For high-net-worth individuals and discerning investors, acquiring a European property is not merely a transaction; it is the curation of a legacy. Beyond brick and mortar, the continent's most coveted addresses offer a unique synthesis of history, culture, and unparalleled craftsmanship. These are not just homes but powerful assets that represent a benchmark in global wealth and sophistication.

From historic châteaux on the French Riviera to avant-garde penthouses in central London, the market for luxury homes in Europe remains a dynamic and compelling landscape. This guide explores nine of the most iconic and aspirational property archetypes, offering an insider’s perspective on what makes each a pinnacle of residential excellence. We delve into the unique value propositions, investment potential, and practical considerations that define Europe's ultra-prime real estate sector.

Beyond the grand facades and historic landscapes, the interior design plays a crucial role in defining the opulence of these estates. For those seeking to personalise their space, exploring various luxury bedroom design ideas can provide inspiration for creating a truly bespoke sanctuary. According to Nick Marr, founder of EuropeanProperty.com, "True luxury in European property is measured not just by price, but by provenance, privacy, and a seamless blend of timeless elegance with modern innovation. The most astute investors understand this distinction."

1. The Modern Versailles: Château Louis XIV, Louveciennes, France

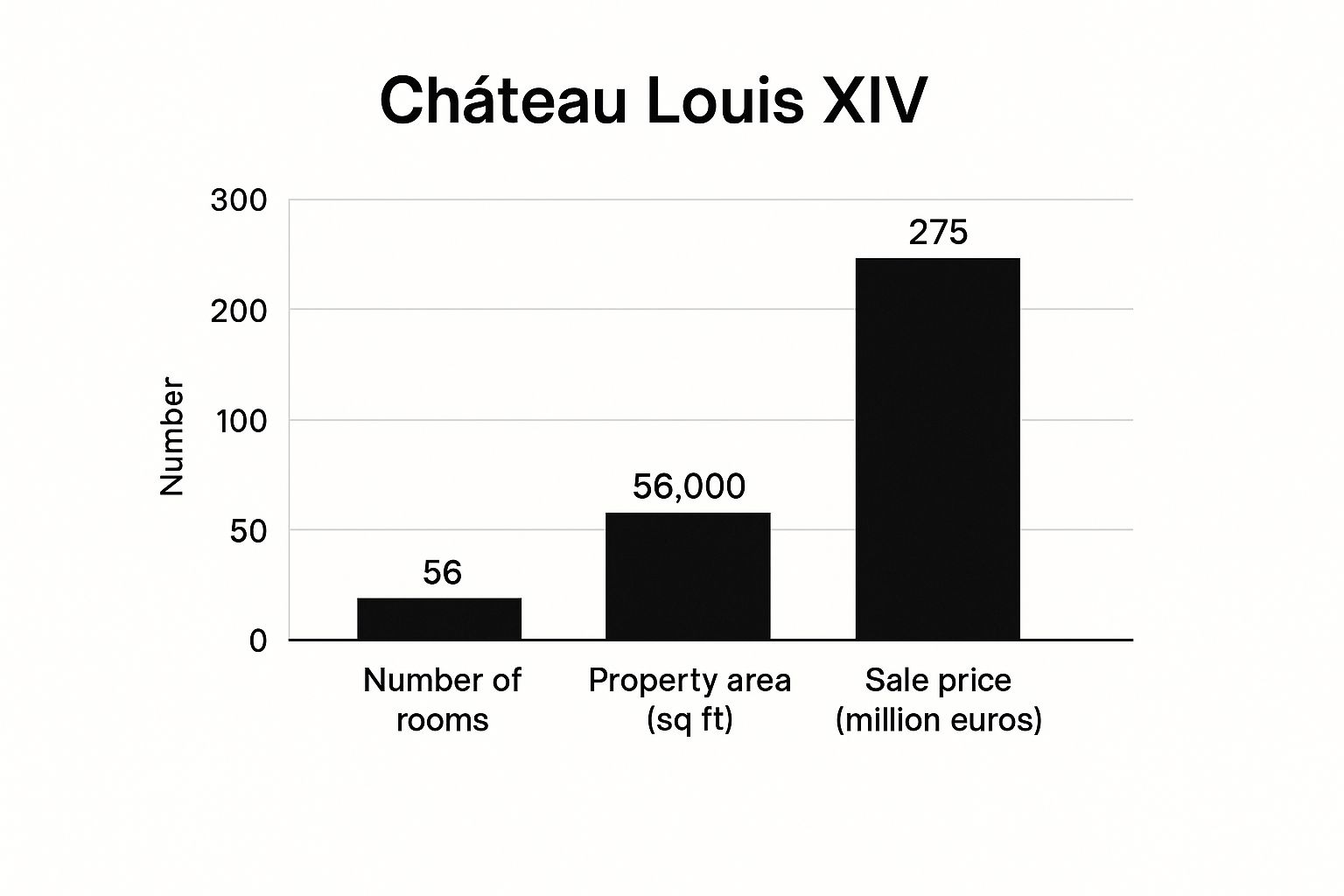

Regarded as a pinnacle of modern opulence, the Château Louis XIV in Louveciennes masterfully blends 17th-century French architectural grandeur with 21st-century technological innovation. Constructed between 2008 and 2011 by developer Emad Khashoggi, this property is a contemporary homage to the splendour of Versailles, located just outside Paris. Despite its historical appearance, it is one of the most technologically advanced luxury homes in Europe, with features like a silent underwater room and a nightclub, all controllable via a smartphone.

The property was thrust into the global spotlight when it sold for a record-breaking €275 million, making it one of the most expensive private residences ever sold. This transaction has since become a benchmark for ultra-prime real estate pricing and a case study in luxury property development.

Key Features and Investment Considerations

Owning a property of this magnitude requires significant strategic planning beyond the initial purchase. Prospective buyers in this tier must account for substantial ongoing operational costs.

- Maintenance & Technology: High-tech systems, from advanced security to climate control, demand specialised, long-term support contracts to ensure seamless operation.

