Investing in European real estate is about so much more than just a transaction. It’s a strategic move into a world of lifestyle, stability, and enduring value. For savvy international buyers, buying property in Europe means securing a tangible asset in one of the world’s most desirable locations—a safe harbour for capital that also delivers an unparalleled quality of life.

Why Invest in European Property Now

For discerning investors, the appeal of European property extends far beyond its postcard-perfect scenery and historic charm. The market here remains a premier destination for global capital, and for good reason. It offers a unique synthesis of financial stability and exceptional lifestyle advantages. In a world of volatile markets and digital assets, the solid, real-world value of a well-located property is a cornerstone of any serious wealth preservation strategy.

This appeal is not a fleeting trend. It is driven by core fundamentals that resonate with high-net-worth individuals and seasoned property professionals alike. These are not investors chasing quick flips; they are focused on acquiring assets that promise resilience, enjoyment, and a lasting legacy.

Before diving in, it’s crucial for any international buyer to understand the main factors at play. These considerations will shape your entire investment journey, from which country you select to the type of property you ultimately acquire.

Core Factors for European Property Investment

| Factor | Key Focus for Investors | Example Implication |

|---|---|---|

| Economic Stability | Look for countries with strong, mature economies and stable political climates. | A property in Switzerland or Germany may offer lower rental yields but superior long-term value preservation compared to a more volatile emerging market. |

| Legal Framework | Understand foreign ownership laws, transaction processes, and property rights. | Countries like France and the UK have transparent, well-established legal systems, while others may present more bureaucratic hurdles for non-residents. |

| Tax Implications | Research purchase taxes, annual property taxes, capital gains, and inheritance laws. | Portugal’s former Non-Habitual Resident (NHR) scheme, while now closed to new applicants, historically offered significant tax benefits that attracted lifestyle buyers and retirees. |

| Lifestyle & Access | Consider proximity to international airports, quality of healthcare, cultural amenities, and personal interests (skiing, sailing, etc.). | A buyer focused on family might prioritise proximity to international schools in Lisbon, while a ski enthusiast would naturally look to the French or Swiss Alps. |

| Residency & Visas | Check for “Golden Visa” or similar residency-by-investment programmes. | Investing €500,000 in Spanish real estate has historically provided a path to EU residency for non-EU nationals, adding a significant non-financial return. |

Weighing these factors is the first step towards making a well-informed decision, ensuring your European property purchase aligns with both your financial goals and personal aspirations.

The Strategic Appeal for Global Investors

The decision to buy property in Europe is rarely an impulse purchase. It is a calculated move based on clear strategic advantages—a well-reasoned addition to a diversified global portfolio.

Here is what is truly motivating sophisticated buyers:

- Wealth Preservation: Prime European real estate is widely regarded as a ‘safe-haven’ asset. In markets like Switzerland, Monaco, or prime central London, property has a proven track record of holding its value, acting as a powerful shield against inflation and currency fluctuations.

- An Unmatched Lifestyle: From the sun-drenched coasts of the Mediterranean to the cultural epicentres of Paris and Rome, Europe offers a quality of life that is difficult to replicate. This lifestyle is a significant, non-monetary return on investment, attracting buyers who want to use and enjoy their assets.

- Legacy and Scarcity: Acquiring a château in the Loire Valley or a waterfront villa on Lake Como is an investment in something truly finite. These are rare assets, often with deep historical roots, that can be passed down through generations to create a lasting family legacy.

“Luxury European real estate isn’t just a transaction; it’s an acquisition of a lifestyle and a legacy. Discerning buyers understand that the value lies not only in the asset itself but in the scarcity and prestige of the location.”

— Nick Marr, Founder of EuropeanProperty.com

Ultimately, the logic behind buying property in Europe is multifaceted. It’s about securing a foothold in stable, mature markets while gaining access to a world-class living experience. For those with the resources, it is an opportunity to diversify holdings, hedge against economic uncertainty, and own a tangible piece of the continent’s timeless appeal.

This guide is designed to provide you with the nuanced, real-world insights needed to navigate this rewarding investment journey successfully.

Pinpointing Europe’s Prime Property Hotspots

Selecting the right location is the absolute cornerstone of a successful European property investment. It is a vast continent, and a strategy that delivers for one investor could be a misstep for another. The real art is to look beyond the glossy travel brochures and align a market’s fundamental characteristics with your specific investment objectives.

