Buying property in southern Spain is a dream for many, and for good reason. For the discerning international investor, it’s a strategic move that blends an exceptional lifestyle, solid investment potential, and access to some of Europe's most desirable coastlines. The purchase process is well-established and transparent, but it requires a sophisticated understanding of the local market and key legal and financial protocols.

The Unshakeable Allure of Southern Spain's Property Market

Southern Spain, particularly the sun-drenched region of Andalucía, has long been a magnet for international property buyers. Its appeal is undeniable—with over 300 days of sunshine, world-class golf courses, and stunning beaches, the lifestyle is self-evident. But for savvy investors, the attraction goes far deeper. It is the unique fusion of rich cultural heritage and modern, high-end living that solidifies its status as a premier global destination.

This is not merely anecdotal; the data underscores the market's strength. The Spanish property sector has demonstrated remarkable resilience and growth, particularly in prime coastal areas. Recently, home sales across Spain jumped by 11% year-on-year, driven largely by a significant 30.9% increase in new-build sales.

Andalucía is at the epicentre of this activity, accounting for the largest share of home sales in the country at 19.6%. This strong, consistent demand has sustained steady price growth, with coastal regions significantly outperforming inland areas. With mortgage rates beginning to normalise from their recent peaks, both Spanish and international buyers are demonstrating renewed confidence. For a closer look at the market's recovery, you can review a detailed analysis on Home Hunts.

More Than a Postcard: The Perfect Blend of Lifestyle and Investment

For both seasoned investors and high-net-worth individuals purchasing for lifestyle reasons, the decision to invest in southern Spain is rarely one-dimensional. It is the powerful synergy of benefits that makes it such a compelling proposition.

Here’s what is driving the demand at the luxury end of the market:

- An Exceptional Quality of Life: The region offers a lifestyle that is both relaxed and distinctly cosmopolitan. One can move seamlessly from Michelin-starred dining in Marbella to historic cultural festivals in Seville or private polo clubs in Sotogrande. The amenities cater to every sophisticated taste.

- Superb Location and Connectivity: With major international airports in Málaga and Gibraltar, southern Spain is a short flight from the UK, Northern Europe, and the Middle East. This ease of access is crucial, not only for personal use but also for sustaining a vibrant international rental market.

- A Mature and Stable Market: Unlike more volatile emerging markets, southern Spain’s luxury property sector is well-established. Decades of international investment have cultivated a stable, transparent environment with a clear legal framework that makes foreign ownership straightforward and secure.

"We see it time and time again. Buyers in this bracket aren't just purchasing a house; they're investing in a lifestyle," notes Nick Marr, founder of EuropeanProperty.com. "The infrastructure here—from international schools and private healthcare to elite sports facilities—supports a long-term, multi-generational commitment to the region."

This unique combination—a sun-kissed lifestyle, modern infrastructure, and a proven track record of market stability—is precisely why buying property in southern Spain continues to be a primary choice for global investors.