- Specialised Insurance: Standard policies are inadequate; coverage must be custom-tailored to protect against a wide range of risks associated with unique, high-value assets.

- Regulatory Compliance: Unique features, such as helipads or extensive subterranean structures, require rigorous verification of all planning permissions and local regulations.

The bar chart below provides a snapshot of the property's impressive scale, comparing its room count, total area, and staggering sale price.

The visualisation clearly illustrates the immense scale of this asset, with the €275 million sale price setting it apart as a true outlier in the global property market.

2. Penthouse at One Hyde Park, London, UK

Located in the prestigious Knightsbridge district, One Hyde Park is the embodiment of prime London real estate and a benchmark for urban luxury living. Developed by the Candy brothers and designed by Rogers Stirk Harbour + Partners, these residences offer breathtaking views over Hyde Park and the city. The penthouses, in particular, represent some of the most valuable residential real estate per square foot globally, symbolising modern British luxury with a distinctly international character.

The building gained worldwide notoriety with record-breaking sales, such as the penthouse reportedly purchased by Ukrainian billionaire Rinat Akhmetov for £136 million. This transaction solidified its status as a landmark development, continuously setting new standards for the super-prime property market in London and making it a fixture in features on the world's most exclusive luxury homes in Europe.

Key Features and Investment Considerations

Investing in a property at One Hyde Park involves understanding its unique financial and lifestyle ecosystem. The association with the adjacent Mandarin Oriental hotel provides residents with unparalleled service, but this comes with significant ongoing commitments.

- Service Charges & Management: The world-class amenities, including a private cinema, spa, and concierge services managed by Mandarin Oriental, result in substantial annual service charges that must be factored into the total cost of ownership.

- Tax Implications: Prospective buyers, particularly international investors, must seek specialised advice on UK tax liabilities, including Stamp Duty Land Tax (SDLT) and potential inheritance tax consequences.

- Reputation & Security: The building's reputation for discretion and state-of-the-art security, managed by former SAS operatives, is a primary draw. Verifying the quality and responsiveness of the building management is crucial for protecting such a high-value asset.

