A luxury property is so much more than just an expensive house. At its heart, it’s a meticulously crafted asset, defined by three things that money alone can’t always buy: an irreplaceable location, architectural significance, and unrivalled quality.

Think of a true luxury property as an experience, a lifestyle, and even a legacy. It’s something that transcends mere monetary value.

What Defines a Luxury Property in Europe?

So, moving beyond the price tag, what really elevates a property into the realm of luxury real estate? The definition isn’t set in stone; it’s a blend of tangible and intangible qualities that create that unmistakable sense of exclusivity and prestige.

It’s a bit like comparing a fine Swiss watch to a standard timepiece. Both tell time, but one embodies a legacy of craftsmanship, heritage, and superior materials that you can feel.

For seasoned investors and property professionals, understanding these core pillars is crucial. It’s how you spot genuine value in Europe’s most sought-after markets and appreciate the attributes that truly command a premium.

The Pillars of True Luxury

The core components that distinguish a luxury home can be broken down into a few key areas. Get these right, and you’re looking at something special.

- Irreplaceable Location: This is the absolute cornerstone of luxury. It could be a penthouse with sweeping, protected views of the Eiffel Tower, a waterfront villa where your garden meets Lake Como, or a completely secluded country estate in the rolling hills of the Cotswolds. The location has to offer something unique and unrepeatable—whether that’s total privacy, exclusive access, or an iconic vista.

- Exceptional Quality and Craftsmanship: Discerning buyers don’t just expect quality; they demand flawless execution. This means using superior materials like rare marbles, exotic hardwoods, and custom-milled fixtures. But it also extends to the unseen—the structural integrity and the incredible skill of the artisans who built and finished the home.

- Architectural Significance and Design: A luxury property often has a distinct architectural pedigree. It might be a historically important building, lovingly restored to meet modern standards, or a contemporary masterpiece designed by a world-renowned architect. The design always prioritises flow, natural light, and a seamless connection between the indoor and outdoor living spaces.

“Luxury is no longer just about size or price. It’s about provenance, design integrity, and the quality of the living experience. A property that tells a unique story or offers an unparalleled lifestyle is what our clients are truly seeking.” — Nick Marr, Founder of EuropeanProperty.com

Bespoke Features and Amenities

Beyond the foundations, it’s the bespoke features that truly personalise the luxury experience. These aren’t just standard upgrades; they are deeply integrated elements designed to cater to a very specific, affluent lifestyle.

The kitchen, for example, is often a major focal point where no expense is spared. You can get a feel for what’s possible by looking at top-tier Luxury Kitchen Design Ideas.

Other common examples of these amenities include:

- Private wellness centres complete with spas, saunas, and state-of-the-art gyms.

- Climate-controlled wine cellars and dedicated tasting rooms.

- Home cinemas with professional-grade acoustics and seating.

- Extensive smart home automation covering security, climate, and entertainment systems.

Ultimately, a true luxury property is an entire ecosystem of excellence, where every detail has been considered. You can even learn more about how these properties are represented online through standards for rich media object graphs, which add a layer of discoverability to high-value assets.

Decoding the European Luxury Property Market

To really understand Europe’s prime property landscape, you need to look beyond the beautiful architecture and prestigious postcodes. It’s a complex world, shaped by powerful economic currents, subtle buyer trends, and ever-changing rules. For sharp investors and agents, figuring out these forces is the real key to spotting opportunities before anyone else.

Think of the luxury real estate market not as one giant entity, but as a collection of unique micro-markets, each with its own pulse. Big-picture factors like geopolitical stability, interest rates, and currency swings set the overall climate. A shift in one of these areas can send ripples across the continent, redirecting capital and changing how investors feel.

At the same time, it’s the smaller, on-the-ground trends that are truly redefining what discerning buyers want in a home. These are the shifts that dictate which properties and locations are in high demand right now.

Key Micro-Trends Shaping Buyer Demand

Evolving buyer preferences are a massive driver in the luxury sector. The post-pandemic world, in particular, has thrown a spotlight on certain demands that have come to define the modern high-end home.

- Wellness and Biophilic Design: There’s a huge swing towards properties that actively promote well-being. We’re talking about homes with dedicated spa facilities, private gyms, yoga studios, and designs that bring nature indoors—think living walls, natural materials, and huge windows that flood a space with light.