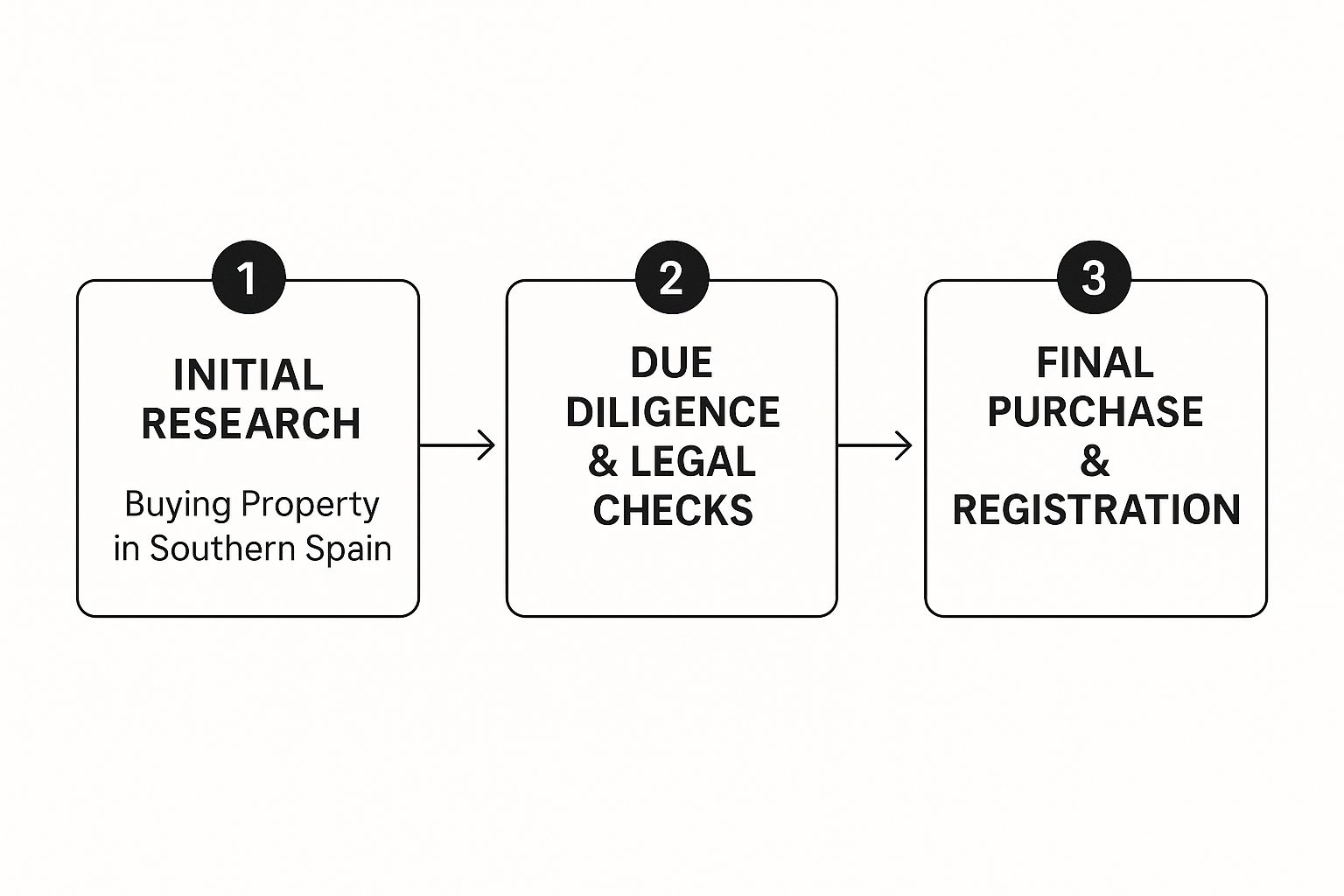

A Practical Guide to Buying Property in Southern Spain

Acquiring a property in Southern Spain is less about navigating a complex maze and more about following a clear, well-trodden path. The system is designed to protect all parties involved, but a thorough understanding of the procedural steps is essential. For any international buyer, a methodical approach is paramount—it transforms a potentially stressful process into a seamless and efficient transaction.

Your journey does not begin with property viewings. It starts with establishing your legal and financial framework. This preparatory groundwork is critical. It ensures that when you identify the ideal villa with a sea view, you are positioned to act swiftly and decisively.

This visual provides an excellent overview of the main stages you will navigate, from the initial legal steps right through to receiving the keys.

As illustrated, it is a logical sequence. Each step builds on the last, which is why completing your due diligence before committing significant capital is so important.

First Things First: Assemble Your Professional Team

Before you consider making an offer, you must engage an independent lawyer (abogado). This is a non-negotiable and should be your first action.

Your lawyer works exclusively for you. Be cautious of legal counsel recommended by the seller or developer; you require a professional whose sole interest is protecting yours. They are responsible for ensuring the property is legally sound, with no hidden debts or encumbrances. Many astute buyers also open a Spanish bank account early in the process to facilitate smoother transactions later.

The All-Important First Steps

With your lawyer appointed, the first practical task is to obtain your NIE number (Número de Identificación de Extranjero). This is your official identification for any financial activity in Spain. You cannot purchase a property without one.

- What it is: A unique tax identification number essential for all foreign nationals.

- How to get it: Your lawyer can typically handle this for you with a power of attorney. Alternatively, you can apply in person at a designated Spanish police station or a Spanish consulate in your home country.

- Why it is a must: Without an NIE, you cannot sign the final deed, register the property in your name, or establish basic utilities like electricity and water.

Completing this administrative task is the key that unlocks the rest of the purchase process.

