Picture this: waking up to the sun-drenched coastline of the Côte d’Azur. It’s a lifestyle that has captivated high-net-worth individuals and savvy investors for generations. The market for homes for sale in the French Riviera is a true bastion of luxury and opportunity, with everything from secluded villas in Saint-Jean-Cap-Ferrat to impossibly chic penthouses in Cannes.

The Enduring Allure of French Riviera Real Estate

The French Riviera, or Côte d’Azur as it’s known locally, is far more than just a beautiful location; it’s a global benchmark for luxury living. For decades, it has attracted a very specific clientele drawn by its unique blend of stunning natural beauty, a glamorous social scene, and a remarkably stable, high-value property market.

This magnetic pull isn’t by accident. It comes down to a few key ingredients:

- A World-Class Lifestyle: The social calendar here is legendary, from the Cannes Film Festival to the Monaco Grand Prix. This is the backdrop for Michelin-starred restaurants, exclusive beach clubs, and world-famous luxury boutiques.

- Breathtaking Natural Scenery: You have the stunning contrast of azure waters against dramatic cliffs, while the hinterland is dotted with charming mediaeval villages like the iconic Saint-Paul-de-Vence.

- Unmatched Accessibility: Nice Côte d’Azur Airport offers direct flights to major global hubs, making the Riviera exceptionally well-connected for international homeowners and investors who need to come and go with ease.

A Market Defined by Prestige and Resilience

Even when global economic winds shift, the French Riviera property market shows incredible resilience. While other markets might wobble, the simple fact is that there’s a finite supply of prime real estate in hotspots like Cap Ferrat and Saint-Tropez.

This ensures demand consistently outstrips supply, safeguarding property values over the long term and creating a secure environment for capital. Let’s be honest, the prestige that comes with a Côte d’Azur address adds an intangible value that simply transcends typical market ups and downs.

Nick Marr, founder of EuropeanProperty.com, puts it perfectly: “The French Riviera isn’t just a place to buy a property; it’s an investment in a legacy. The demand for homes for sale in the French Riviera is driven by a desire for a quality of life that is simply unmatched anywhere else in the world.”

The sheer diversity of properties is another major draw. Whether you’re searching for a contemporary villa with all the latest tech or a historic Belle Époque estate dripping with timeless elegance, the market here caters to a wide spectrum of sophisticated tastes. Even the interiors reflect this high standard, with features like a beautifully designed luxury bathroom often being a given.

To get a feel for the broader French real estate landscape, you can explore the full range of properties available across France. Understanding that wider context can give you a valuable perspective as you zero in on the truly exclusive homes for sale on the Riviera.

Decoding the Current Property Market Dynamics

If you’re a serious investor, you know that understanding market cycles is everything. A close look at the French Riviera’s current property climate tells a story far more interesting than what you might read in the headlines. The market for homes for sale in the French Riviera isn’t in a slump; it’s undergoing a strategic reset.

Transaction volumes have slowed down in recent years, which is a perfectly natural response to shifts in the global economy. This isn’t a red flag. It’s a correction that’s carving out unique buying opportunities for those ready to make a move, offering more leverage than we’ve seen in a long time.

Understanding the Market Correction

The period between 2022 and early 2024 definitely felt cooler. Global factors, like rising interest rates, made buyers more cautious and naturally pulled prices down from the highs we saw right after the pandemic.

But this slowdown gave the market some much-needed breathing room. It cleared away the speculative frenzy and brought the focus back to what matters: enduring value and the incredible lifestyle the region offers. For an investor, that means a more stable, predictable landscape for long-term growth.

The numbers back this up. Between 2022 and 2024, luxury real estate transactions (properties over one million euros) dropped by around 45%. But this dip is setting the stage for a strong recovery in 2025, fuelled by falling interest rates and the welcome return of international buyers, especially from the UK and the US.

The Forces Shaping Today’s Climate

Several key factors are influencing the homes for sale in the French Riviera right now. Getting a handle on these is crucial for timing your entry into the market.

- Shifting Interest Rates: As central banks start to ease up, financing is becoming more attractive. This makes luxury properties more accessible for buyers who need to arrange a mortgage.