- Sustainability as a Status Symbol: Being eco-conscious isn’t just a niche interest anymore; it’s a mark of true modern luxury. Buyers are now specifically looking for homes with top-tier energy-efficiency ratings, renewable energy sources like solar panels, sustainable building materials, and smart tech that minimises their environmental footprint.

- The Rise of ‘Co-Primary’ Homes: The old model of having one main city residence and a separate holiday home is fading. High-net-worth individuals are increasingly buying multiple ‘co-primary’ homes in different places, spending serious time in each. This fuels demand for turnkey, fully serviced properties that offer maximum convenience and a consistent luxury lifestyle.

In a market this competitive, standout marketing is everything. For those wanting to show off the unique appeal of a European luxury home, a good real estate drone photography guide offers invaluable tips for making a property shine.

The Impact of Regulatory and Tax Environments

Nothing shakes up the luxury real estate market quite like a change in the rules. Governments can tweak tax laws, residency requirements, and foreign ownership regulations, which directly impacts how attractive a market is to international money.

The United Kingdom is a perfect example. According to Knight Frank, prime central London property prices saw a major correction over the last decade, influenced heavily by a shifting political and tax climate. When the UK government decided to abolish the long-standing non-domiciled tax regime, some wealthy international buyers were prompted to rethink their investments. This directly contributed to a cooling of demand in certain segments.

These shifts highlight just how vital it is to stay informed. A sudden policy change can create both headaches and massive opportunities. For a smart buyer, understanding the small print of local tax law is just as important as appreciating a property’s architecture.

This all comes down to one non-negotiable truth: you need deep, location-specific knowledge. What’s true for London won’t be true for Lisbon or Lake Como. A successful investment in European luxury real estate depends on this detailed analysis—blending a grasp of global economics with intel on local buyer habits and regulatory quirks. This is the holistic view that empowers you to look past the headlines and make decisions based on a real understanding of how the market actually works.

Exploring Europe’s Prime Real Estate Hotspots

When we talk about Europe’s prime luxury real estate hotspots, it’s about much more than just a prestigious postcode. Each location has its own personality—a distinct blend of lifestyle, culture, and investment potential that draws in a discerning global audience. For today’s high-net-worth individual, the decision isn’t just about buying an asset; it’s about investing in a way of life.

Some are drawn to the timeless glamour and sun-drenched coastlines of the Mediterranean. Others prefer the quiet, year-round sophistication of an Alpine retreat or a historic city. Every premier market tells a different story, and the real question is which story best fits your personal and financial goals.

The Enduring Allure of the Mediterranean Coasts

The coastlines of France, Spain, and Italy are the undisputed pillars of the European luxury real estate scene. These aren’t just summer holiday spots; they are established havens for a global elite who value heritage, world-class amenities, and an unbeatable quality of life.

- The French Riviera (Côte d’Azur): Synonymous with glamour since the early 20th century, places like Saint-Tropez, Cannes, and Cap Ferrat are legendary. Here, the market is defined by majestic Belle Époque villas, sleek contemporary masterpieces, and exclusive private estates with breathtaking sea views. It’s a magnet for buyers chasing a vibrant social scene, Michelin-starred dining, and premier yachting events.

- Marbella’s Golden Mile, Spain: This famous stretch of coastline offers a more modern, high-energy take on luxury. It’s known for its state-of-the-art villas, exclusive gated communities, and prestigious beach clubs. The Golden Mile pulls in a dynamic international crowd, attracted by its year-round sunshine, championship golf courses, and cosmopolitan vibe.

These coastal hotspots represent more than just property; they are a lifestyle statement. As mature markets, they also offer a degree of stability and long-term value that savvy investors find incredibly attractive. To get a real edge, it’s worth understanding how properties are presented online by reviewing SEO insights from specialists like RankMath, which can reveal how the most successful listings gain visibility.