Therefore, the first question to ask yourself is: what am I really trying to achieve? Are you seeking a legacy asset in an iconic luxury enclave? Or are you pursuing significant capital growth in an up-and-coming city? Perhaps your priority is stability and solid, long-term rental income.

Your answer changes everything. It immediately narrows the search from dozens of countries to a handful of specific cities or regions. For instance, buying property in Europe to pass down through the family points you in a completely different direction than a pure numbers-driven investment.

Established Luxury Hubs for Legacy Assets

If your goal is wealth preservation and owning a timeless piece of Europe, then the classic luxury hubs are your natural playground. Think of markets defined by scarcity, an unshakeable reputation, and a long history of holding their value. We are referring to locations like the French Riviera, the rolling hills of Tuscany, or the serene shores of Switzerland’s Lake Geneva region.

These locations offer more than just a deed; they provide an exclusive lifestyle and a tangible slice of European heritage.

What sets these markets apart?

- High barriers to entry, which act as a powerful shield against market shocks.

- Extremely strict planning regulations that protect their unique character and limit new supply.

- A deep-rooted global appeal that guarantees consistent demand from the world’s elite.

An investment here is not about flipping for a quick profit. It is about securing a world-class asset to be enjoyed for generations. A family office, for example, might target a historic villa in Tuscany, prizing its cultural significance and long-term stability far more than its potential for rapid growth. It is a classic capital preservation play in a globally recognised ‘safe-haven’ asset class.

“When you buy in an iconic location like the Côte d’Azur, you’re not just buying bricks and mortar—you are investing in a globally recognised brand. These markets have a resilience that newer, unproven hotspots simply cannot match.”

— Nick Marr, Founder of EuropeanProperty.com

High-Growth Hotspots for Capital Appreciation

Conversely, if you have a greater appetite for risk and wish to see your investment increase in value, you should be looking at Europe’s most dynamic, high-growth cities. Places like Lisbon, Athens, and certain districts in Berlin have been on a remarkable upward trajectory. This momentum is fuelled by economic turnarounds, booming tech scenes, and a steady influx of international talent.

The key drivers here are often:

- Major urban regeneration projects that are breathing new life into once-neglected neighbourhoods.

- Smart government initiatives, like Portugal’s now-retired but highly influential Golden Visa and NHR tax schemes, which historically kick-started foreign investment.

- A thriving start-up culture that attracts a young, affluent workforce and supercharges rental demand.

Imagine a tech entrepreneur relocating to Europe. They might choose Lisbon not just for the lifestyle, but because its vibrant tech ecosystem signals huge potential for their property’s value to grow as the city’s global reputation soars. Here, the investment thesis is built on entering a market that is on an upward curve. To gain an edge, it is vital to understand these local trends.

Stable Markets for Long-Term Income

Finally, let us consider the investors who prioritise steady, predictable returns. For them, certain European markets are brilliant for their stability and strong rental yields. Think of major German cities like Munich and Hamburg, or key business hubs in Switzerland. These markets are anchored by powerful local economies, low unemployment, and a deep-rooted culture of renting.

You will not see the explosive growth of an emerging hotspot, but you will benefit from a reliable income stream that acts as a fantastic hedge against economic turbulence.

An investor seeking a hands-off, long-term hold might acquire a small portfolio of apartments in a major German city. They can rest assured, confident in the consistent tenant demand and clear legal framework. This approach to buying property in Europe is less about glamour and more about solid, predictable financial performance—making it a vital component of any diversified international property portfolio.

See

Navigating the Legal Maze of Property Purchases

Let’s be candid: successfully buying property in Europe is less about finding the perfect villa and more about mastering its complex and varied legal landscape. A smooth purchase truly hinges on rigorous due diligence and expert guidance. Get this right, and you transform a potentially stressful process into a secure investment. While every country has its own distinct legal traditions, the core principles of protecting your interests are universal.

The journey from making an offer to receiving the keys is punctuated by several critical legal steps. In France, for instance, you’ll encounter the compromis de vente, a binding preliminary contract. Over in Italy, the equivalent is the contratto preliminare. These are not casual agreements; they lock in the terms and usually require a substantial deposit, making them legally significant milestones in any transaction.

This is precisely why engaging independent legal counsel from day one is non-negotiable. A local notary plays a crucial, impartial role in formalising the deal, but their primary duty is to the state—to ensure the sale is legally sound. Your personal lawyer, on the other hand, is your advocate, dedicated exclusively to safeguarding your interests.

