Yes, buying property in Spain as a foreigner is not only achievable but also a well-established route for international investors. However, before immersing yourself in listings for sun-drenched villas, two non-negotiable administrative tasks must be addressed first: securing a Foreigner's Identity Number (NIE) and opening a Spanish bank account.

Consider these the legal and financial foundations of your entire Spanish property venture. Addressing them upfront will prevent the bureaucratic headaches that often derail unprepared international buyers.

Setting the Stage: Your First Steps to Buying in Spain

Embarking on your Spanish property search begins with laying the right groundwork. Finalising these fundamentals from the outset is the difference between a smooth, successful purchase and a frustrating ordeal filled with delays. Preparation is key, allowing you to move quickly and decisively when you identify the right opportunity.

The All-Important NIE Number

The Número de Identificación de Extranjero (NIE) is a unique tax identification number assigned to every foreigner involved in significant legal or financial activities in Spain. It is the master key to the entire process. You cannot legally acquire a property, pay taxes, or even establish utility contracts without one.

This number must appear on every official document you sign, including the final property deed. For any foreigner investigating buying property in Spain, obtaining the NIE should be the primary item on their agenda. The process itself is not complex, but it can be slow, making an early start a strategic advantage.

There are several methods for obtaining your NIE:

- In Person in Spain: You can apply at a designated National Police station (Comisaría General de Extranjería y Fronteras). This route requires a pre-booked appointment (cita previa), and waiting lists can be notoriously long, particularly in popular expatriate regions.

- At a Spanish Consulate Abroad: A far more convenient option is to apply from your home country through your local Spanish consulate. You will need to complete the EX-15 form and provide the necessary supporting documents.

- Through a Legal Representative: For most high-net-worth buyers, this is the most efficient method. Many international investors grant a Power of Attorney (poder) to their Spanish lawyer (abogado), who can then manage the entire application on their behalf, navigating language barriers and bureaucratic complexities.

To ensure absolute clarity, here is a breakdown of the essentials required to begin.

Essential First Steps for Foreign Buyers

| Requirement | What It Is | Why It's Critical |

|---|---|---|

| NIE Number | A unique tax identification number for foreigners. | You legally cannot buy property, pay taxes, or set up utilities without it. |

| Spanish Bank Account | A local bank account in your name. | Essential for transferring purchase funds, paying deposits, and managing ongoing costs like bills and community fees. |

| Proof of Funds | Documentation showing the legal origin of your capital. | A strict anti-money laundering requirement in Spain. Your bank and lawyer will need this. |

Securing these three items demonstrates to sellers and professionals that you are a serious, organised buyer ready to transact.

Setting Up Your Financial Hub: A Spanish Bank Account

While a Spanish bank account is not a legal prerequisite to begin your property search, it is a practical necessity that streamlines the entire process. It is required for everything from paying the initial reservation deposit to making the final payment at the notary's office.

Beyond the acquisition, it becomes your financial hub for managing the property.

As Nick Marr, founder of EuropeanProperty.com, points out, "A Spanish bank account isn't just about the purchase. It's about efficiently managing your asset long-term. Direct debits for community fees, utility bills, and local taxes like IBI are managed seamlessly, which is vital for non-resident owners."

A local account simplifies all transactions. It aids in proving the legal source of your funds (a major anti-money laundering check in Spain) and helps you avoid punitive international transfer fees or last-minute panics over unfavourable exchange rates. It sends a clear signal that you are a sophisticated buyer who has done their homework.

Understanding the Spanish Real Estate Market Dynamics

To make an astute investment when buying property in Spain, you must look beyond glossy brochures and gain a genuine understanding of the forces shaping the market. The Spanish property landscape is not a monolith; it is a mosaic of distinct regional markets, each with its own price points, buyer demographics, and property supply.

Success is contingent on grasping these local dynamics. A prime beachfront apartment in Marbella, for instance, operates in an entirely different market to a rustic finca in inland Andalusia or a chic penthouse in Barcelona. Understanding these nuances is the first step towards a sound, strategic acquisition.