“While established markets like the Riviera and Marbella retain their powerful draw, we’re seeing savvy investors look towards areas offering a different pace. The ‘new luxury’ is often about privacy, authenticity, and a connection to nature, which is why certain less-obvious regions are gaining serious momentum.” — Nick Marr, Founder of EuropeanProperty.com

The Sophistication of Lakeside and Historic Retreats

Step away from the sea, and a different kind of luxury emerges in Europe’s tranquil lakeside regions and historic city centres. These markets cater to buyers who place a premium on privacy, cultural depth, and understated elegance over the buzz of the coast.

Lake Como, Italy: A world away from the hustle of the Mediterranean, Lake Como offers a more discreet and serene brand of luxury. Its shores are lined with historic palazzos and elegant villas, many with private boat docks and magnificent gardens set against a dramatic mountain backdrop. The lifestyle here is one of quiet refinement, perfect for those who value privacy and timeless beauty.

Lisbon, Portugal: The historic districts of Lisbon, like Chiado and Príncipe Real, have become hotspots for buyers chasing urban sophistication mixed with rich cultural heritage. The demand is for beautifully renovated apartments in historic buildings that blend modern comforts with traditional Portuguese charm. The city’s vibrant culture, growing tech scene, and high quality of life make it a compelling choice for a primary or secondary home.

