To chase down a listing for a luxury mansion for sale in Europe is to do far more than just buy a property. It’s an acquisition of legacy, a piece of art, and a definitive statement of success. For generations, Europe has been the epicentre of this ambition, where historical grandeur collides with modern sophistication to create a market unlike any other. This isn't just real estate; it's about curating a dynasty.

The Timeless Appeal of Owning a European Mansion

The draw of a European mansion goes well beyond fleeting market trends. These homes are tangible assets, connecting owners to centuries of history, culture, and architectural genius. Unlike brand-new constructions, many of these estates come with a story—a provenance telling of the influential families, artists, and leaders who once walked their halls. That sense of heritage offers something unique that simply can't be built from scratch.

For discerning international buyers and seasoned investors, the real appeal is in this powerful blend of legacy and lifestyle. Owning a Palladian villa in Tuscany or a Regency-era estate in the English countryside isn't just an investment in a building; it's an investment in a piece of cultural identity. It provides a sanctuary of privacy and exclusivity while doubling as a robust, tangible asset in a diversified portfolio. It’s no surprise that demand for such properties among the global elite remains consistently strong.

A Fusion of History and Modernity

But today's market for luxury mansions for sale isn't just about preserving the past. The most sought-after properties are those that masterfully blend period features with twenty-first-century living. Buyers now expect the character of hand-carved mouldings and original stone fireplaces to coexist seamlessly with smart home technology, private wellness centres, and advanced security systems.

It’s a delicate balance. The goal is to ensure the soul of the property remains intact while the day-to-day experience is one of supreme comfort and convenience. The ability to host a grand event in a historic ballroom and then unwind in a state-of-the-art spa, all within the same residence, is what defines modern European luxury.

"A European mansion is one of the few assets that appreciates both financially and emotionally," notes Nick Marr, founder of EuropeanProperty.com. "Investors are not just buying square footage; they are securing a piece of history and a foundation for their family's future."

Why This Guide Is Your Essential Roadmap

Navigating the European luxury property market requires more than just capital. It demands specialist knowledge and a sharp, strategic eye. That’s exactly what this guide is designed to provide. We’ll move beyond the glossy brochures to give you a real analysis of what truly creates value in this exclusive world.

This roadmap will cover:

- Identifying Genuine Value: We'll break down the key attributes that separate a merely expensive house from a true legacy mansion.

- Prime Investment Zones: Discover the established havens and emerging hotspots offering unique opportunities across the continent.

- Navigating the Process: A step-by-step walkthrough of the international buying journey, from due diligence to getting the keys.

- Mastering the Financials: An inside look at sophisticated financing, tax implications, and smart ownership structures.

By the end, you'll have the intelligence you need to make confident, informed decisions in your search for Europe’s finest luxury mansions for sale.

What Really Defines a True Mansion?

Let's be clear, the word "mansion" gets thrown around far too easily. But for those in the know—the serious buyers and seasoned investors—what elevates a beautiful house into the realm of a true mansion? It's not just about a hefty price tag. Think of it like the difference between a top-of-the-line luxury car and a completely bespoke, handcrafted vehicle. Both cost a fortune, but only one has a soul.

The market for luxury mansions for sale has shifted. Of course, size and a prestigious address are still the bedrock. But today’s discerning buyers are looking for much more. They demand a blend of history, artistry, and state-of-the-art living. A property has to do more than just provide shelter; it needs to deliver an entire lifestyle experience.

Architectural Soul and a Story to Tell

The first mark of a genuine mansion is its architectural significance. This isn’t just about square footage, but about the integrity of its design, its place in history, and the story held within its walls. A Georgian manor crafted by a celebrated architect or a modernist villa that broke all the rules for its time has an gravitas that even the most extravagant new build can’t quite match. This is what we call provenance—the property's unique backstory.

A mansion with real provenance might have been the country seat of an aristocratic family, the quiet retreat of a world-famous artist, or even the setting for a major historical moment. This lineage adds a priceless, intangible layer to the property, turning it from a mere asset into a piece of living history. It’s this story that truly captures the imagination of buyers looking for something with a unique identity.