One of the most significant factors currently influencing the Spanish market is a structural deficit between supply and demand. This has exerted considerable upward pressure on prices, with Spain’s housing market seeing a 7.5% year-on-year increase in the first quarter of 2025. With approximately 246,000 new households forming annually but only around 90,000 new homes being built, this shortage continues to fuel price appreciation.

Assembling Your Professional Team

Navigating this complex environment is not a solo endeavour. In fact, building a trusted team of local professionals is arguably the most important investment you will make in this process. These experts are tasked with protecting your interests, managing complexities, and ensuring your purchase is legally and financially sound.

Your on-the-ground team should include:

- An Independent Lawyer (Abogado): Your most critical ally. They must be independent, meaning they work for you alone—not the seller or the estate agent. Their primary role is to conduct exhaustive due diligence.

- A Reputable Estate Agent: A well-connected agent can provide access to off-market properties and offers invaluable local market intelligence.

- A Notary (Notario): A public official who oversees the final sale, certifies the public deed, and ensures all legal protocols are correctly followed.

- A Financial Advisor or Mortgage Broker: Essential for structuring your financing, whether you are a cash buyer or require a Spanish mortgage.

The Abogado's Critical Role in Due Diligence

While every member of your team plays a vital role, your abogado is the absolute cornerstone of a secure transaction. Their main responsibility is to perform thorough due diligence before you sign any legally binding document.

A crucial component of this is obtaining and analysing the Nota Simple Informativa from the Land Registry. This document provides a legal snapshot of the property. Your lawyer will use it to check for any outstanding debts, mortgages, or legal claims against the property, which can be passed on to the new owner in Spain. This step is non-negotiable.

They will also verify that the property registered in the Land Registry matches the physical building, checking for common issues like illegal extensions or unrecorded alterations that could cause significant legal and financial problems later.

Nick Marr, founder of EuropeanProperty.com, advises, "The Spanish market remains incredibly resilient, but its dynamics are shifting. Astute investors must look beyond the headlines and understand the local supply constraints and legal nuances. A top-tier local 'abogado' isn't just an expense; they are your most critical asset in navigating the complexities and securing your investment."

For anyone considering buying property in Spain as an investment, it is also vital to calculate potential rental yield to forecast profitability. This is another area where a deep understanding of market trends, supported by robust professional advice, is essential. By combining market data with rigorous legal checks, you place yourself in the strongest possible position to buy with confidence.

How to Finance Your Spanish Property Purchase

Determining the financing strategy for your Spanish property is a pivotal step in the acquisition journey. For many high-net-worth individuals, a cash purchase is the most efficient route, allowing you to bypass the administrative burden of the lending process.

That said, securing a Spanish mortgage can be a shrewd financial decision, freeing up your capital for other investments and maintaining a diversified portfolio. Whether you pay with cash or leverage financing, a clear strategy is required from the outset as it will dictate your entire timeline.

Cash Buyers vs Spanish Mortgages

A cash offer holds significant power in the Spanish market. It eliminates the mortgage approval process, lender valuations, and potential financing contingencies. Sellers favour cash offers for the speed and certainty they provide, which gives you considerable negotiating leverage. The primary challenge for cash buyers is managing the large-scale currency transfer efficiently.

Alternatively, obtaining a Spanish mortgage is a well-established path for foreign buyers. While lending regulations and interest rates fluctuate, financing a portion of the property allows you to keep your capital working for you elsewhere.

Securing a Mortgage as a Foreigner

Spanish banks are accustomed to lending to non-residents, but the underwriting criteria are more stringent than for domestic borrowers. From the lender's perspective, non-residents represent a higher risk profile. They will require a comprehensive overview of your global financial health to be confident in your ability to service the debt.

When you are ready to transfer your deposit and other funds, intelligent currency conversion is key to avoiding unnecessary losses. It is well worth investigating an online foreign currency exchange service to secure optimal rates.