Your Due Diligence Checklist

Think of thorough due diligence as your shield against future complications. Before any contracts are signed, your legal team must conduct a meticulous investigation into every aspect of the property. This is where you uncover any hidden issues that could jeopardise your investment or lead to costly disputes down the line.

A robust checklist should always cover these key areas:

- Verifying Title Deeds: This confirms the seller has the undisputed legal right to sell. It involves checking the property register (Land Registry in the UK, Cadastre in France) for a clean and unencumbered title.

- Checking for Liens and Charges: You need to be certain the property is free from debts, mortgages, or legal claims that could be passed on to you.

- Understanding Zoning and Planning Laws: It is crucial to verify that the property complies with local regulations and that any extensions or renovations were legally permitted, especially if you plan to undertake work yourself.

- Regulatory Compliance: For new builds or recently renovated properties, you must ensure all construction meets national and local building codes.

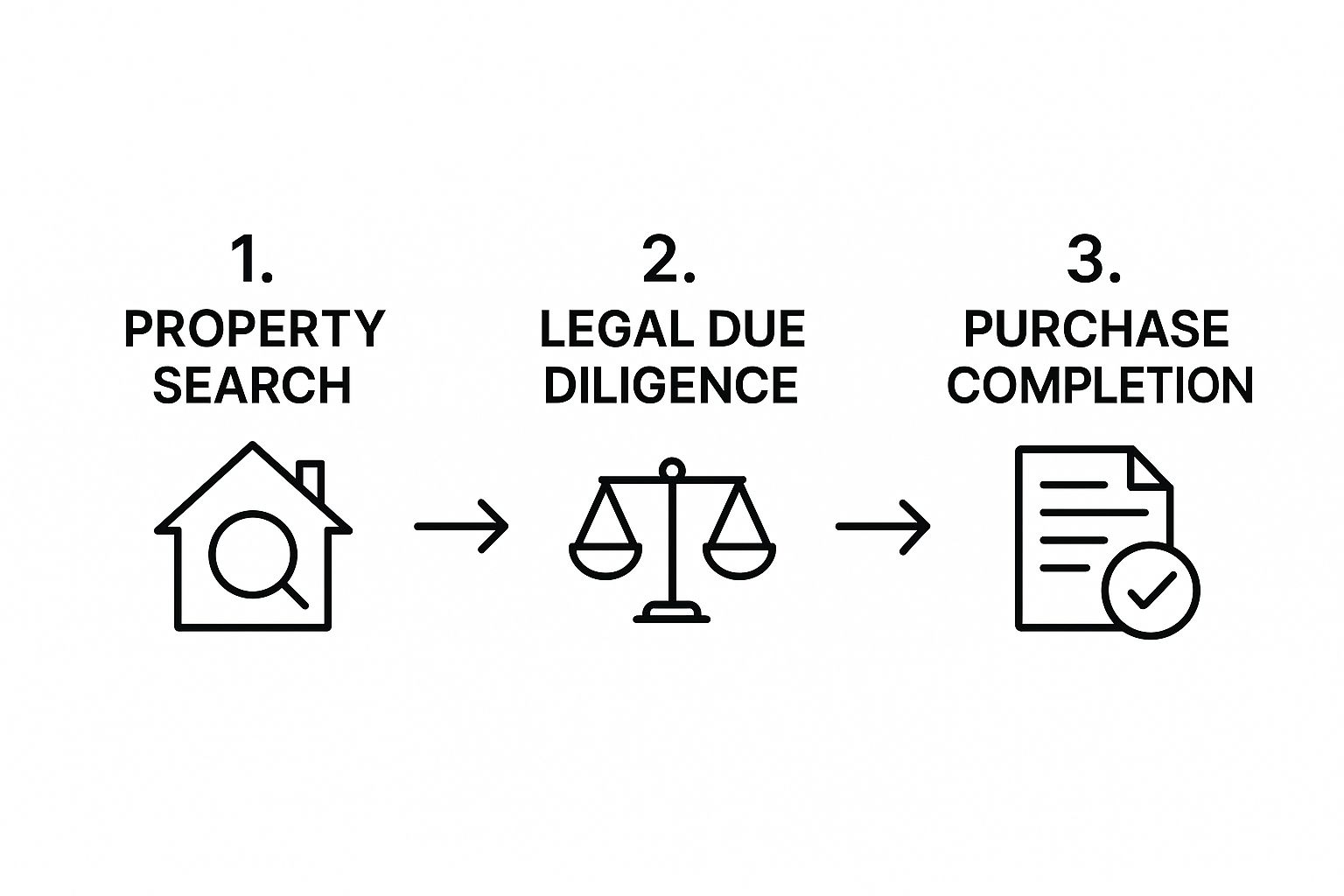

The visual below provides a high-level overview of a typical European property purchase, showing where this critical legal work fits into the bigger picture.