Doing Your Homework: The Due Diligence Phase

Once you have found a property you wish to acquire, your lawyer begins their substantive work. Their first task is to obtain a 'nota simple' from the Land Registry (Registro de la Propiedad). This document is a comprehensive health check of the property's legal status.

The 'nota simple' is your first line of defence. It confirms the legal owner, reveals any mortgages or debts attached to the property, and verifies its official dimensions and description. Any discrepancy here is a major red flag.

A classic issue in Southern Spain, for example, is discovering a beautiful swimming pool or a stunning terrace extension that was constructed without planning permission. If it is not on the official record, it could become your legal and financial liability post-purchase. Your lawyer will also verify that all community fees (gastos de comunidad) and local property taxes (IBI) are fully paid.

The table below summarises these key stages, providing a clear roadmap of what to expect.

Key Stages in the Spanish Property Purchase Process

| Stage | Key Document or Action | Primary Professional Involved | Typical Timeline |

|---|---|---|---|

| Preparation | Obtain NIE number & open bank account | Lawyer (Abogado) | 2-4 weeks |

| Due Diligence | Obtain & review the 'Nota Simple' | Lawyer (Abogado) | 1-2 weeks |

| Reservation | Sign Reservation Agreement & pay small deposit | Lawyer & Real Estate Agent | 1-3 days |

| Binding Contract | Sign Private Purchase Contract & pay 10% deposit | Lawyer | 15-30 days after reservation |

| Completion | Sign the final deed (Escritura) at the notary | Lawyer & Notary | 4-8 weeks after private contract |

| Post-Completion | Register property & transfer utilities | Lawyer | 1-3 months |

This process ensures every detail is meticulously checked and verified before you take the final step.

Making It Official: Securing the Property

Once your lawyer provides the all-clear, it is time to formalise the acquisition. This typically occurs in two stages:

-

The Reservation Agreement (Contrato de Reserva): You will pay a small holding deposit, usually between €3,000 and €6,000, to take the property off the market. This grants your lawyer additional time (typically 15-30 days) to finalise their due diligence without the risk of another buyer intervening.

-

The Private Purchase Contract (Contrato de Arras): This is a significant milestone. It is a legally binding contract where you will pay the main 10% deposit. If you withdraw after signing this, you forfeit your deposit. Conversely, if the seller withdraws, they are legally obligated to pay you back double your deposit. It signifies a serious commitment from both parties.

For those interested in the technical standards that underpin digital property listings, you might find details on the Open Graph protocol an interesting aside.

The Final Handover: Completion Day

The final step is the completion (escritura de compraventa), which takes place at a public notary’s office. You (or your lawyer, with power of attorney) and the seller will sign the final deed of sale. At this point, you pay the remaining balance of the purchase price, and the seller hands over the keys. ¡Felicidades, you are a homeowner!

Subsequently, your lawyer will manage the registration of the deed with the Land Registry, which officially confirms you as the new owner. They will also handle the payment of the necessary taxes and the transfer of utility bills into your name, concluding a successful and well-managed purchase.

A Financial Breakdown of Your Spanish Property Investment

When you are buying property in Southern Spain, the asking price is just the starting point. Gaining a comprehensive understanding of the total cost is essential for a sound investment. A common pitfall for buyers is failing to budget for the additional taxes and fees.

As a general rule, you should anticipate an additional 10-15% of the purchase price to cover all transactional costs. Accurately forecasting this from the outset ensures there are no unwelcome surprises at the time of completion.

The first element to understand is that the applicable tax depends entirely on whether you are buying a brand-new home from a developer or a resale property from a previous owner. This distinction is the first and most critical step in forecasting your budget accurately.

Understanding Property Purchase Taxes

For most individuals purchasing a holiday home or relocating, the focus will be on resale properties. In this case, the main tax you will face is the Property Transfer Tax (ITP), known locally as Impuesto de Transmisiones Patrimoniales. As this is a regional tax, the rate varies, but in Andalucía, it is applied on a sliding scale based on the property's price.

Conversely, if you are purchasing a new-build property directly from a developer, you do not pay ITP. Instead, your purchase is subject to two separate taxes:

- VAT (IVA): This is a national tax fixed at 10% for new residential homes.

- Stamp Duty (AJD): Known as Actos Jurídicos Documentados, this is an additional tax on new builds, currently set at 1.2% in Andalucía.