- International Buyer Return: A more stable global outlook and favourable currency exchange rates are bringing back buyers from key overseas markets. We’re seeing a real comeback from buyers in the United States, the UK, and Northern Europe.

- Inventory Levels: While demand is picking up, the supply of prime, well-located properties is, as always, limited. This scarcity is the bedrock that supports long-term value here.

The current market isn’t about finding a ‘bargain’ in the traditional sense. It’s about securing exceptional value in one of the world’s most resilient real estate markets. The smart money is focused on quality and location, recognising that these are the assets that always outperform.

Forecasting the Road Ahead

Looking towards 2025 and beyond, the picture is bright. The market is heading for steady, sustainable growth, leaving the recent volatility behind. The return of British and American investors, now on stronger economic footing, is a key reason for this renewed optimism.

What’s more, a new wave of ultra-luxury developments is set to raise the region’s profile even higher. Projects like the new high-end hotel complex in Cap d’Ail are injecting fresh prestige and setting new standards for quality. While we’re focused on the wider property market, it’s also worth keeping an eye on the latest kitchen and bath market trends, as these details can boost a property’s appeal.

It’s this combination—stabilising financial conditions, returning international demand, and new prime developments—that makes such a compelling case for investing now. The current climate is a strategic window of opportunity to acquire a premier asset before the next wave of appreciation truly kicks in. The key is to turn market intelligence into your advantage.

Exploring the Riviera’s Most Desirable Locations

Where you choose to buy on the Côte d’Azur is every bit as important as the property itself. Each town and village has its own unique character, a distinct lifestyle, and a completely different investment profile. Let’s move beyond the famous names and take a look at the real intelligence behind the Riviera’s most sought-after micro-markets, so you can match your goals with the perfect location.

Searching for homes for sale in the French Riviera is a journey through a tapestry of different atmospheres. From the unapologetic glamour of Saint-Tropez to the artistic soul of the inland villages, understanding these subtleties is the secret to a successful investment.

Saint-Tropez: The Epitome of Glamour

Saint-Tropez hardly needs an introduction. It’s the global benchmark for jet-set luxury and pure summer energy. The property market here is all about magnificent waterfront villas, often with private moorings, and exclusive estates tucked away in the quiet hills of Ramatuelle.

This is the place for those who live for a high-energy social scene and value the sheer prestige of a Saint-Tropez address. And while it’s famous for its summer buzz, the shoulder seasons offer a quieter, yet just as sophisticated, experience for homeowners.

Cannes: A Hub of Prestige and Commerce

Cannes is, of course, synonymous with its world-famous film festival, but its appeal as a real estate destination is year-round. The city offers a rare mix of beachfront glamour along the Croisette and a busy, thriving commercial heart. Investors are typically drawn to the luxurious penthouse apartments with sweeping sea views and the elegant Belle Époque villas in quieter residential spots like La Californie.

It’s the perfect choice for buyers who want city conveniences, world-class shopping, and fantastic international transport links, all wrapped up in that quintessential Riviera package. The market is dynamic, attracting both lifestyle buyers and those laser-focused on strong rental returns.