As you can see, legal due diligence is not just a final box to tick. It is an integral part of the acquisition journey, running alongside your property search and financing efforts.

Tackling Specific Legal Hurdles

Beyond the standard checks, you might encounter more complex legal scenarios, particularly when acquiring unique or high-value properties. This is where specialist knowledge becomes essential.

For example, understanding local inheritance laws is vital. Some countries, like France, have ‘forced heirship’ rules that dictate how a property is passed down, which can sometimes override the wishes in your will. The right legal structuring can help you manage these rules effectively. You can see an example of how complex property details are often laid out in our guide on understanding property listings.

Co-ownership structures, such as France’s copropriété which is common in apartment buildings, are another area to scrutinise. This setup involves shared ownership of common areas and means you will have to follow the building’s established rules and contribute to maintenance funds. Reviewing the co-ownership agreement is a critical part of due diligence here.

“Many buyers focus solely on the property itself, but the legal structure and local regulations are just as important. A beautiful historic home with unclear ownership or restrictive planning covenants can quickly become a liability. Diligence is everything.”

— Nick Marr, Founder of EuropeanProperty.com

Properties with historical significance often come with their own set of stringent regulations that can limit renovations or alterations. While these rules preserve the character of the building, you must fully understand them before committing.

The UK housing market, which is particularly robust, offers a different perspective. Recent Office for National Statistics data showed the average house price in England had climbed to £296,000, a 6.7% year-on-year increase. This kind of growth highlights why you need to be prepared to act decisively once your due diligence is complete in such a competitive market.

Finally, since you are exchanging a significant amount of personal and financial information, familiarising yourself with a good GDPR compliance checklist is a smart move to ensure your data is protected. By anticipating these legal details, you can navigate your purchase with confidence and make sure your European property is a source of enjoyment, not a legal headache.

Financing Your Purchase and Understanding Tax Rules

Structuring your financing correctly and understanding the tax implications are two of the most critical components of buying property in Europe. Executed well, this can result in significant savings. Get it wrong, and you face a world of unnecessary costs and complications. For high-net-worth buyers, this extends far beyond a simple mortgage application—it is a strategic puzzle involving international lenders, local banks, and private banking relationships.

Each path has its own advantages and disadvantages. An international bank might offer a smoother experience because they understand the complexities of cross-border wealth. Conversely, a local European bank could provide better rates or have a deeper appreciation for the unique, historic property you wish to acquire.

For many, the most direct route is through an existing private banking relationship. These institutions already know your financial standing intimately and can assemble bespoke lending packages that a high-street bank simply cannot match.

Get free advice on Luxury Overseas Mortgages

Navigating Your Mortgage Options

When you are applying for a mortgage as a non-resident, be prepared for additional scrutiny. From a lender’s perspective, you represent a higher risk, and their terms will reflect that.

Here is what you need to be prepared for:

- Loan-to-Value (LTV) Ratios: Do not expect to borrow as much as a local. Non-residents are typically offered lower LTV ratios, usually around 60-70%. This means you will need to provide a substantial deposit, often 30-40% of the property’s price.

- Interest Rate Structures: You will find both fixed and variable-rate mortgages. Variable rates, often tied to the Euribor, can seem tempting with their lower initial payments. However, in a volatile economic climate, a fixed rate provides long-term certainty.

- Cross-Border Application Nuances: The paperwork can be extensive. You will need to supply comprehensive proof of income, a full record of your assets, and a pre-agreement with the seller. The lender will also need to verify the property is clear of any tax debts.

“Financing a luxury European home is about more than just securing funds; it’s about building the right financial structure. The best deals are often found through specialist mortgage brokers who have access to both public and private lending markets across the continent.”

— Nick Marr, Founder of EuropeanProperty.com

Mastering European Property Tax Rules

A smart tax strategy is not an afterthought—it is central to a successful purchase. Europe’s tax landscape is a complex patchwork of national and regional laws, and navigating them adeptly is key to managing your costs over the long term. Generally, you will encounter three types of taxes: at purchase, annually, and upon selling.

Purchase Taxes:

This is the immediate tax you pay when you buy. It varies wildly from one country to another.

- In Spain, you will pay either a Property Transfer Tax (ITP) on a resale home (between 6-10%) or Value Added Tax (VAT) on a new build (typically 10%).