"A mansion's value is as much in its story as in its stones," notes Nick Marr, founder of EuropeanProperty.com. "Buyers today are investing in a narrative, a legacy they can become part of. That's why properties with a clear, distinguished history command such a premium."

At its core, a mansion should offer a unique living experience rooted in exceptional design and quality. The table below breaks down the attributes that separate a simply expensive house from a true luxury mansion in today's market.

Core Attributes of a Modern European Luxury Mansion

| Attribute Category | Essential Features | Emerging Trends |

|---|---|---|

| Architecture & Provenance | Renowned architect or historical significance. Cohesive, timeless design. | Restorations that blend historic character with modern extensions. Certified heritage status. |

| Craftsmanship & Materials | Bespoke joinery, custom stonework, rare or imported materials (e.g., Carrara marble, old-growth oak). | Use of sustainable, locally sourced artisanal materials. Integration of smart glass and advanced composites. |

| Location & Grounds | Prime, exclusive address (e.g., Côte d'Azur, Lake Como). Extensive, private landscaped grounds. | Secluded, off-market locations. Regenerative gardens and private vineyards or olive groves. Helipads. |

| Modern Amenities | Home cinema, wine cellar, chef's kitchen, multi-car garage. | Full wellness suites (sauna, spa, gym, yoga studio), smart home automation, panic rooms, art galleries. |

| Privacy & Security | Gated entrances, high walls, professional on-site security posts. | Advanced cyber-security, drone detection systems, biometric access controls, complete off-grid capability. |

| Sustainability & Tech | Energy-efficient systems, high-speed connectivity. | Geothermal heating/cooling, solar energy farms, greywater recycling systems, electric vehicle supercharging stations. |

These features combine to create a property that is not only a home but a self-contained private resort, offering a lifestyle that is both luxurious and deeply personal.

The Signature of True Craftsmanship

Right alongside architecture is the quality of craftsmanship. In an age of mass production, the touch of a master artisan has become the ultimate status symbol. You can see it—and feel it—in the details that simply can't be rushed or faked:

- Bespoke Materials: Sourcing that specific slab of marble from an Italian quarry, laying floors with reclaimed oak from a centuries-old building, or commissioning a master blacksmith for custom ironwork.

- Intricate Details: The perfect curve of a hand-carved moulding, the flawless execution of ornate plasterwork, and the seamless fit of custom cabinetry all speak to a deep commitment to quality.

- Harmonious Design: It's how all these exquisite elements come together. The best mansions have a natural flow, where every room and every detail feels like it belongs, creating an environment that's both grand and gracefully cohesive.

This obsession with detail signals a serious investment in quality over speed. It creates an atmosphere of permanence that defines the world’s most sought-after homes. Any discerning buyer will feel that difference the moment they walk through the door.

Modern Comforts and Iron-Clad Privacy

Finally, a mansion today must meet the demands of a modern high-net-worth lifestyle. The focus has decisively shifted towards personal wellness, absolute security, and effortless living. These are no longer just nice-to-haves; they are essentials.

- Private Wellness Centres: We're talking more than just a treadmill in the basement. Expansive home gyms, yoga studios, indoor pools, saunas, and steam rooms are now standard expectations.

- Seamless Technology: Fully integrated smart home systems are a must. The ability to control lighting, climate, entertainment, and security from a single, intuitive interface is non-negotiable.

- Absolute Privacy and Security: This is paramount. It means sprawling grounds, high-tech gated entrances with security posts, sophisticated surveillance systems, and sometimes even fortified safe rooms.

- Sustainable Luxury: Eco-conscious features are also gaining serious traction. Forward-thinking buyers increasingly look for geothermal heating, solar power integration, and advanced water recycling systems.

Ultimately, a true mansion offers a self-sufficient sanctuary where every need is anticipated and catered for. It's this powerful fusion of historic soul, artisanal quality, and modern-day innovation that separates the merely expensive from the truly exceptional.

