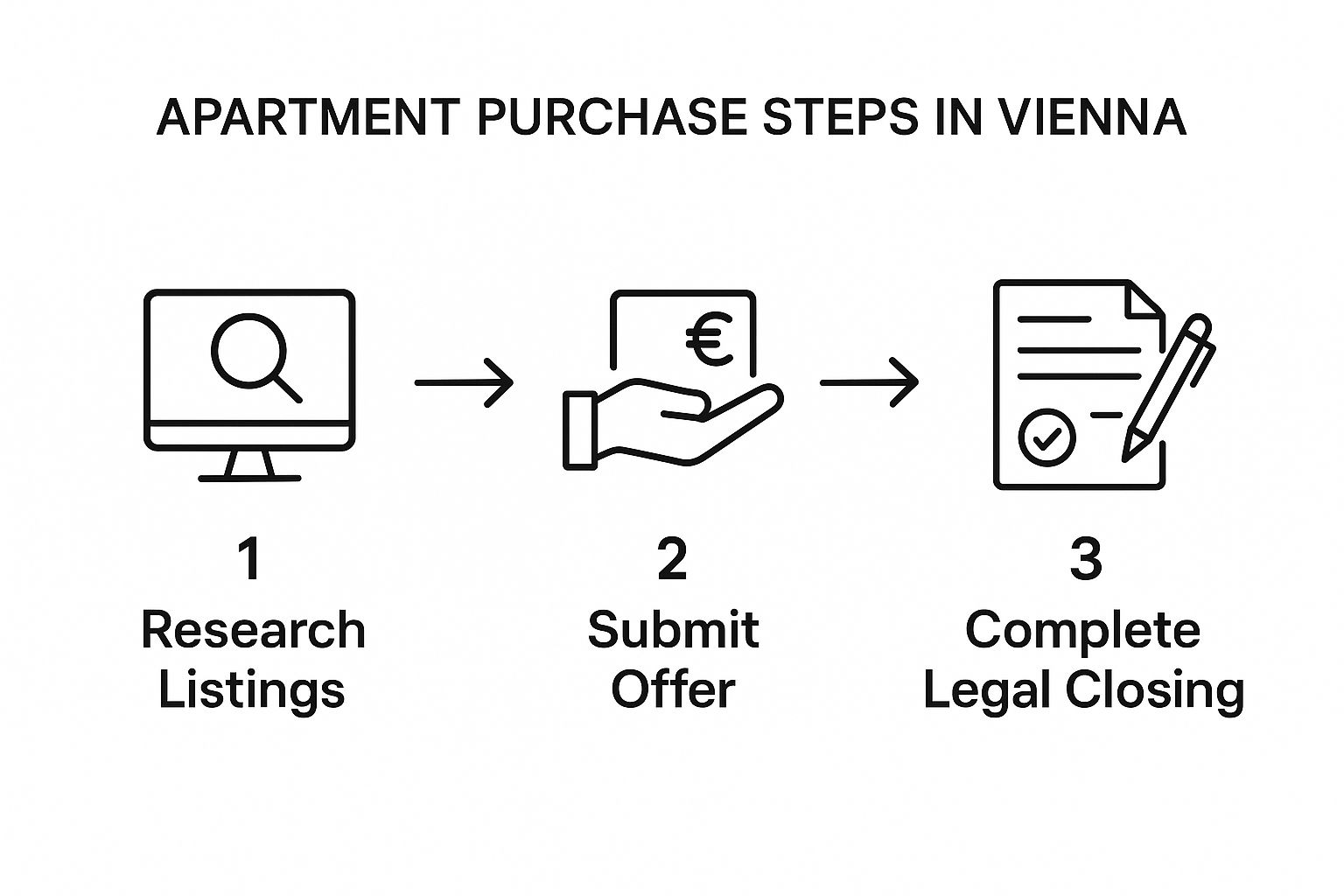

This simple flowchart provides a bird’s-eye view of the journey to ownership in Vienna.

As you can see, the system is designed to be linear and secure, leading to a closing that is legally watertight.

Delving into the Details

Beyond the Land Register, there are two other pieces of due diligence that are non-negotiable when buying an apartment.

- Building Condition Assessment: Engage a professional surveyor to inspect the property. This is your best way to confirm the structural integrity and flag any urgent repair work needed. It is especially vital if you are considering one of Vienna’s gorgeous but historic Altbau buildings.

- Condominium Meeting Minutes (Protokolle): This is an insider tip. Request the minutes from the last few homeowners’ association meetings. They provide invaluable clues about the building’s dynamics, revealing planned major renovations, simmering disputes between owners, or the health of the building’s repair fund (the Rücklage).

This level of detailed review ensures you understand not just the four walls you are buying, but the entire community and asset you are becoming a part of. A well-documented property will have clear information like this example of a property’s floor plan and features.

The Notary’s Role and Final Closing

With due diligence successfully completed, a state-appointed notary (a Notar) steps in to draft the final purchase agreement. This is a key feature of the Austrian system. The notary is an impartial professional who ensures the contract is fully compliant with local law and protects both you and the seller.