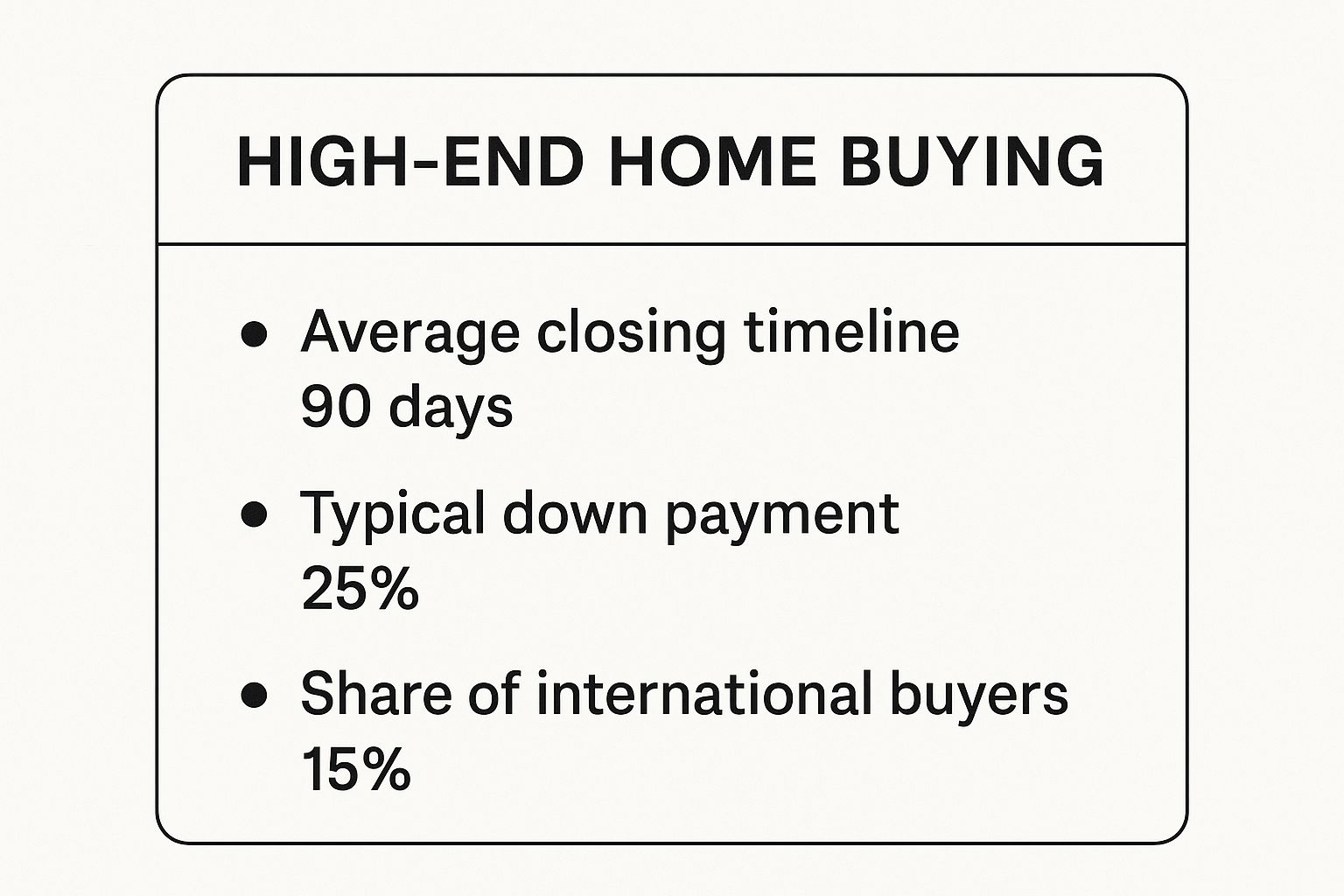

This snapshot gives a sense of the typical investment levels and buyer profiles across these high-end markets.

The data really brings home the significant capital involved and just how international the luxury real estate sector truly is.

Before you start your search, it helps to see how these prime locations stack up against each other. Each offers a completely different experience, attracting a different type of buyer.

A Comparative Snapshot of Prime European Locations

| Location | Dominant Property Style | Key Lifestyle Appeal | Primary Buyer Profile |

|---|---|---|---|

| French Riviera | Belle Époque villas, modern sea-view estates | Glamour, high society, yachting, fine dining | Established wealth, families seeking a legacy asset |

| Marbella, Spain | Gated communities, contemporary villas | Golf, beach clubs, year-round sun, cosmopolitan nightlife | Entrepreneurs, modern families, lifestyle investors |

| Lake Como, Italy | Historic palazzos, waterfront villas | Privacy, scenic beauty, boating, tranquillity | Discerning individuals seeking privacy and timeless elegance |

| Lisbon, Portugal | Renovated historic apartments, modern penthouses | Cultural richness, urban energy, favourable tax schemes | Tech professionals, digital nomads, cultural enthusiasts |

This table is just a starting point, of course, but it illustrates how crucial it is to match the location’s character with your own aspirations.

Ultimately, choosing the right European hotspot is a deeply personal journey. It demands a clear-eyed look at your own lifestyle priorities and investment goals, weighed against the unique flavour and market dynamics of each incredible location.

Navigating the Purchase Process with Confidence

Buying luxury real estate in Europe isn’t like purchasing a home down the street. It’s a complex strategic move that demands precision, a bit of foresight, and, most importantly, expert guidance. The rules of the game change dramatically from one country to the next, each with its own legal quirks, tax pitfalls, and cultural norms.

A successful purchase comes down to one thing: understanding these local intricacies. Approaching a multi-million-euro acquisition with a domestic mindset is a common and expensive mistake. The stakes are higher, the paperwork is deeper, and the potential for costly missteps is far greater. This section gives you the operational intelligence to handle your transaction like a seasoned pro.

Assembling Your Specialist Acquisition Team

Your first, and most critical, move is to build the right team. Trying to manage a cross-border luxury real estate deal alone is a recipe for disaster. Your success will hinge on professionals who not only know their field inside-out but also specialise in high-net-worth clients and the specific country you’re targeting.

Your core team should include:

- A Specialist Buyer’s Agent: This is not your typical estate agent. A buyer’s agent works exclusively for you, digging up off-market gems, giving unbiased advice on pricing, and negotiating aggressively on your behalf.

- A Local Legal Advisor: This is absolutely non-negotiable. In France, you’ll need a notaire; in the UK, a solicitor. Their job is to make sure every legal detail is watertight, from checking the property titles to drafting contracts that put your interests first.

- A Tax Advisor: Owning property internationally comes with a web of tax implications, including wealth taxes, inheritance laws, and capital gains. A specialist can structure the purchase to be as tax-efficient as possible, potentially saving you a fortune in the long run.

“A common mistake international buyers make is underestimating the value of a hyper-local team. The right lawyer and agent on the ground are worth their weight in gold; they foresee problems you would never even know to look for.”

Conducting Meticulous Due Diligence

With your expert team in place, it’s time for some serious digging. Due diligence for a luxury real estate asset goes far beyond a standard building survey. You’re not just investigating the bricks and mortar; you’re investigating its entire legal and financial history.