Mapping Europe's Prime Mansion Investment Zones

Figuring out where to invest in Europe’s luxury property market isn't just about picking a famous city. While capitals like Paris and Rome will always have their charm, the sharpest investors are looking beyond the obvious. They're exploring regions that offer a unique mix of lifestyle, value, and future growth. The hunt for luxury mansions for sale has moved beyond the usual postcodes into new territories where privacy, space, and one-of-a-kind experiences are the real prize.

Of course, the classic playgrounds for the global elite—the French Riviera, Italy’s Tuscany, and Spain’s Costa del Sol—are still rock-solid markets. Their appeal is timeless, built on decades of cultural glamour, world-class living, and a proven ability to weather economic storms. In these places, a luxury mansion isn't just a home; it's a legacy asset, often passed down through generations.

The Enduring Appeal of Classic Luxury Havens

Destinations like the Côte d'Azur offer a blend of glamour, natural beauty, and exclusivity that’s hard to beat. Owning a waterfront villa in Saint-Tropez or a Belle Époque estate in Cap Ferrat means you’re not just buying property; you’re buying into a lifestyle of superyachts, Michelin-starred restaurants, and high-profile international events. It’s a mature, stable market that consistently attracts global wealth, ensuring properties hold their value.

Over in Italy, the rolling hills of Tuscany offer a different flavour of luxury—something more rustic and peaceful. A restored 16th-century farmhouse surrounded by vineyards gives you a sense of tranquillity and connection to the land that you just can't find elsewhere. This market is driven by buyers who want privacy, authenticity, and a slower pace of life, but without giving up any sophistication.

When you're mapping out prime investment zones, you can't ignore Monaco. It’s famous for its exceptional security, favourable tax rules, and the highest concentration of wealth on the planet. Property supply is incredibly tight, which means demand for the few lavish properties for sale in Monaco is always sky-high. This makes it one of the most prestigious real estate markets anywhere in the world.