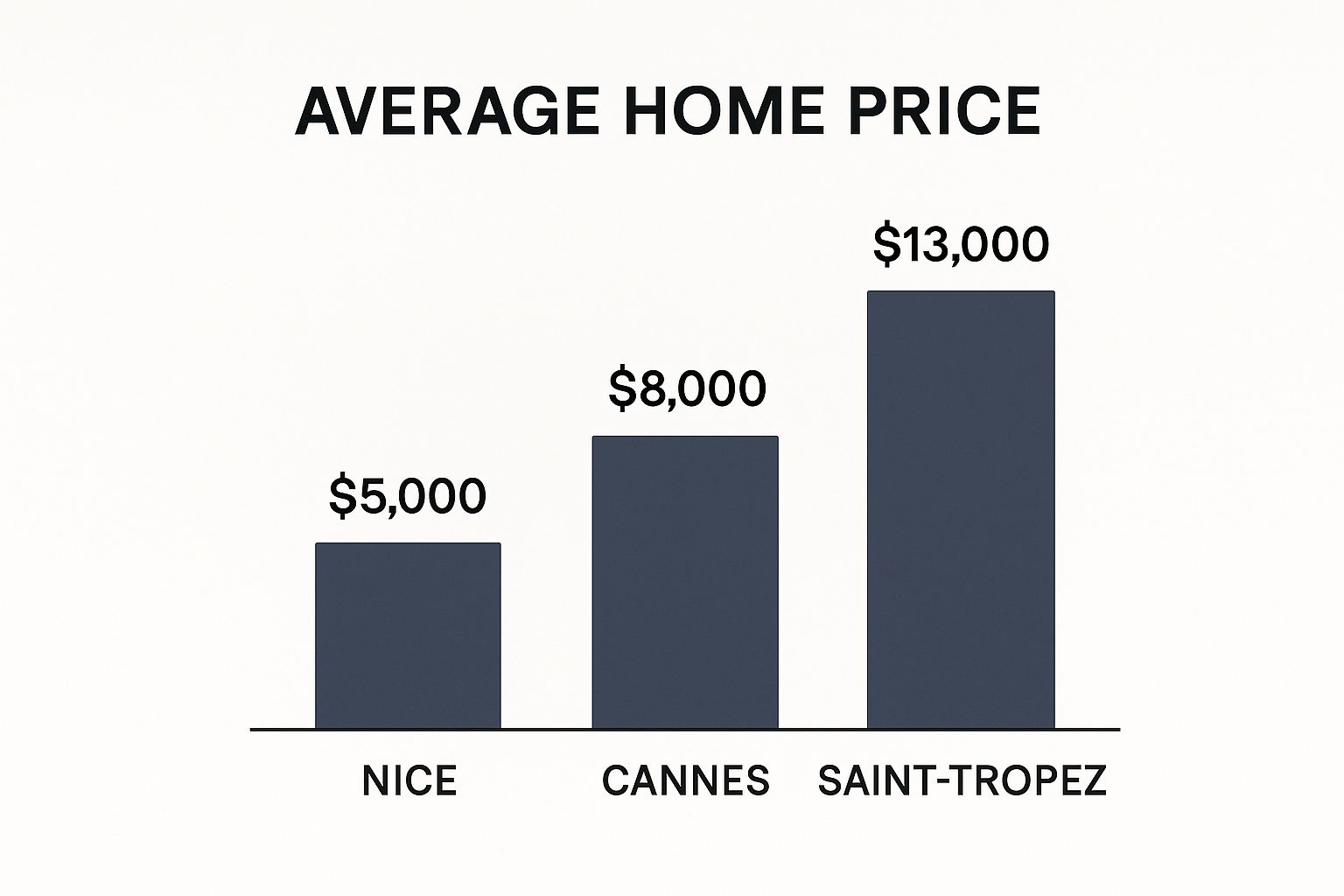

The chart below gives you a clear visual comparison of average property prices across the key Riviera hotspots.

It really highlights the premium you pay for locations like Saint-Tropez, while showing Cannes and Nice as more accessible—but still high-value—entry points to the market.

To help you decide, here is a quick snapshot comparing the top locations for investors.

French Riviera Location Snapshot: A Comparison for Investors

| Location | Dominant Property Style | Atmosphere & Lifestyle | Typical Price Point | Best For |

|---|---|---|---|---|

| Saint-Tropez | Waterfront Villas, Secluded Estates | High-octane glamour, exclusive social scene | Very High | Prestige buyers & summer socialites |

| Cannes | Penthouse Apartments, Belle Époque Villas | Chic urban living, international events | High | Year-round convenience & rental investors |

| Nice | Sea-view Apartments, Bourgeois Buildings | Vibrant city life, cultural hub, accessible | Medium-High | Strategic investors & year-round residents |

| Saint-Paul de Vence | Historic Stone Houses, Country Estates | Artistic, tranquil, authentic Provençal | High | Buyers seeking privacy & creative inspiration |

This table should give you a clearer idea of how each area’s property market aligns with different lifestyles and investment strategies.