3. Villa Leopolda, French Riviera

An icon of Belle Époque glamour, Villa Leopolda in Villefranche-sur-Mer is one of the most legendary and historically significant luxury homes in Europe. Perched on 18 acres with unparalleled panoramic views of the Mediterranean, this estate represents the golden age of the French Riviera. Originally built for King Leopold II of Belgium, its storied past includes owners like banking heiress Lily Safra and appearances in classic films such as Alfred Hitchcock's To Catch a Thief.

The villa famously made headlines with an attempted purchase by Russian oligarch Mikhail Prokhorov for a reported €390 million, a transaction that underscored its status as a trophy asset. It remains a benchmark for heritage luxury, blending architectural grandeur with an irreplaceable location. The legacy and prestige of such a property are as much a part of its value as the physical estate itself. For those looking to explore similar prime locations, you can find more information about homes for sale in the French Riviera.

Key Features and Investment Considerations

Investing in a heritage property like Villa Leopolda demands a deep appreciation for its history and a commitment to its preservation. The complexities extend far beyond a standard high-value property transaction.

- Historical Preservation: Any renovations or modifications will likely be subject to strict heritage regulations. Prospective buyers must conduct thorough due diligence on all historical preservation requirements and restrictions.

- Specialised Maintenance: The estate’s unique, historic features, from its architecture to its sprawling landscaped gardens, require specialist artisans and gardeners for their upkeep, representing a significant ongoing cost.

- Staffing & Operations: Managing an estate of this scale necessitates a large, professional staff. Investors must verify local employment regulations, including contracts, housing, and social security contributions.

- Seasonal Usage Patterns: The Riviera’s high season impacts everything from logistics and security to local availability of services. A strategic operational plan must account for these seasonal fluctuations.

4. Kensington Palace Gardens Properties, London

Affectionately known as 'Billionaires' Row,' Kensington Palace Gardens in London is one of the world's most exclusive and secure residential addresses. These grand mansions, many of which are Grade II listed, were originally conceived as homes for ambassadors and diplomats. Today, they represent the absolute pinnacle of London's luxury residential market, housing a discreet community of international royalty, business magnates, and high-net-worth individuals who value privacy and prestige above all else.

The street has become legendary for its record-breaking property transactions, including steel magnate Lakshmi Mittal's reported £117 million purchase and the former residence of Roman Abramovich, valued at over £125 million. These sales underscore its status as a premier location for some of the most sought-after luxury homes in Europe, where ownership is a powerful statement of global standing.

Key Features and Investment Considerations

Acquiring a property on this historic street involves navigating a unique set of challenges and opportunities. Due to the historical and prestigious nature of these homes, investors must be prepared for a highly specialised purchasing process.

- Listed Building Expertise: Many properties are Grade II listed, meaning renovations and alterations require specialist architects and consent from Historic England. Budgets should account for an additional 20-30% for historically sensitive restoration work.

- Crown Estate Leaseholds: A significant number of these properties are held on long leaseholds from the Crown Estate, which has specific covenants and requirements that a buyer's legal team must thoroughly investigate.

- Advanced Security Integration: Given the profile of its residents, engaging top-tier security consultants from the very outset is not just recommended, it is essential for designing and implementing bespoke physical and cyber-security systems.

5. Palazzo di Amore, Lake Como, Italy

Representing the pinnacle of Italian renaissance luxury, the extraordinary villas on Lake Como blend historic charm with contemporary opulence. While the name "Palazzo di Amore" is more famously associated with a Beverly Hills estate, the spirit it evokes perfectly captures the essence of Lake Como's grand properties. These historic villas, many dating back to the 18th century, have been meticulously restored to serve as modern palaces, offering unparalleled luxury in one of Europe's most romantic and sought-after settings.

The region's profile has been significantly elevated by celebrity residents like George Clooney and its use as a backdrop for major films, including James Bond and Star Wars. This has cemented its status as a premier destination for high-net-worth individuals seeking privacy, history, and breathtaking natural beauty. These properties are not just homes; they are timeless assets and cultural landmarks, making them a unique feature in the landscape of luxury homes in Europe.