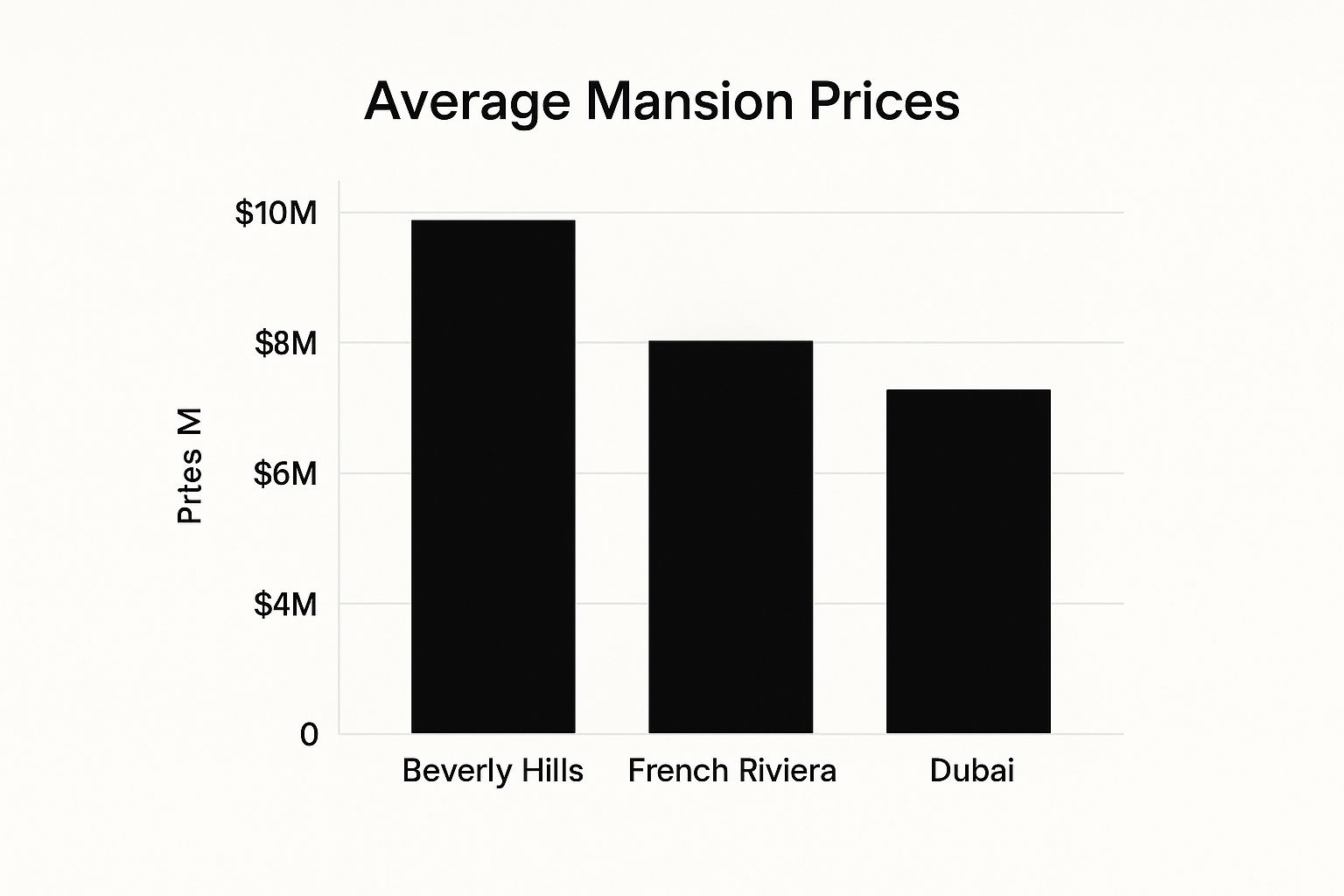

This chart gives you a quick comparison of average mansion prices across some of the world's top luxury markets.

As you can see, established European hotspots like the French Riviera hold their own against other global leaders, offering real value for truly top-tier properties.

Emerging Markets and Shifting Dynamics

Beyond the traditional strongholds, savvy investors are looking at emerging prime markets that offer exciting new opportunities. Portugal’s Algarve region, for instance, has seen a massive surge in interest. This is partly thanks to its residency programmes, but also its championship golf courses and a more relaxed vibe than its Mediterranean neighbours. Areas like Quinta do Lago and Vale do Lobo are now hotspots for brand-new luxury mansions for sale packed with the latest amenities.

Switzerland, with its political stability and incredible quality of life, is another key target. Lakeside mansions near Geneva and Zurich, along with alpine chalets in Gstaad and St. Moritz, are highly sought after for their security and exclusivity.

"We're seeing a clear trend of market diversification. While the classic locations will always be in demand, the smart money is also exploring regions that offer new growth trajectories. It's about finding the 'next' Golden Mile before everyone else does."

— Nick Marr, Founder of EuropeanProperty.com

Case Study: The UK's Regional Luxury Boom

This trend of diversification is especially clear in the United Kingdom. The UK’s luxury market has exploded since 2019, with the number of homes priced at £1 million or more doubling by early 2025. Today, over 5% of all homes for sale in Great Britain have a seven-figure price tag, a huge jump from just under 3% five years ago.

While London is still a global hub, the most dramatic growth has happened in regional counties. Cornwall, for example, saw a 246% increase in luxury homes for sale. Other areas like Somerset and Surrey’s Mole Valley have seen similar booms. It just goes to show that the market for luxury mansions for sale is no longer all about London, creating fresh opportunities for investors willing to look beyond the capital.

Ultimately, whether you're drawn to the sun-drenched coast of Spain or the quiet charm of an English county, understanding these regional shifts is crucial. From historic estates in Tuscany, like this stunning example of classic Italian architecture, to the modern marvels popping up in Portugal, Europe's luxury landscape is rich and varied. The right choice comes down to balancing your investment goals with your personal lifestyle ambitions.

How to Navigate the International Buying Process

Buying a luxury mansion in Europe is a serious undertaking, far more complex than a standard property purchase. For an international buyer, it’s a journey through a maze of different legal systems, financial regulations, and even cultural etiquette. Getting it right comes down to one thing: a methodical approach backed by a team of trusted, local experts who can steer you through each step.