Nice: The Strategic and Vibrant Capital

For many international buyers, especially from the UK, Nice is a standout strategic choice. It has a compelling mix of easy accessibility, cultural vibrancy, and solid investment fundamentals. Unlike the smaller towns that peak seasonally, Nice is a living, breathing city all year long.

Property prices here have shown modest but steady growth. In 2025, the average price per square metre sits between €4,500 and €5,500, which is a 1.9% increase on the previous year. This puts the city in a competitive sweet spot—around 20% more affordable than Cannes, yet still priced higher than Marseille.

Critically for investors, the rental yield in Nice is approximately 5.2%. That figure comfortably surpasses Cannes (4.5%) and Saint-Tropez (3.9%), making it a very attractive proposition.

Saint-Paul de Vence: The Artistic Soul

If you’re looking for a different kind of luxury—one rooted in history, art, and tranquillity—the medieval hilltop village of Saint-Paul de Vence is a perfect fit. Famed for its art galleries and cobblestone streets once walked by Picasso and Chagall, it’s a true escape from the coastal buzz.

The real estate here is defined by historic stone houses, charming village properties, and larger estates with absolutely breathtaking country views. Buyers are often drawn to the privacy and authenticity of the lifestyle, valuing creative inspiration over coastal glamour.

Properties in this region often come with meticulously cared-for grounds. The design of these outdoor spaces is a huge part of a home’s appeal, as you can see from this example of classic Riviera landscaping and gardens.

Ultimately, the “best” location comes down to your personal and financial goals. Whether you’re drawn to the vibrant energy of the coast or the serene charm of the hinterland, the French Riviera has a home to suit every discerning taste.

Navigating the Purchase Process for International Buyers

Buying one of the coveted homes for sale in the French Riviera might seem complicated from the outside, but it’s actually a well-oiled and secure system. Think of this section as your roadmap. It’s designed specifically for international buyers to demystify the journey, from making an offer to finally getting the keys in your hand.

The whole process is structured to protect both you and the seller. With key legal milestones built in, you’re assured of transparency at every stage. Once you understand these steps, what looks like a daunting task becomes a series of clear, manageable actions.

The Initial Offer and Preliminary Contract

So, you’ve found the perfect property. What’s next? The first formal step is to submit a written offer, known as an ‘offre d’achat’. This document simply outlines the price you’re willing to pay and any conditions you might have. If the seller accepts, you’re ready for the most critical pre-completion stage: signing the preliminary sales contract.

This contract, usually a ‘compromis de vente’, is a legally binding agreement that locks in all the terms of the sale. This is where you’ll pay a deposit, typically between 5% and 10% of the purchase price. Don’t worry—the money is held safely in an escrow account managed by a public official called the notaire.

Nick Marr, founder of EuropeanProperty.com, advises, “Local expertise isn’t a luxury; it’s the cornerstone of a successful international purchase. Engaging with professionals who understand the nuances of the ‘compromis de vente’ is absolutely essential.”

Understanding Your Rights and Obligations

A brilliant feature of the ‘compromis de vente’ is its conditional clauses, or ‘clauses suspensives’. These are your safety net. For instance, a very common clause makes the entire deal conditional on you securing a mortgage. If the bank says no, you can walk away from the sale and get your deposit back.

After signing the ‘compromis de vente’, French law also gives you, the buyer, a 10-day cooling-off period. During these ten days, you can back out of the purchase for any reason at all, no questions asked and no penalty. It’s a vital safeguard that gives you breathing room before you’re fully committed.

The Central Role of the Notaire

In France, every property transaction is overseen by a ‘notaire’, a government-appointed legal expert. A notaire isn’t like a solicitor in the UK or an attorney in the US. They are an impartial public official who represents the state, ensuring the deal is done correctly and by the book.

The notaire handles all the crucial checks and balances:

- Conducting all legal due diligence on the property.

- Making sure there are no hidden debts or legal claims against it.

- Preparing the final deed of sale, the ‘acte de vente’.

- Collecting all the necessary taxes and officially registering the new ownership.

Even though the notaire is impartial, it’s a smart move for international buyers to hire their own legal representative. They can work alongside the notaire to make sure your specific interests are protected every step of the way.