Key Features and Investment Considerations

Acquiring a historic waterfront villa on Lake Como involves unique strategic considerations that differ from modern constructions. An investor must navigate a complex blend of preservation, regulation, and logistical planning.

- Italian Property & Inheritance Laws: A thorough understanding of Italian property law, including succession rules and taxation, is critical. Legal counsel specialised in historic properties is essential.

- Waterfront & Seasonal Maintenance: Owning a lakeside property necessitates specialised upkeep for features like private docks, seawalls, and terraced gardens, which are subject to seasonal weather changes.

- Planning & Modification Permits: Any planned renovations or modernisations to a historically significant villa require navigating strict local and national heritage regulations. Verifying all existing permits and understanding future limitations is non-negotiable.

- Boating & Accessibility: Given the lake's importance for transport and recreation, considerations for boat storage, mooring rights, and water sports equipment are integral to the lifestyle and property value.

6. Luxury Ski Chalets in St. Moritz, Switzerland

St. Moritz represents the gold standard of Alpine luxury living, where ultra-high-net-worth individuals own spectacular chalets that serve as exclusive winter retreats. These properties combine traditional Swiss architecture with cutting-edge luxury amenities, often offering direct ski-in/ski-out access and breathtaking mountain views in one of the world's most prestigious resort destinations. From historic chalets owned by European royalty to ultra-modern architectural showcases like the Chesa Futura, St. Moritz is a pinnacle of mountain real estate.

The market here is defined by extreme exclusivity and scarcity, which maintains high property values. Ownership is a symbol of status, attracting tech billionaires, celebrities, and financiers who value both the world-class skiing and the unparalleled privacy and security the location affords. This combination of lifestyle and investment security makes St. Moritz a unique segment within the European luxury homes market.

Key Features and Investment Considerations

Acquiring a property in St. Moritz involves navigating a complex and highly regulated market, demanding careful due diligence beyond the property's aesthetic appeal.

- Ownership Restrictions: Switzerland imposes strict rules on foreign ownership (Lex Koller). Buyers must verify their eligibility and understand the specific cantonal regulations that apply.

- Year-Round Maintenance: Even if used seasonally, these properties require substantial year-round maintenance contracts to manage harsh weather conditions, secure the premises, and maintain high-tech systems.

- Property Management & Rental Income: Professional property management is essential for generating rental income, handling guest services, and ensuring the chalet remains in pristine condition, which can offset significant running costs.

- Ski Access Rights: It is crucial to verify private ski slope access rights, easements, and any associated restrictions to ensure the property delivers the seamless experience expected at this level. You can learn more about the complexities of Swiss property prices and regulations on europeanproperty.com.

7. Quinta da Marinha Estate, Cascais, Portugal

The Quinta da Marinha Estate in Cascais embodies the sophisticated allure of Portuguese coastal living, offering a unique combination of natural beauty and refined luxury. This exclusive gated community, set against the dramatic backdrop of the Atlantic coastline near Lisbon, provides an appealing alternative to more traditional European luxury markets. It features a mix of contemporary villas and historic quintas, blending modern design with traditional Portuguese architectural elements, which appeals to a broad international clientele.

This location has become a magnet for international buyers, including tech entrepreneurs and European executives, who are drawn to its world-class golf courses, equestrian centre, and high-end amenities. Its reputation as a prime destination for second homes and retirement has been bolstered by its accessibility and lifestyle offerings, making it a standout choice for those seeking luxury homes in Europe at relatively competitive prices.

Key Features and Investment Considerations

Investing in Quinta da Marinha offers unique advantages, particularly for non-EU buyers, but requires careful local planning. The estate's appeal is strongly tied to both its lifestyle and the financial incentives offered by the Portuguese government.

- Golden Visa Programme: This estate is a popular choice for investors leveraging Portugal's Golden Visa programme, which offers a path to residency through real estate investment.

- Rental Potential: Its status as a year-round luxury destination provides significant potential for high-yield holiday rentals, demanding professional property management for international owners. Learn more about the factors driving Lisbon's property boom.

- Regulatory Expertise: Engaging with local architects and legal experts who are well-versed in Portuguese planning regulations is crucial to navigate the purchasing process and any potential renovations smoothly.