It all starts with a clear strategy. Don't just browse listings. First, define what you really want. Is this a legacy asset for your family, a high-yield investment, or a primary home with a specific lifestyle in mind? Your answer dictates the entire search and the kind of advice you'll need.

Assembling Your Local Dream Team

Before you even think about making an offer, your most important investment is in people. Trying to handle a multi-million-euro deal from overseas without local expertise is a recipe for disaster. Every European country has its own property laws, tax codes, and procedural quirks that can trip you up.

Here’s who you need on your side:

- A Specialist Real Estate Agent: Find an agent who lives and breathes the luxury sector in your target region. They have access to off-market luxury mansions for sale and know how to negotiate effectively.

- An Independent Property Lawyer: This is non-negotiable. Your lawyer is your shield. They’ll perform deep due diligence, check every clause in the contract, verify the property's title, and ensure it’s clear of any hidden debts or legal issues.

- A Notary: In many countries like Spain, France, and Italy, the notary is a public official who officiates the transaction, registers the deed, and ensures every legal box is ticked.

- A Tax Advisor: This expert is crucial for structuring the purchase in a tax-efficient way. They’ll advise on everything from wealth and inheritance tax to capital gains down the line.

“The single biggest mistake international buyers make is underestimating the value of a local team. Having the right lawyer and agent isn't a cost—it's your best insurance policy against unforeseen risks and a key to unlocking true value.”

The Step-by-Step Buying Playbook

With your expert team in place, the buying process becomes a structured, manageable game plan. While the details change from country to country, the core stages for securing luxury mansions for sale are broadly the same.

- Initial Offer and Preliminary Agreement: Once you’ve found the one, your agent submits a formal offer. If it’s accepted, you’ll sign a preliminary contract (like the Compromis de Vente in France or Contratto Preliminare in Italy) and usually pay a deposit to secure it.

- Rigorous Due Diligence: This is where your lawyer truly shines. They will dig into every detail: planning permissions, zoning laws, property boundaries, and any unpaid taxes or utility bills. This is your chance to uncover problems before you’re legally committed.

- Exploring Residency Programmes: For non-EU buyers, this is the perfect time to look into residency-by-investment options. Countries like Portugal, Spain, and Greece offer Golden Visa schemes tied to property purchases. Your legal team can show you how a stunning villa, like this example of a Spanish luxury property, might qualify.

- Finalising the Transaction: With due diligence cleared, it's time to sign the final deed of sale (Acte de Vente or Escritura) in front of the notary. This is when the remaining balance, plus all taxes and fees, is paid.

- Registration and Handover: The notary officially registers your ownership with the Land Registry. Once that’s done, you get the keys. Congratulations—you're the proud owner of a spectacular European mansion.

Securing Finance for a Luxury Property Acquisition

Financing a multi-million-euro mansion isn’t anything like getting a standard mortgage. It's a completely different world, one that demands strategic planning and access to financial tools that you won't find at a high-street bank.

For high-net-worth individuals, this process is rarely about just borrowing money. It's an exercise in optimising cash flow, protecting your existing investments, and structuring the deal for the best possible tax efficiency. The journey almost always begins inside the quiet, discreet offices of a private bank. These institutions are built to understand the complex and often global financial lives of affluent clients, offering bespoke lending that a retail bank simply can't match.

Beyond the Conventional Mortgage

While a straightforward mortgage is always on the table, the world of high-value finance offers far more powerful and flexible options. Seasoned buyers often prefer these alternative routes to keep their investment portfolios liquid and ready to seize other market opportunities.

Here are the key strategies you’ll encounter:

- Private Banking Relationships: This is the cornerstone. Building a strong relationship with a private bank gives you access to tailored credit lines, often at better rates, secured against your entire asset portfolio—not just the house you’re buying.