A common oversight among buyers is the miscalculation of their tax liability. For a €2 million resale villa in Marbella, for instance, the ITP constitutes a significant sum that must be liquid and available upon completion. An error in this calculation can jeopardise the entire purchase.

Understanding this clear division between resale and new-build taxes is fundamental to planning the finances for your Spanish property acquisition.

Additional Transactional Costs

Taxes represent the largest portion, but they are not the only additional costs. You will also need to budget for several professional fees to ensure your purchase is legally sound and correctly registered. These are standard in any Spanish property transaction.

Here is what you should expect to pay:

- Legal Fees: Engaging an independent lawyer is not just recommended; it is essential. Their fees typically range between 1% and 1.5% of the purchase price (plus VAT). This fee covers comprehensive legal checks, due diligence, contract reviews, and management of the entire closing process.

- Notary Fees: The notary is a public official who witnesses the signing of the final deed (escritura) and renders it legally binding. Their fees are set by a national tariff and usually fall between 0.1% and 0.4% of the property’s declared value.

- Property Registry Fees: Once the sale is notarised, your ownership must be officially recorded in the Land Registry. This fee is also based on a national scale and is generally slightly less than the notary fees.

- Mortgage Arrangement Fees: If you are financing the purchase with a Spanish mortgage, the bank will almost certainly charge an arrangement fee, often around 1% of the loan amount.

Ongoing Costs of Ownership

Once you have the keys, your financial commitments shift to the ongoing costs of owning a home in Spain.

The main annual tax is IBI (Impuesto sobre Bienes Inmuebles), which is Spain’s equivalent of the UK's council tax. It is set by the local town hall (ayuntamiento) and is based on the property’s official rateable value, or valor catastral.

If your property is part of a complex or development with shared facilities, you will also have community fees (gastos de comunidad). These cover the maintenance of gardens, swimming pools, security, and other communal areas.

Finally, non-resident owners may also be liable for Wealth Tax (Patrimonio) if their total Spanish assets exceed the regional threshold. There is also a notional income tax based on the property's value. Structuring your purchase correctly from the outset and obtaining expert advice on these long-term commitments is key to a successful investment strategy. For more advanced financial structuring, you can explore resources on Rank Math to understand asset visibility.

Decoding the Luxury Market on the Costa del Sol

To gain a true appreciation of the value of buying property in southern Spain, one must look beyond general headlines and delve into the nuances of the luxury market. The Costa del Sol is not a single, uniform area; it is a collection of exclusive enclaves, each with its own distinct character and investment profile.

World-renowned locations like Marbella’s Golden Mile, the ultra-private La Zagaleta estate, and the sophisticated marina town of Sotogrande consistently command premium prices, and for good reason. They offer more than just a beautiful residence; they provide a lifestyle defined by privacy, top-tier security, and amenities of the highest calibre.

This is a market shaped by discerning international buyers who value quality and exclusivity above all else. Consequently, we are witnessing intense demand for sleek, sustainable villas featuring smart home technology, private wellness centres, and the seamless indoor-outdoor living that is so highly coveted.

Prime Locations and Price Benchmarks

So, what does capital secure in these elite postcodes? In prime Marbella, for instance, the price-per-square-metre is a useful starting point, but it never tells the complete story.

- Marbella's Golden Mile: This is the classic epicentre of luxury. Here, frontline beach properties and sprawling villas can easily exceed €15,000 per square metre, a price driven by scarcity and legacy status.

- La Zagaleta: This exclusive gated community offers a different prize: ultimate privacy and security. The plots are substantial, the build quality is exceptional, and prices often commence in the multi-millions, reflecting the estate's unparalleled exclusivity.

- Sotogrande: Known for its world-class polo fields and magnificent marina, Sotogrande attracts a family-oriented, sporting clientele. Prices are robust, yet still offer excellent value for large, modern family homes.

The rock-solid performance of these established areas proves their enduring appeal. For a closer look at how property values have been trending, you can review helpful charts illustrating market trends in Southern Spain. The data clearly demonstrates the stability and growth occurring in these prime zones.

Emerging Luxury Hotspots

While traditional hotspots remain powerful magnets for capital, astute investors are also exploring emerging luxury corridors. The area known as the New Golden Mile in Estepona, for example, is rapidly gaining traction. It is populated with brand-new contemporary developments and luxury beachfront apartments, offering a modern alternative to the more established parts of Marbella.