8. Santorini Luxury Cave Houses, Greece

These extraordinary properties carved into Santorini's volcanic cliffs represent a unique form of luxury living that combines ancient Cycladic architecture with modern, high-end amenities. Offering arguably the world's most spectacular sunsets and caldera views, these "yposkafos" (cave houses) are coveted by international buyers seeking one of the most distinctive forms of Mediterranean luxury. Originally built to protect inhabitants from harsh winds and pirates, they now serve as iconic retreats.

This unique property type has been popularised by luxury travel influencers and features in countless architectural magazines, making it synonymous with elite travel and destination weddings. The conversion of traditional dwellings into boutique hotels and private villas, like those inspiring the Grace Hotel's presidential suite, has set a high standard for design, cementing Santorini's status among the most desirable luxury homes in Europe.

Key Features and Investment Considerations

Investing in a Santorini cave house involves navigating a unique set of challenges and opportunities distinct from conventional property purchases. The blend of historical structure and modern luxury demands specialised due diligence.

- Structural Integrity: It is crucial to obtain a thorough structural survey from an engineer who specialises in cave dwellings to verify stability and earthquake safety measures.

- Greek Property Law: Foreign buyers must understand the nuances of Greek property laws and tax implications, which can be complex. Engaging a local, reputable solicitor is non-negotiable.

- Utilities & Maintenance: These properties often present unique challenges regarding water storage, desalination systems, and damp-proofing. Ongoing maintenance is vital to preserve the structure's integrity.

- Rental Management: Due to extreme seasonal demand, partnering with a high-end seasonal rental management service can maximise investment returns while ensuring the property is well-maintained during the off-season.

9. Neuschwanstein-Inspired Castles, Bavaria, Germany

In the Bavarian Alps, a unique category of luxury real estate draws inspiration from King Ludwig II's romantic vision: modern castles designed to echo the fairy-tale aesthetic of Neuschwanstein. This niche market appeals to high-net-worth individuals who commission custom-built residences that blend medieval grandeur with state-of-the-art contemporary luxury. These properties offer the romance and visual splendour of a historic castle but are engineered for 21st-century living, set against Germany's stunning Alpine landscapes.

This trend represents a distinct segment of the luxury homes Europe market, where historical fantasy meets modern engineering. Rather than restoring ancient structures, buyers create new legacies, commissioning architects to build properties that serve as private retreats, exclusive event venues, or even luxury hotel conversions. These projects are a testament to ultimate personalisation in high-end real estate.

Key Features and Investment Considerations

Commissioning a modern castle is a monumental undertaking that demands meticulous planning and a deep understanding of the associated long-term commitments. The investment extends far beyond the architectural design and construction phases.

- Specialist Architecture: Engaging architects and builders with proven experience in castle-style construction or historic restoration is critical to achieving both aesthetic authenticity and structural integrity.

- Maintenance & Operations: The scale and complexity of such properties necessitate a comprehensive and substantial ongoing budget for maintenance, groundskeeping, and specialised staff.

- Zoning & Heritage Laws: Even for new builds, local planning regulations in regions like Bavaria can be stringent. It is essential to verify all zoning laws and potential heritage restrictions that might impact design and land use.

Luxury European Homes Comparison Table

| Property | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| Château Louis XIV, France | Very high (complex blend of traditional & ultra-modern) | Extensive staff, high-tech maintenance, security | Ultra-luxury living, privacy, prestige | Ultra-high-net-worth private residence | Cutting-edge technology, privacy, architectural masterpiece |

| Penthouse at One Hyde Park, UK | High (modern luxury with integrated smart tech) | High service charges, full concierge support | Prime urban luxury, investment potential | Urban luxury buyers, investors | Prime London location, hotel-level service, views |

| Villa Leopolda, French Riviera | High (historic restoration with large grounds) | Large staff, heritage maintenance | Historic prestige, privacy, lifestyle | Wealthy private estate owners | Rich history, large grounds, heritage value |

| Kensington Palace Gardens, UK | Very high (historic mansions with modern upgrades) | Specialist renovations, diplomatic-level security | Ultimate exclusivity and security | Ultra-luxury urban families, diplomats | Prestige, security, exclusivity |