- Asset-Backed Lending (Lombard Loans): This is a smart way to raise capital without selling your winners. You can pledge liquid assets, like a managed stock portfolio or bonds, as collateral for a loan. It’s an incredibly efficient way to fund a property purchase while leaving your profitable investments to continue growing.

- Corporate Ownership Structures: Buying a property through a company (like a limited company or a specialised property vehicle) can bring major benefits. Think liability protection, easier succession planning, and sometimes, a more favourable tax position. Lenders are very familiar with these structures, though you can expect the due diligence to be more intensive.

Wealth Verification and Documentation

Get ready for some paperwork. European lenders operate under strict anti-money laundering (AML) and Know Your Customer (KYC) regulations, and they will require a complete picture of your source of wealth and funds. This isn't just red tape; it's a fundamental step that builds trust and keeps the transaction moving smoothly.

Your financial advisor will be key here, helping you pull together the necessary file. This usually includes:

- Detailed statements of your global assets and liabilities.

- Proof of income from businesses, investments, and other ventures.

- A crystal-clear paper trail showing where the deposit funds originated.

"Securing finance for a luxury mansion is a strategic exercise in wealth management. It's about using the right levers to acquire the asset while optimising your overall financial position. The most successful buyers see the financing process as an integral part of their investment strategy, not just a hurdle to overcome."

Confidence in the top end of the market remains strong. Projections for UK prime property, including luxury mansions for sale, point to steady growth, especially in regional hotspots outside of London. Even as overall UK house price growth has cooled, mortgage approvals saw a 5.6% year-on-year rise in June, and the prime regional market is tipped to grow by almost 18% by 2029. This shows lenders are still very comfortable with the high-end market's resilience and future potential. You can read the full UK property market analysis from Fine & Country to dig into these regional trends.

This is not a journey to take alone. It's vital to work with specialists who live and breathe high-value international property finance. To explore funding solutions designed for your unique situation, you can find expert luxury property mortgage advice here.

Mastering Tax and Ownership Structures in Europe

For any serious investor, acquiring a luxury mansion is as much a financial manoeuvre as it is a lifestyle choice. The real art of the deal isn't just about the sale price; it's about navigating the intricate web of European taxation and legal ownership structures. Get this right, and you can preserve your wealth for generations. A misstep, however, can lead to some seriously unpleasant financial surprises down the line.

Before you even think about making an offer, you need to understand the fiscal landscape. Every European country has its own distinct rulebook covering everything from the moment you buy to the day you sell or pass the property on. These aren't minor details—they are absolutely central to your investment's long-term performance.

Key Tax Considerations Across Europe

Your advisory team needs to run a thorough analysis of several key tax areas before you commit. The names and rates will differ from one country to the next, but the core concepts are universal.

- Annual Property Levies: These are the yearly taxes you'll pay based on the property’s assessed value. Think Council Tax in the UK or the Impuesto sobre Bienes Inmuebles (IBI) in Spain.

- Capital Gains Tax (CGT): This is the tax you owe on the profit when you sell the mansion. Rates and exemptions can vary wildly, especially depending on whether the property is your main home.

- Inheritance Tax (IHT): A critical one for legacy planning. This tax is levied on the value of the estate you pass to your heirs. Without smart structuring, IHT can take a huge slice of the property's value.

- Wealth Tax: While less common, some countries like Spain and Switzerland hit you with an annual tax on your total net worth, which will naturally include a high-value property.

The Impact of Fiscal Policy: A UK Case Study

Tax policies aren't set in stone; they change with political and economic tides, and those changes directly ripple through the market. A perfect example is the UK's recent decision to abolish its non-domiciled tax status from April 2025.

For years, this "non-dom" status shielded wealthy foreigners from UK inheritance tax on their worldwide assets, making London a magnet for global capital. That's all changing. The move has sent a chill through the capital’s ultra-high-end market. While the supply of mansions priced over £5 million jumped by 22% in May 2024, sales volumes actually plummeted by nearly 15% year-over-year.

Faced with a potential 40% inheritance tax bill on their global estates, many affluent owners are now selling up, creating a glut. It’s a powerful lesson in how a single policy shift can completely reshape the game, a dynamic you can explore in this detailed analysis of London's luxury home sales.