The luxury market here has surged, fuelled by intense international demand, particularly from UK buyers. Marbella remains the epicentre, with some neighbourhoods like Playa de la Fontanilla experiencing year-on-year price increases of almost 30%.

In other high-end zones like Los Monteros and Estepona’s Guadalmanza, average prices have risen by over 16–22% annually, pushing values well beyond €8,000 per square metre. This growth, which far outpaces the national average, is a direct result of limited supply meeting immense demand for exclusive coastal properties. You can find more insights on Andalucía’s market performance on The Property Finders.

"When advising investors, we stress looking at both capital appreciation and potential rental yield," says Nick Marr, founder of EuropeanProperty.com. "A villa in a prime, consolidated area might offer steady, long-term growth, whereas a new-build in an emerging luxury zone could provide stronger short-term rental returns. The key is aligning the asset with the investor's specific financial goals."

This sophisticated approach is what differentiates a simple holiday home purchase from a strategic international property investment. By understanding these micro-locations and balancing growth with income, you can make a truly informed decision when buying on the Costa del Sol.

Mastering Negotiation and Finalising Your Purchase

This is the moment your property search transitions into a tangible asset. In Southern Spain, progressing from an accepted offer to holding the keys involves more than a simple price negotiation. It is a nuanced process where local customs and professional guidance can make a significant difference.

A well-structured, credible offer does more than just state a figure; it signals that you are a serious buyer and sets a professional tone for the remainder of the transaction.

Your real estate agent is your most valuable asset here. They act as your intermediary, equipped with an understanding of the seller's motivations and the local market's dynamics. This allows them to position your offer in the most compelling manner. Remember, Spanish business culture often values relationship-building. A respectful, well-reasoned approach will almost always prove more effective than aggressive, low-ball tactics.

This is a critical stage when buying property in southern spain, and having an expert guide you through the negotiations is key to navigating it with confidence.

Structuring Your Offer Beyond the Price

While the price is the headline figure, it is not the only negotiable element. An astute buyer understands the importance of considering the entire package. Do not hesitate to negotiate on terms that can add significant value or convenience to your purchase.

Here are a few key points that are often open for discussion:

- Inclusion of Furniture ('Muebles'): It is common for high-end properties to be sold fully furnished. If the décor is to your taste, negotiating for the furniture to be included can save you considerable expense and logistical effort, making the home turnkey-ready.

- Completion Timeline: Do you require a swift completion, or would a longer timeframe assist with your financial planning? The completion date can often be adjusted to suit both parties, providing valuable flexibility.

- Minor Repairs or Adjustments: If your survey has identified minor issues, you can request that the seller rectifies them before completion. Alternatively, you could agree to a small price reduction to cover the cost yourself.

"Many first-time international buyers focus solely on the price," notes Nick Marr, founder of EuropeanProperty.com. "Experienced investors know that negotiating on timelines, furnishings, or even payment structures can create just as much value. A good agent will identify these opportunities."

These points can elevate a good deal to a great one. It is vital to discuss these possibilities with your agent before submitting a formal offer so they can advise on what is reasonable to request.

The Critical Final Inspection

Before you attend the notary’s office to sign the final deed of sale (escritura de compraventa), it is imperative to conduct a final inspection. This is your last opportunity to confirm the property is in the exact condition agreed upon.

Your final walkthrough is about confirming a few key details:

- Condition: The property has not sustained any damage since your last viewing.

- Inclusions: All agreed-upon fixtures, fittings, and furniture are present.

- Vacant Possession: The property is empty and ready for you, unless an alternative arrangement has been made.

This check should be performed with your agent, ideally the day before or the morning of the completion. It is a simple but vital step that prevents any last-minute discrepancies or disputes at the notary's office. Getting this right ensures a smooth and satisfactory conclusion to your purchase, transforming a complex process into a well-managed final step toward owning your dream home in Southern Spain.

So, you have signed the escritura and opened the cava – congratulations! But as any seasoned property owner in Spain will attest, receiving the keys is just the beginning. The subsequent weeks are about establishing your new life and ensuring your investment is managed correctly, especially when you are not in residence full-time.