- France has similar duties, which are bundled into the overall frais de notaire (notary fees).

Annual Taxes:

These are the ongoing costs of ownership.

- In France, homeowners pay the taxe foncière, an annual property tax calculated on the home’s theoretical rental value.

- Over in Spain, you will pay the Impuesto sobre Bienes Inmuebles (IBI), which is a local municipal tax.

Taxes on Disposal:

When you decide to sell, you will face Capital Gains Tax on your profit. The rates and rules for exemptions vary widely. For example, some countries reduce your tax liability the longer you have owned the property.

Advanced Tax Considerations for Investors

Beyond the basics, serious investors need to consider wealth tax and inheritance planning. Some countries, like Spain, levy an annual wealth tax (Impuesto sobre el Patrimonio) on an individual’s worldwide assets above a certain threshold, although non-residents often benefit from generous allowances.

This is where double-taxation treaties become so important. These are agreements between your home country and the European country where you are buying, designed to prevent you from being taxed twice on the same income or gain. Your advisory team should be using these treaties to structure your purchase in the most tax-efficient manner.

Market volatility also plays a crucial role. For example, recent UK government data showed house prices rose 3.9% in the year to May, even while the number of sales dropped. The regional picture was even more varied: Yorkshire and the Humber saw a 2.4% monthly price jump, while the North East led the country with 6.3% annual growth. You can dive into the full UK House Price Index for May 2025 to see these trends for yourself. Figures like these demonstrate just how much local market conditions can and should shape your investment timing and financial strategy.

Finalising the Deal and Managing Your New Asset

This is it—the final stage where all your careful planning culminates. The deal solidifies, and your role shifts from buyer to owner. This moment, often called ‘completion’ or in France, the l’acte de vente, is the formal handover where your diligence is rewarded.

The closing meeting is a coordinated event involving the notary, your legal team, and agents. The notary will read the final deed of sale aloud, confirm all conditions have been met, and then witness the signatures. Once that is done, funds are transferred, and you officially receive the keys to your new European home.

Understanding Your Final Closing Costs

It is crucial to have a crystal-clear picture of your final financial outlay. Beyond the purchase price, you need to budget for closing costs, which can add a significant amount to the total. These are not hidden fees; they are standard charges tied to the legal transfer of property.

Typically, your closing costs will include:

- Notary Fees: A government-regulated fee for the notary’s work in executing and registering the deed.

- Property Registration Tax: Often called stamp duty, this is a state tax to officially record you as the new owner.

- Legal Fees: The fee for your independent lawyer who handled the due diligence and protected your interests.

Be prepared to budget for these costs, which can range from 7% to 15% of the property’s price, depending on the country and asset type. Getting this right means no unpleasant surprises at the finish line.

Post-Purchase Asset Management Strategies

Receiving the keys is just the beginning of your journey. If you are a non-resident owner, establishing a solid property management strategy is not just a good idea—it is essential for protecting your investment, especially if you will not be living there full-time.

Your first move should be to hire a reputable local management company. A good firm will be your eyes and ears on the ground, handling everything from routine maintenance and security checks to managing tenants if you plan to rent out the property.

Finding a trustworthy management partner is arguably as important as finding the right property. They are the custodians of your asset, ensuring it is maintained to the highest standard and generating income efficiently if that is your goal.

Next, you will need to sort out the practicalities of ownership. This means setting up local utility accounts for water, electricity, and internet. You will almost certainly need to open a European bank account to simplify payments for local taxes and services.

Finally, obtaining the right insurance is non-negotiable. You will need comprehensive building and contents insurance that is valid for non-resident owners and, if you are renting it out, covers rental activities.

Preparing for Rental Obligations

If generating rental income is part of your investment plan, you must understand your obligations as a landlord. This includes complying with local rental laws, ensuring the property meets all safety standards, and correctly declaring rental income for tax purposes—both in the property’s country and in your country of residence.

Market dynamics will also shape your rental strategy. For instance, recent Halifax data showed that UK annual property price growth hit +3.7%, largely driven by demand for bigger homes. Yet, flats still made up 27% of first-time buyer purchases, soaring to 71% in London. Understanding these details helps you attract the right kind of tenant.

A smart, well-informed management strategy ensures your European asset performs at its best from day one.

Frequently Asked Questions for International Buyers

Even the most experienced investor finds that buying property in Europe comes with its own unique set of questions. It’s a different game, with different rules. Here, we tackle some of the most common queries we get from international buyers, offering straight answers to clear up the confusion on everything from residency rights to handling your money.