To gain mortgage approval, you will need to assemble a significant amount of documentation. Typically, a Spanish lender will request:

- Proof of Income: Recent payslips, a contract of employment, or statements showing pension income.

- Tax Returns: Be prepared to provide tax declarations from your home country for the last two to three years.

- Credit History: A credit report from a major agency in your country of residence (such as Experian or Equifax) is essential.

- Proof of Existing Assets and Debts: They will require a clear overview of your other properties, investments, and any outstanding loans.

A common misconception among international buyers is that they can secure the same lending terms as a local. While Spanish banks are open for business, they apply a different risk model to non-residents, which is reflected in the loan-to-value ratios and required paperwork.

Understanding Loan-to-Value (LTV) Ratios

This is one of the most critical distinctions for foreign buyers in Spain. The loan-to-value (LTV) ratio determines the maximum amount the bank will lend against the property's official appraised value. While a Spanish resident may be offered a mortgage of up to 80%, non-residents face a lower cap.

You should anticipate LTV ratios of around 60–70%. In practical terms, this means you require a much larger deposit—at least 30–40% of the purchase price, plus an additional 10-15% to cover taxes and fees. Lenders view non-resident loans as higher risk, and this conservative LTV is their primary mitigation tool.

Fixed-Rate vs Variable-Rate Mortgages

You will encounter two main types of mortgages in Spain: fixed-rate (tipo fijo) and variable-rate (tipo variable).

-

Fixed-Rate Mortgages: These lock in an interest rate for the entire loan term, typically 20 to 25 years. This provides total predictability; your monthly repayments will not change, protecting you from interest rate hikes.

-

Variable-Rate Mortgages: These are linked to the Euribor (the key European interbank lending rate) plus the bank’s margin. Your repayments will rise and fall with the Euribor. They often start with a lower initial rate but carry the risk that your payments could increase significantly over time.

The correct choice depends on your personal risk tolerance. The majority of international investors we work with prefer the certainty of a fixed-rate mortgage. Knowing your exact holding costs for the next two decades provides invaluable peace of mind. Our advice is to engage a specialist mortgage broker who has extensive experience with expatriate clients. Their expertise is priceless and can help you secure the best possible terms for your situation.

The Spanish Property Purchase Process Unpacked

Buying a property in Spain can appear complex, but it follows a clear and well-defined process. Once you understand the key stages, the journey becomes a series of manageable, logical steps.

From the moment your offer is accepted to the day you receive the keys, every part of the process is designed to protect both you and the seller. This is where having your financial and legal teams in place pays dividends, allowing you to move forward with confidence.

The Initial Step: The Reservation Agreement

Once you have found your ideal property and the seller has accepted your offer, the first formal step is to sign a reservation agreement, known in Spanish as a contrato de reserva.

This is a straightforward document that removes the property from the market for a specified period, usually 15 to 30 days. To formalise this, you will pay a small reservation deposit, typically between €3,000 and €6,000. This demonstrates your serious intent to the seller.

This fee provides your lawyer (abogado) with the necessary time to commence their due diligence. It is a standard part of the process, but it is imperative that your lawyer reviews the agreement before you sign or transfer any funds. The reservation fee is usually held in escrow by the estate agent or the seller’s lawyer.

The Legally Binding Private Purchase Contract

Once your lawyer has completed their initial checks and provided a positive report, you will proceed to the most significant contract: the private purchase contract (contrato privado de compraventa). This is a detailed and legally binding document that outlines all terms and conditions of the sale.

This is the point of no return. Upon signing this contract, you will be required to pay a substantial deposit, almost always 10% of the purchase price (less the reservation fee already paid). Once both parties have signed, you are legally committed to purchasing the property.

A critical detail to look for in the contrato de compraventa is the "arras penitenciales" clause. This is a powerful protection for both parties. It states that if you, the buyer, withdraw from the sale after signing, you forfeit your 10% deposit. However, if the seller withdraws, they must repay you double your deposit. It’s a strong incentive for all parties to complete the transaction.