Finalising the Sale and Associated Costs

The grand finale is signing the ‘acte de vente’ at the notaire’s office. At this meeting, you’ll pay the remaining balance, and just like that, the property officially becomes yours. You’ll be handed the keys to your new home on the French Riviera.

Of course, it’s not just the purchase price you need to budget for. Expect to pay associated costs of around 7-8% of the property’s value. This covers the notaire’s fees and property registration taxes, which are similar to ‘stamp duty’. You will also take on ongoing property taxes, like the ‘taxe foncière’. Getting a clear picture of these finances from the start is the key to a smooth and successful purchase.

Building Your French Riviera Investment Strategy

Buying a property on the Côte d’Azur isn’t just about securing a beautiful home; it’s a serious financial move. A well-thought-out investment strategy is what separates a simple lifestyle purchase from a genuinely smart asset.

Whether you’re aiming for healthy rental yields or long-term capital growth, getting it right starts with careful financial planning. Understanding the full economic picture—from identifying who holds the negotiating power to structuring the purchase for tax efficiency—is absolutely paramount when looking at homes for sale in the French Riviera.

Rental Yields vs Capital Appreciation

First things first: what do you want this property to do for you financially? Your approach will hinge on whether you’re after a steady income or a long-term nest egg.

- Chasing Strong Rental Yields: If you want your property to generate cash flow, you need footfall. Think locations with year-round appeal like Nice and Cannes, which pull in a constant stream of tourists and business travellers. A modern, well-placed apartment here can deliver consistent returns.

- Playing the Long Game with Capital Appreciation: For those more interested in watching their asset grow in value over time, exclusivity is everything. This is the world of ultra-prime locations like Saint-Jean-Cap-Ferrat or secluded estates tucked away near Saint-Tropez. Here, scarcity and prestige are what drive prices skyward.

This isn’t a minor detail. A flat geared for high rental turnover has completely different management costs and needs compared to a private villa held for its appreciating value. Your strategy must reflect this from day one. You can get a feel for the different opportunities by exploring a variety of homes for sale with different investment potentials.

Navigating the Financial and Tax Landscape

For any international buyer, getting to grips with the French tax system is non-negotiable. The key is to structure your purchase correctly from the outset to sidestep any costly surprises later on.

A major one to watch is the Impôt sur la Fortune Immobilière (IFI), France’s real estate wealth tax. This applies to anyone whose net property assets in France tip over the €1.3 million mark. Don’t panic, though—there are legitimate ways to soften its impact, like using a mortgage to lower your net asset value.

“A well-structured mortgage can be a powerful tool for tax efficiency,” notes Nick Marr, founder of EuropeanProperty.com. “It not only helps with the IFI but can also be beneficial when it comes to capital gains and inheritance planning for non-residents.”

Capital gains tax is the other big one, especially if you plan to sell down the line. The rate you’ll pay and any allowances you can claim depend heavily on your residency status and how long you’ve owned the property. This is one area where professional advice isn’t just recommended; it’s essential.

Understanding Current Market Leverage

Recent shifts in the market have opened a unique window of opportunity for shrewd investors. The French Riviera has seen a definite cooling-off period, which has changed the game for UK and other international buyers.

Between 2021 and 2024, sales of older properties dropped by around 33%, and prices fell by an average of 20% in 2023 alone. This is a stark correction from the overheated prices we saw during the pandemic.

What does this mean for you? It means buyers have more power. A staggering 92% of agencies are reporting wider negotiating margins, putting buyers in a stronger position than they’ve seen in years. This climate of price adjustments and seller flexibility is a strategic moment to acquire a prime asset on more favourable terms.

Your Gateway to the Côte d’Azur Lifestyle

So there you have it—a deep dive into the world of homes for sale in the French Riviera. We’ve peeled back the layers on this world-class destination, showing that while the market has its complexities, right now is a fantastic time for savvy buyers to make their move. The appeal of the Côte d’Azur isn’t just a fleeting trend; it’s built on decades of prestige, breathtaking natural beauty, and a lifestyle that is, quite simply, second to none.