| Palazzo di Amore, Lake Como, Italy | High (historic villa with modern restoration) | Seasonal upkeep, waterfront maintenance | Cultural luxury, privacy, rental potential | Luxury retreat and tourism rental | Scenic location, historic charm, rental income |

| Luxury Ski Chalets, St. Moritz | High (traditional alpine style with modern luxury) | Seasonal maintenance, winter services | Ski resort luxury, rental income | Winter sports enthusiasts, seasonal owners | Ski access, mountain views, exclusivity |

| Quinta da Marinha Estate, Portugal | Moderate (modern villas + traditional style) | Medium maintenance, gated community services | Accessible European luxury living | International buyers, retirees | Good value, Golden Visa programme, climate |

| Santorini Luxury Cave Houses, Greece | Moderate to high (unique cliff construction) | Limited expansion, infrastructure challenges | Distinctive Mediterranean luxury | Vacation homes, rental properties | Unique architecture, famous views, rental income |

| Neuschwanstein-Inspired Castles, Germany | Very high (medieval design with modern systems) | High construction & maintenance costs | Unique luxury statement, event potential | Luxury retreats, event venues | Distinctive design, cultural appeal, natural setting |

Your Next Chapter in European Luxury Real Estate

Our journey through Europe's most exceptional properties reveals a landscape rich in history, innovation, and unparalleled luxury. From the historic grandeur of Château Louis XIV and the stately residences of Kensington Palace Gardens to the modernist marvel of One Hyde Park's penthouse, the diversity is astounding. We've explored the sun-drenched elegance of Villa Leopolda on the French Riviera, the lakeside serenity of Palazzo di Amore, and the coastal charm of Portugal's Quinta da Marinha. Each property is a testament to its unique locale, whether it's the alpine prestige of a St. Moritz chalet, the iconic beauty of a Santorini cave house, or the fairytale allure of a Bavarian castle.

These properties are far more than just architectural masterpieces; they represent a convergence of legacy, lifestyle, and strategic investment. For high-net-worth buyers and seasoned investors, the decision to acquire one of these luxury homes in Europe is a significant financial manoeuvre. It involves navigating complex legal frameworks, understanding local market dynamics, and appreciating the cultural heritage that imbues each property with its intrinsic value. As we have seen, securing a prime asset in London requires a different approach than acquiring a historic villa in Italy or a modern estate in Portugal.

Key Takeaways for the Astute Buyer

- Location is a Lifestyle Statement: The choice between a vibrant urban centre like London and a secluded coastal retreat like the French Riviera or Cascais defines your daily experience and long-term investment profile.

- Heritage Holds Value: Properties with historical significance or architectural provenance, such as those inspired by Neuschwanstein or the grand estates of France, often demonstrate greater value appreciation and resilience.

- Modern Amenities Drive Demand: State-of-the-art security, bespoke wellness facilities, and sustainable technologies are no longer optional extras; they are core expectations in the prime European real estate market.

Embarking on this acquisition journey requires meticulous preparation. As you consider your next significant investment, mastering cross-border financial planning becomes indispensable for navigating the complexities of international property acquisition. This expertise ensures a seamless transaction, optimises your tax position, and safeguards your wealth for generations to come. The European property market is not merely about buying a home; it is about curating a global portfolio and crafting a legacy. With the right knowledge and expert guidance, you can confidently secure your piece of Europe's enduring allure, turning a vision of luxury living into a tangible and rewarding reality.

Ready to find your own piece of European legacy? Explore an exclusive collection of the finest luxury homes in Europe on EuropeanProperty.com. Our platform connects discerning buyers with premier agents and developers across the continent, providing the expertise and access you need to make your next acquisition a success.

About EuropeanProperty.com

EuropeanProperty.com is Europe’s longest-running luxury real estate platform, online since 1999. It connects luxury real estate agents, developers, and homeowners with high-net-worth buyers and international investors.

Looking for expert mortgage guidance? Get luxury property mortgage advice here:

👉 https://europeanproperty.com/luxury-overseas-mortgages/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/