Can Foreigners Legally Buy Property Across Europe?

Yes, for the most part, absolutely. The majority of European nations are more than happy to welcome foreign investment in their real estate markets. Countries like the UK, France, Portugal, and Germany have very few restrictions, making the journey for an international buyer relatively straightforward.

That said, you can’t assume it’s a free-for-all everywhere. Some countries have their own specific rules. Switzerland, for instance, has strict quotas on how many holiday homes can be sold to foreigners. In places like Hungary, you might find limitations on buying rural or agricultural land. The key takeaway? Always, always verify the local foreign ownership laws in your target country and, just as importantly, the specific region you’re interested in.

Do I Need a European Bank Account to Buy Property?

While it may not always be a strict legal requirement, opening a local bank account is something I would consider practically essential. It simply makes the entire process of buying property in Europe so much smoother.

Consider this. A local account is what you will use for:

- Transferring purchase funds in a secure and, crucially, traceable manner.

- Paying local taxes, like the annual IBI in Spain or the taxe foncière in France.

- Setting up direct debits for all your utilities—water, electricity, internet.

- Receiving rental income if you plan on letting out the property.

Opening an account is usually quite straightforward. You will typically need your passport, a proof of address, and a local tax identification number (like a Spanish NIE or an Italian Codice Fiscale).

What Is a Golden Visa and Is It Still an Option?

You have likely heard the term “Golden Visa.” It refers to residency-by-investment programmes that several European countries have offered. In short, these schemes grant residency permits to non-EU nationals who make a significant investment, most often in property.

Portugal, Greece, and Malta have all run popular Golden Visa programmes. Spain’s scheme was a huge driver for the luxury market, granting residency for a real estate investment of €500,000 or more, but it is now being phased out. A beautiful home, like this stunning property in Spain, could have historically been the centrepiece of a Golden Visa application.

The landscape for these programmes is changing rapidly. Countries are tightening the rules or scrapping them entirely. If residency is a major driver for your purchase, you absolutely must obtain up-to-the-minute advice from an immigration specialist.

How Should I Handle Currency Exchange?

This is a significant consideration. Managing currency exchange is a critical financial step when buying property in Europe. A minor fluctuation in the exchange rate between signing the preliminary agreement and finalising the deal can alter the final cost by tens of thousands of pounds, euros, or dollars.

Simply instructing your home bank to make the transfer is almost always the most expensive method. You will be subject to uncompetitive rates and high fees. Astute investors avoid this by using a specialist foreign exchange (FX) broker.

An FX specialist can offer you what is known as a forward contract. This allows you to lock in a favourable exchange rate today for a transaction that will happen in the future. It completely removes the risk of the currency moving against you and provides total certainty on the final price.

What Documents Will I Need to Provide?

The exact list varies by country, but non-resident buyers generally need to provide a standard set of documents to prove their identity and that they have the necessary funds. Assembling these papers before you begin your search can accelerate the entire process enormously.

Here’s a quick checklist of the essentials you will almost certainly need. Having these ready demonstrates to lawyers, notaries, and banks that you are a serious and organised buyer.

Document Checklist for Non-Resident Buyers

| Document Category | Specific Documents Often Required | Pro Tip |

|---|---|---|

| Personal Identity | A valid passport, and often a second form of photo ID. | Ensure your passport has at least six months of validity remaining. Some notaries might request an apostilled copy. |

| Financial Standing | Recent bank statements, proof of income (payslips, tax returns). | Organise these digitally so they are ready to send. If you are obtaining a mortgage, lenders will scrutinise these meticulously. |

| Proof of Address | A recent utility bill or bank statement from your home country. | The document must clearly show your full name and current address and usually must be less than three months old. |

| Local Tax ID Number | Spanish NIE, Italian Codice Fiscale, Portuguese NIF. | This is non-negotiable in many countries. Your lawyer can and should assist you in obtaining this as one of the very first steps. |

Having this paperwork organised from the start is a game-changer. It smooths every interaction you will have and makes the whole journey of buying property in Europe far less stressful and much more efficient.

About EuropeanProperty.com

EuropeanProperty.com is Europe’s longest-running luxury real estate platform, online since 1999. It connects luxury real estate agents, developers, and homeowners with high-net-worth buyers and international investors.

Looking for expert mortgage guidance? Get luxury property mortgage advice here:

👉 https://europeanproperty.com/luxury-overseas-mortgages/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/