Choosing the Right Ownership Structure

How you decide to hold the title to your new mansion is one of the most important decisions you'll make. It has massive implications for your liability, privacy, and tax bill.

"The ownership structure is the foundational blueprint for your entire investment. It should be designed with the same care and precision as the mansion itself, tailored to your personal circumstances and long-term goals."

Essentially, you have two main routes: owning it in your own name or holding the asset through a company.

- Personal Ownership: This is the most straightforward approach. The property is registered directly in your name. Simple, yes, but it offers zero liability protection and can make succession planning a headache.

- Company Ownership: Holding the property through a domestic or even a specialised offshore company can offer some big advantages. This structure can shield your other assets from any liabilities tied to the property and often provides better privacy and tax optimisation, especially for inheritance. It's no surprise that many prime properties, like this elegant villa in a prime European location, are held in such a way.

There is no one-size-fits-all answer here. The best choice demands bespoke advice from legal and tax experts who can model the outcome of each option based on your specific financial profile and residency status. Arming yourself with this knowledge means you'll be asking the right questions from the very beginning.

Common Questions About Buying a European Mansion

When you're navigating the high-end property market in Europe, a few key questions always come up. It's completely natural. Here are some straightforward answers to the queries we hear most often from international buyers looking at luxury mansions for sale.

What Does a Specialist Agent Really Do?

A great luxury agent is so much more than a tour guide for fancy houses. Think of them as your strategic partner on the ground. They bring deep market intelligence to the table, often granting you access to exclusive, off-market properties that never see the light of day online.

Their job is to get inside your head, understand exactly what you're looking for, and then negotiate relentlessly on your behalf. They're the project manager for your entire purchase, connecting you with their trusted network of lawyers and financiers to make sure everything flows smoothly, from the first viewing to the day you get the keys.

How Much Should I Realistically Budget for Running Costs?

The purchase price is just the first cheque you'll write. A good rule of thumb for annual running costs is to budget somewhere between 1% and 3% of the property’s value. Of course, this can swing depending on the estate.

These ongoing expenses are what keep the property in prime condition. They typically include:

- Property Taxes: These are the annual local taxes, like Council Tax in the UK or the IBI in Spain.

- Insurance: For a high-value asset, comprehensive cover isn't just a good idea—it's essential.

- Utilities: Be prepared for higher bills, especially with large or historic properties that weren't built with modern efficiency in mind.

- Staffing & Maintenance: This covers the costs for gardeners, housekeepers, security, and a property manager to keep everything running seamlessly.

Any good agent can give you a detailed breakdown of projected costs for a specific mansion you're interested in.

How Important Is Due Diligence, Really?

It’s everything. Honestly, it's probably the single most critical step in the whole process. Think of it this way: thorough due diligence, handled by your own independent lawyer, is your best and only defence against eye-wateringly expensive problems down the line.

This deep dive involves verifying the legal title, checking for any hidden debts or claims against the property, making sure all planning permissions are legitimate, and confirming there are no nasty surprises with boundary lines. Cutting corners here is a gamble that no serious buyer should ever consider taking.

Can I Buy a Mansion Through a Company?

Yes, absolutely. In fact, it's a very common approach for high-net-worth individuals. Holding a property through a corporate entity, like a UK Limited Company or a French SCI (Société Civile Immobilière), can offer some serious upsides.

The benefits often boil down to greater privacy, protection from personal liability, and a much cleaner way to handle tax and inheritance planning. It's not a simple route, though. It involves more complex administration and setup, so you'll need top-tier legal and tax advice to figure out if it's the right move for your personal situation.

About EuropeanProperty.com

EuropeanProperty.com is Europe’s longest-running luxury real estate platform, online since 1999. It connects luxury real estate agents, developers, and homeowners with high-net-worth buyers and international investors.

Looking for expert mortgage guidance? Get luxury property mortgage advice here:

👉 https://europeanproperty.com/luxury-overseas-mortgages/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/