The Grand Finale: Completion and The Title Deeds

The final, and most rewarding, stage of the process is the completion. In Spain, this is formalised through the signing of the public deed of sale (escritura de compraventa), which takes place at the office of a public notary (notario). This is the official handover.

All relevant parties will be present: you (or your legal representative with Power of Attorney), the seller, both of your lawyers, and the notary.

The following occurs at this meeting:

- You make the final payment to the seller.

- The notary reads the title deed (escritura) aloud, ensuring all details are correct.

- You and the seller both sign the title deed.

- The keys are handed over, and you are officially the owner of a property in Spain.

The notary acts as an impartial government official, verifying the identity of all parties and ensuring the sale is fully compliant with Spanish law. Afterwards, the notary will register your ownership at the Spanish Land Registry (Registro de la Propiedad), providing you with ultimate legal protection. Handled by the right professionals, buying property in Spain as a non-resident is a transparent and secure process.

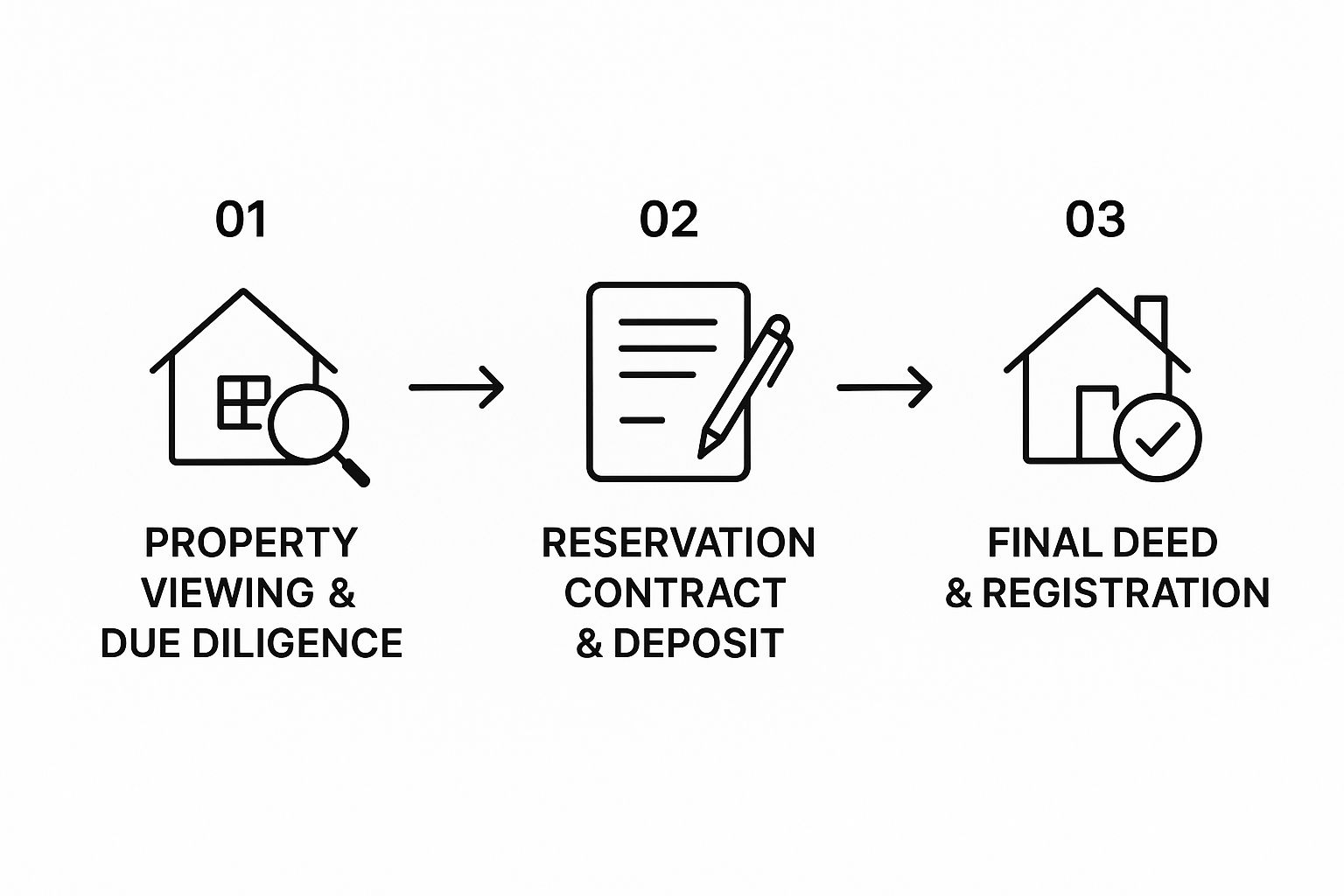

This infographic simplifies the key stages you'll go through when buying Spanish real estate.

As you can see, it is a structured journey, moving from initial due diligence to a binding commitment and, finally, to official ownership. You can find visual references for available properties on our luxury real estate listings in Spain.

Taxes, Residency Rules, and the Golden Visa Option

Owning a property in Spain involves more than just lifestyle benefits; it comes with a clear set of financial and legal responsibilities that must be understood from the outset. For sophisticated international investors, mastering these ongoing obligations is key to managing your asset without unforeseen complications.

The primary areas of focus are property-related taxes and, for those seeking a foothold in Europe, Spain's highly popular Golden Visa programme.

Navigating these elements correctly will ensure your investment remains compliant and financially sound. It is a part of the ownership journey that demands your attention from day one.

The Initial Tax Impact of Your Purchase

The moment you acquire a Spanish property, you will incur a one-off tax liability. The type of tax and its rate depend entirely on whether you are buying a new-build property from a developer or a resale property from a previous owner.