This deep dive is crucial for uncovering hidden liabilities that could sink the property’s value or prevent you from using it the way you want. Think of it as protecting your investment and ensuring there are no nasty surprises after the ink is dry.

Common Pitfalls for International Buyers

Europe’s property laws can feel like a minefield if you’re unprepared. Certain ownership structures and local rules can seem baffling to overseas investors and need an expert to untangle them.

Watch out for these common issues:

- Complex Ownership Structures: In France, for example, it’s common to find high-value properties held in a Société Civile Immobilière (SCI). While this structure offers flexibility, it has its own set of legal and tax rules that you must fully grasp before buying shares in one.

- Restrictive Covenants and Planning: That historic chateau or villa in a protected area? It likely comes with strict rules about what you can and can’t change. Your legal advisor must check for any covenants that could derail your renovation or development plans.

- Local Inheritance Laws: Many European countries have ‘forced heirship’ rules that dictate how property is passed on. These local laws can sometimes override a will written in your home country, so understanding them is vital for smart estate planning.

At the end of the day, a successful luxury real estate purchase in Europe comes down to preparation and expertise. By building the right team and conducting forensic due diligence, you can turn a daunting process into a secure and confident investment that safeguards your asset for years to come.

Financing and Structuring Your Acquisition

Buying a high-value property in Europe isn’t just about getting a standard mortgage. The financial scaffolding behind a luxury real estate deal is a world unto itself—a sophisticated mix of strategic leverage, tax planning, and long-term asset security. While cash offers used to rule the prime market, we’re seeing a significant shift that’s creating new challenges and opportunities for buyers who come prepared.

This move away from all-cash purchases adds a few layers of complexity, sure, but it also rewards those who can think creatively about their finances and move quickly. Honestly, understanding the advanced financing and ownership options available is no longer a “nice-to-have”; it’s fundamental to getting the most out of your investment from day one.

Beyond Traditional Mortgages

For anyone operating at this level, a standard high street mortgage just won’t cut it. The terms are often too rigid. Thankfully, the world of private finance offers a much more powerful and flexible toolkit, specifically designed for these kinds of high-value, complex transactions. Building a solid relationship with a private bank is usually the best first move you can make, opening doors to bespoke solutions a retail lender could never offer.

Here are the key routes you should be exploring:

- Private Banking Relationships: A private bank sees you as a whole client, not just a loan applicant. They’ll look at your global assets and can offer much better loan-to-value ratios, flexible repayment schedules, and interest-only options that make sense for your overall financial picture.

- Lombard Lending (Asset-Backed Finance): This is a seriously powerful strategy. It lets you borrow against your existing investment portfolio—things like stocks, bonds, or other securities. You can raise a lot of capital this way without having to sell off profitable assets, giving you a fast and efficient way to fund a property purchase while your investments keep growing.

- Bespoke Bridging Loans: Need to move incredibly fast? Perhaps to snatch an off-market gem before a rival buyer? A specialist bridging loan can get you the short-term capital needed to close the deal, giving you breathing room to sort out your long-term financing.

The Evolving Role of Cash in Luxury Real Estate

The days when cash buyers dominated the top end of the market are fading. This is recalibrating expectations for everyone. In the UK, for example, we’ve seen a noticeable drop in the proportion of cash buyers in prime postcodes. This change is actually bringing the market back toward its historical norms and shows that even the most cash-rich buyers are being more cautious. What does this mean for you? Negotiations are becoming more nuanced, which can favour buyers who have flexible, pre-arranged financing and can still act decisively. You can learn more about these shifting buyer behaviour patterns on YouTube.

Strategic Ownership Structures for Asset Protection

How you actually own the property is just as critical as how you pay for it. The right ownership structure can offer huge benefits for tax efficiency, planning your inheritance, and protecting your assets. Simply putting a multi-million-euro property in your personal name is almost never the smartest move.

“We always advise clients to consider the long-term implications of ownership. A well-chosen structure is not an expense; it’s an investment in the security and future value of your asset. It protects against unforeseen liabilities and ensures a smooth transition to the next generation.”

Chat with your legal and tax advisors about these common vehicles:

- Holding Companies: Using a dedicated company to hold the property (whether it’s onshore or offshore will depend on jurisdiction and expert advice) can separate it from your personal finances. This can make tax reporting simpler and, crucially, limit your personal liability.