The notary also manages a secure escrow account, or Treuhandkonto. You will transfer the full purchase price, along with all associated taxes and fees, into this account. Here is the brilliant part: those funds are only released to the seller after the notary has officially confirmed your name is registered as the new owner in the Land Register.

This escrow system provides an incredible layer of security. It completely removes counterparty risk, guaranteeing that the seller does not see a cent until your ownership is legally and irrevocably locked in.

The final handover of keys usually happens at the exact moment your title registration is confirmed. At that point, congratulations are in order. You are the official, undisputed owner of a piece of Vienna, having navigated one of Europe’s most transparent and secure property purchase systems.

Final Thoughts on Your Vienna Property Investment

Vienna’s property market is, without a doubt, a compelling place to invest right now. The city is facing a classic supply-demand imbalance, which is excellent news for anyone seeking solid rental income and long-term capital growth.

If there is one takeaway from this guide, it is this: assemble a top-notch local team. A good lawyer, a reliable notary, and a sharp real estate agent who truly understands the city’s nuances are non-negotiable. They are your key to a smooth and successful purchase.

Vienna’s long-term outlook cements its reputation as a blue-chip destination for property investors. Your journey to owning a piece of this incredible city begins with well-informed, decisive action.

The Current Market Landscape

Let us be clear: the market in 2025 is incredibly competitive. There is a severe housing shortage, and it is affecting anyone looking to buy an apartment in Vienna. We are expecting only around 1,800 new rental units to come online this year—a staggering 60% drop from 2024.

This is not a temporary blip. A sluggish construction sector and sky-high building costs have forced many developers to put major projects on hold, widening the supply gap even further.

Naturally, this is putting serious upward pressure on both sale prices and rents, especially in the most sought-after districts. To get a deeper dive, you can explore detailed forecasts on Vienna’s property market. In this kind of climate, expert guidance is not just helpful—it is essential.

Successfully investing in Vienna requires more than just capital; it demands strategic timing and access to local intelligence. The current supply constraints favour decisive buyers who are well-prepared to act when the right opportunity, like this beautifully presented apartment, becomes available.

Ultimately, a carefully researched purchase in Vienna is not just about acquiring a property. It is an investment in one of Europe’s most stable and liveable cities, promising both impressive financial returns and an unmatched quality of life.

Common Questions Answered

If you are considering buying an apartment in Vienna, you likely have several questions. Here are straightforward answers to the most common queries we hear from international investors, cutting through the jargon to provide the practical advice you need.

Can Foreigners Legally Buy Property in Vienna?

Yes, they can, but the regulations differ based on nationality.

For EU/EEA citizens, the process is straightforward – you have the same property rights as any Austrian citizen. It is a level playing field.

For non-EU/EEA nationals, an additional step is required. You will need official approval from the Municipal Land Transfer Commission (Grundverkehrskommission). Do not be intimidated by the German name; this is more of a formality than an obstacle for a serious buyer. Your lawyer will handle the application, which essentially demonstrates a valid social or economic reason for the purchase. Be aware that this adds a few months to the timeline, but it is a standard part of the procedure.

What Are the Real Ongoing Costs of Ownership?

The purchase price is just the beginning. Once you own the apartment, you will have monthly running costs called Betriebskosten.

These costs cover the essentials for the building: maintenance, insurance, management fees, and shared utilities like lighting in hallways. You can typically budget for €2.50 to €4.00 per square metre per month.

On top of that, every owner contributes to a repair fund (Rücklage). This is a prudent, forward-thinking system that ensures money is always set aside for larger renovations, protecting the building’s value over the long term. There is also an annual property tax (Grundsteuer), but it is usually a modest amount.

The Great Debate: Altbau vs Neubau?

This is the classic Viennese property dilemma, and the optimal choice really depends on your investment objectives. There is no single correct answer.

- Altbau properties are the beautiful pre-WWII buildings that define Vienna’s architectural character. Think high ceilings, herringbone floors, and ornate façades. They are hugely popular with tenants who desire that authentic, historic Viennese lifestyle and can command top rents in the central districts.

- Neubau refers to modern, post-war buildings. What they may lack in historical charm, they make up for in practicality. Expect amenities like lifts, underground parking, and much better energy efficiency, which translates to lower utility bills for tenants. These apartments attract individuals who value convenience and modern comforts.

Ultimately, an Altbau offers timeless prestige, while a Neubau provides modern practicality and lower running costs. Both represent fantastic investment opportunities that cater to very different, but equally strong, segments of the rental market.

Ready to find your perfect Viennese property? EuropeanProperty.com is the place to start.

👉 Explore current apartment listings in Vienna

About EuropeanProperty.com

EuropeanProperty.com is Europe’s longest-running luxury real estate platform, online since 1999. It connects luxury real estate agents, developers, and homeowners with high-net-worth buyers and international investors.

Looking for expert mortgage guidance? Get luxury property mortgage advice here:

👉 https://europeanproperty.com/luxury-overseas-mortgages/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/