- For Resale Properties: You will pay Property Transfer Tax (ITP), or Impuesto de Transmisiones Patrimoniales. This is a regional tax, meaning the rate varies depending on the autonomous community where you buy. Expect it to be between 6% and 10% of the purchase price declared in the deeds.

- For New-Build Properties: In this case, you will pay VAT (IVA), set nationally at a flat rate of 10%. On top of that, you must also pay Stamp Duty (AJD), or Actos Jurídicos Documentados. This typically adds another 1.2% to 1.5% to the acquisition cost.

These taxes constitute a significant portion of your closing costs and must be factored into your budget to avoid any unwelcome surprises.

Ongoing Annual Property Taxes for Foreign Owners

Your tax obligations do not cease once you have the keys. As a non-resident owner, you are liable for a couple of annual taxes that are vital to manage correctly.

First is the local council tax, known as Impuesto sobre Bienes Inmuebles (IBI). This is paid to your local town hall (ayuntamiento) and is calculated based on the property’s official rateable value, the valor catastral. It funds local services like refuse collection, street cleaning, and infrastructure maintenance.

Second is the non-resident income tax, or Impuesto sobre la Renta de No Residentes (IRNR). This tax often surprises foreign owners. You are required to pay it even if you do not rent out your property. The Spanish tax authorities consider you to have a "deemed" or "imputed" rental income simply by virtue of owning a second home, and this theoretical income is taxed. If you do rent out your property, you will pay IRNR on the actual rental income you earn instead.

The Golden Visa: A Pathway to Spanish Residency

For many high-net-worth investors from outside the European Union, buying a property in Spain is not just a lifestyle choice—it's a strategic move to gain residency in Europe. Spain's Golden Visa programme is one of the most sought-after residency-by-investment schemes on the continent for good reason.

The primary requirement is a real estate investment of at least €500,000. Crucially, this amount must be free of any mortgage or loan. You can meet this threshold by acquiring a single property or by combining several.

The benefits are significant:

- Residency for You and Your Family: The visa extends to your spouse, dependent children, and dependent parents.