The time has come to stop dreaming and start doing. The insights in this guide, from understanding market shifts to navigating the buying process, are designed to give you the confidence to turn your vision into a set of keys.

Embrace the Ultimate Lifestyle

The Côte d’Azur offers a quality of life that you can’t put a price on. It’s the simple things: sun-drenched mornings on a private terrace, wandering through historic towns as they come alive at dusk, and lazy afternoons spent by the Mediterranean. For those who truly want to immerse themselves in the maritime culture, some even look beyond traditional houses, exploring unique options like What It’s Like To Live On A Boat.

“The French Riviera is a destination where life’s finest elements converge,” says Nick Marr, founder of EuropeanProperty.com. “Owning a home here is not just an acquisition; it’s an entry ticket to a world of unparalleled experiences.”

We encourage you to explore our curated listings of exclusive homes for sale in the French Riviera right here on EuropeanProperty.com. Our network of expert agents lives and breathes this market. They have the local knowledge and professional skill to guide you through every step, ensuring you feel confident and prepared.

Your gateway to the Côte d’Azur is open. Let us help you walk through it.

Your Questions Answered: A Practical Guide to Buying on the Riviera

When you’re considering buying a home on the French Riviera, a lot of practical questions are bound to pop up. It’s completely normal. To help clear things up, I’ve put together answers to some of the most common queries we get from international buyers, covering everything from annual costs to the legal bits and pieces.

What Will I Pay in Annual Property Taxes?

In France, property owners typically deal with two main annual taxes.

First, there’s the ‘taxe foncière’, or land tax. This is paid by the owner of the property, simple as that, whether you live there full-time or not.

The second was the ‘taxe d’habitation’, an occupancy tax. The good news is that this was scrapped for primary homes in 2023. However, if you’re buying a second home, you’ll still need to budget for it. The exact amounts can vary quite a bit depending on the town and the value of your property, so it’s something to factor into your yearly running costs from the start.

Can I Still Buy Property in France if I’m Not an EU Citizen?

Yes, absolutely. France places no restrictions on foreign ownership. Whether you’re from the UK, the US, or anywhere else outside the EU, the door is wide open.

The buying process is identical for everyone. The whole system, which is overseen by a public official called a notaire, is specifically designed to be secure and transparent for all buyers, regardless of nationality.

I’ve Heard About Something Called a ‘Usufruit’ – What Is It?

A ‘usufruit’ (or usufruct) is a clever legal structure that essentially splits property ownership. It’s a bit like having two different owners with two different roles.

One person, the ‘nu-propriétaire’, holds the actual title to the property—they own the “bricks and mortar.” The other, the ‘usufruitier’, has the right to use the home and, crucially, to receive any income it generates, like rent. It’s a popular tool in French estate planning, often used to streamline inheritance and minimise future tax burdens.

The ‘usufruit’ is a sophisticated strategy, but it’s not a one-size-fits-all solution. You need to be sure it aligns perfectly with your long-term financial goals and family situation. This is exactly why getting personalised legal advice is non-negotiable when you’re investing in French property.

Is a French Bank Account essential?

While you don’t legally need one to complete the property purchase itself, opening a French bank account is incredibly practical. I’d go as far as to say it’s a must-have for smooth sailing once you own the place.

Think about it: setting up direct debits for your utilities, taxes, and any property management fees makes life so much easier. French banks are very familiar with handling accounts for non-resident clients, so the process is usually straightforward.

Do I Have to Be in France to Sign the Final Papers?

No, you don’t. It’s perfectly possible to finalise the purchase without flying over.

You can grant a power of attorney, known as a ‘procuration’, to someone you trust. This is often the notaire’s own clerk or your legal advisor. This representative can then sign the final deed of sale, the ‘acte de vente’, on your behalf. It’s a common, secure, and well-established practice that gives international buyers valuable flexibility.

About EuropeanProperty.com

EuropeanProperty.com is Europe’s longest-running luxury real estate platform, online since 1999. It connects luxury real estate agents, developers, and homeowners with high-net-worth buyers and international investors.

Looking for expert mortgage guidance? Get luxury property mortgage advice here:

👉 https://europeanproperty.com/luxury-overseas-mortgages/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/