First, you will need to arrange the utilities. Your lawyer should handle the transfer of electricity (luz), water (agua), and internet services into your name. Concurrently, you must register for the local council tax, known as IBI (Impuesto sobre Bienes Inmuebles), at the town hall (ayuntamiento). This is an annual tax that is crucial to manage, as penalties for non-registration can be significant.

Managing Your Property From Afar

Realistically, managing a property from another country presents considerable challenges. This is where a professional property management company becomes an indispensable partner. They are your presence on the ground, providing complete peace of mind that your home is in safe hands.

What services do they typically provide?

- Keyholding and Regular Inspections: They will hold a set of keys and inspect your property regularly to ensure it is secure and in good order.

- Maintenance and Repairs: From a minor leak to a boiler failure, they arrange for trusted local tradespeople to resolve the issue. This eliminates the stress of finding reliable contractors from thousands of miles away.

- Bill Management: They can manage the payment of your utility bills, community fees, and local taxes on your behalf.

- Rental Management: If you plan to let the property, they can manage the entire process, from bookings and guest changeovers to cleaning and maintenance.

Protecting your asset is equally important. Comprehensive home insurance is essential, covering the building, its contents, and public liability. For an additional layer of security and the ability to monitor the property remotely, it is worth exploring the top DIY home security systems.

Generating Income and Tax Obligations

Considering renting out your new Spanish home? An excellent idea, but you will require a tourist licence (licencia de turismo). In Andalucía, this is a legal requirement for anyone offering short-term holiday lets. It involves registering your property with the regional tourism authority, a process your manager or lawyer can assist with.

The rental market here is booming, driven largely by foreign buyers. In the first quarter of this year alone, non-Spaniards accounted for 14.1% of all home purchases. British buyers led this trend, acquiring 2,110 properties—a 7% increase from the previous year. Many are attracted by the strong rental income potential in high-demand coastal areas.

Key Takeaway: As a non-resident owner in Spain, you are required to file an annual tax return. This applies even if you do not rent out your property. It is a critical point that many new owners overlook.

This non-resident tax is calculated either on the rental income you earn or, if the property is for personal use, on a notional income based on its rateable value (valor catastral). The Spanish tax system can be complex, so I always advise clients to engage a local tax advisor (gestor). They will ensure you remain fully compliant and save you considerable stress.

Got Questions? We've Got Answers

Navigating the specifics of buying property in southern spain invariably raises a few common questions, especially for our international clients. Let's address some of the most frequent queries to provide further clarity as you plan your purchase.

Can I Buy a Property in Spain Without Being There in Person?

Absolutely. It is not only possible but also a very common practice to purchase a property remotely. The key is to grant a Power of Attorney, known in Spanish as a Poder Notarial, to your independent lawyer.

This legal instrument authorises your lawyer to perform specific actions on your behalf, such as signing the final deed (escritura) at the notary's office. It is a secure, efficient process favoured by discerning international buyers who cannot always be physically present for every step of the transaction.

What's the Deal with the Spanish 'Golden Visa'?

The 'Golden Visa' is a residency-by-investment programme designed for non-EU nationals. By making a qualifying investment—most commonly a real estate purchase of €500,000 or more without mortgage financing—you and your immediate family can obtain Spanish residency permits.

This visa has been a significant driver for the luxury property market, as it provides a pathway to living in Spain and travelling freely throughout the Schengen Area. A word of caution is advised: the Spanish government is currently reviewing the future of this programme, so obtaining up-to-the-minute legal counsel is non-negotiable.

Should I Go for a New-Build or a Resale Property?

This decision really depends on your investment objectives. There is no single "better" option; there is only what is better for you.

A new-build property offers a fresh, modern aesthetic with the latest home comforts and builder guarantees. The trade-off is the tax liability, which is higher in Andalucía at 10% VAT plus 1.2% Stamp Duty.

On the other hand, a resale property comes with a lower transfer tax (ITP) and is often situated in a more established, prime location. It may require some modernisation, but for many investors, this is part of the appeal—it offers character and the opportunity to add significant value through renovation. It is a strategic choice for a different type of buyer.

About EuropeanProperty.com

EuropeanProperty.com is Europe’s longest-running luxury real estate platform, online since 1999. It connects luxury real estate agents, developers, and homeowners with high-net-worth buyers and international investors.

Looking for expert mortgage guidance? Get luxury property mortgage advice here:

👉 https://europeanproperty.com/luxury-overseas-mortgages/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/