- Schengen Area Travel: It grants you the freedom to travel visa-free across all 27 countries in the Schengen Zone.

- Minimal Stay Requirement: You are only required to visit Spain once per year to maintain the residency permit.

The Golden Visa offers a direct, streamlined route to living and eventually working in Spain, bypassing the bureaucratic hurdles often associated with other visa routes. It is a powerful tool for those wishing to establish a more permanent base in Europe. The process itself is simplified for investors, and you can see a breakdown of the required documents in our guide to the Golden Visa application.

The market is also reacting to potential regulatory changes, including controversial proposals for a 100% tax on property purchases by non-EU nationals. If enacted, this would dramatically alter the landscape for buyers from countries like the UK. Despite this, British nationals remain the largest group of foreign buyers, with purchases rising 7% in Q1 2023. You can read more about what this proposed Spanish tax could mean for UK buyers.

Common Questions From Foreign Property Buyers

When navigating the world of buying property in Spain for foreigners, questions are inevitable. Whether you are a seasoned investor or a first-time international buyer, every jurisdiction has its own unique rules and customs.

Let’s address some of the most common queries we receive from international buyers, providing the clear, straightforward answers you need to proceed with confidence.

As a UK Citizen, Can I Still Buy Property in Spain After Brexit?

Absolutely. British citizens can still buy property in Spain without any restrictions on ownership. The core acquisition process has not changed significantly.

The main difference post-Brexit is that you are now treated as a non-EU national. This primarily affects residency rules and may involve slightly more paperwork than before. However, the fundamentals remain the same for all foreign buyers: you will need a Foreigner's Identity Number (NIE) and a Spanish bank account.

Now more than ever, it is crucial to engage an abogado (lawyer) who is fully conversant with the latest regulations for British buyers to ensure a seamless process.

What Are the Biggest Risks to Avoid When Buying in Spain?

From our experience, the most significant risks almost always stem from attempting to cut corners on legal checks and due diligence. It is a classic but costly error.

Here are the main pitfalls to avoid:

- Skipping Full Legal Checks: This is a critical mistake. You could inherit hidden debts, charges from the previous owner, or discover that an attractive feature like a terrace was an illegal extension. These problems become your liability.

- Not Using an Independent Lawyer: Never use a lawyer recommended by the seller or the estate agent. This is a clear conflict of interest. Your abogado must work exclusively for you, protecting only your interests.

- Underestimating the Additional Costs: Many buyers are surprised when they realise the final bill is considerably higher than the headline purchase price. Taxes, notary fees, and other costs can easily add another 10-15% to the total. Always insist on a detailed breakdown of all expected costs from your lawyer at the outset.

What Ongoing Costs Should I Budget for Annually?

Your financial commitment does not end upon receiving the keys. A prudent investor always budgets for the annual running costs to avoid financial pressure down the line.

Be prepared for these regular expenses:

- IBI Tax (Impuesto sobre Bienes Inmuebles): This is Spain’s equivalent of council tax, paid annually to your local town hall (ayuntamiento).

- Community Fees (Gastos de Comunidad): If your property is part of a development or apartment building, these fees cover the maintenance of shared facilities like gardens, swimming pools, and lifts.

- Non-Resident Income Tax (IRNR): A national tax that applies even if you do not rent out your property. It's calculated on a "deemed income" based on the property’s official value.

- Utilities and Insurance: Your standard bills for electricity, water, and comprehensive building and contents insurance.

It is always a good idea to think ahead about other potential questions. For a solid framework, review this list of essential questions for foreign property buyers, as many of the principles apply regardless of the purchasing jurisdiction.

About EuropeanProperty.com

EuropeanProperty.com is Europe’s longest-running luxury real estate platform, online since 1999. It connects luxury real estate agents, developers, and homeowners with high-net-worth buyers and international investors.

Looking for expert mortgage guidance? Get luxury property mortgage advice here:

👉 https://europeanproperty.com/luxury-overseas-mortgages/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/