- Trusts: Placing a property into a trust is an excellent tool for estate planning. It gives you control over how the asset is managed and eventually passed to your beneficiaries, often skipping the complex and expensive probate process.

- Family Investment Partnerships: These structures are perfect for families looking to pool their capital and co-invest in property. They come with clear, pre-agreed rules on governance and how any profits are distributed.

Ultimately, the goal is to build a financial and legal framework that is as well-designed as the home itself. This kind of strategic foresight protects your capital, strengthens your hand in negotiations, and makes sure your luxury real estate investment is secure for years to come. You can see an example of the kind of property that warrants such careful planning by viewing this stunning Marbella villa listing.

The Future of European Luxury Real Estate

If you’re trying to understand where the European luxury real estate market is headed, it’s not about more gold taps or bigger ballrooms. The real question is: what will define genuine value over the next decade? The market never sits still, and to stay ahead, you need to look past today’s trends and see what’s truly shaping tomorrow’s most desirable properties.

The future of luxury isn’t about more excess. It’s about smarter, more conscious living. Three key pillars are emerging that will dictate which homes command premium prices: seamless smart home technology, non-negotiable sustainability, and the evolution of branded residences. For any serious investor or developer, mastering these areas is no longer optional.

The Rise of Intelligent and Sustainable Homes

Technology and environmentalism are fundamentally reshaping what a luxury home even means. What was once a “nice-to-have” is now a core expectation for discerning buyers.

- Integrated Smart Home Ecosystems: We’re way past single-function gadgets. The future is about fully integrated systems where your lighting, climate, security, and entertainment all communicate. Buyers want homes that anticipate their needs and operate from a single, intuitive control panel.

- Sustainability as the Ultimate Amenity: Eco-friendly design is no longer a niche interest; it’s a hallmark of 21st-century luxury. This covers everything from homes with a net-zero carbon footprint and advanced water recycling to the use of ethically sourced, non-toxic materials in construction.

“A truly modern luxury property is one that enhances well-being while minimising its environmental impact. It offers a lifestyle of effortless comfort and peace of mind, knowing that it has been built responsibly for the future.”

Market forecasts back this up. In the UK, for instance, the prime regional market is showing strong signs of recovery. Projections suggest prices for high-end country homes are set to climb by nearly 18% over the next five years. This growth is being fuelled by affluent buyers who are increasingly prioritising sustainable and flexible luxury assets. You can find more details on this UK prime market forecast on Statista.

The Evolution of Branded Residences

Branded residences—those luxury homes linked to a premium hotel or lifestyle brand—are also entering a new era. They used to be popular for their hotel-style services, but their appeal is getting much broader and more creative.

We’re starting to see collaborations with brands far beyond hospitality—think high fashion, luxury automotive, or even wellness gurus. These properties don’t just offer a concierge; they provide access to an exclusive community and a curated lifestyle that embodies the brand’s identity. For the right buyer, it’s a turnkey solution for a world-class living experience, making it a powerful and growing trend in the global luxury real estate landscape.

Your Questions, Answered

When you’re navigating Europe’s luxury property market, especially as an international buyer, a few key questions always come up. Let’s tackle some of the most common queries we hear from discerning investors and their advisors.

How Different Are Property Taxes Across Europe?

Vastly different. Thinking you can apply one country’s tax rules to another is a recipe for a very expensive surprise. Every nation has its own unique system, and you absolutely need local advice to understand the true cost of ownership.

Just look at the variety:

- In France, you’ll face the annual taxe foncière (a land tax every owner pays) and, if your portfolio is large enough, the Impôt sur la Fortune Immobilière—a wealth tax on high-value property.

- Over in Spain, there’s the Impuesto sobre Bienes Inmuebles (IBI), a local property tax, which can be coupled with wealth taxes and specific income taxes for non-residents.

- The UK uses Council Tax to fund local services, but the big one is the Stamp Duty Land Tax (SDLT) you pay on purchase. For prime properties, this tiered tax can be a very substantial figure.

This isn’t something you can just Google and get right. Bringing a specialist tax advisor on board early is one of the smartest moves you can make. They’ll help you model the real costs and structure the purchase in the most efficient way possible.

Do I Really Need a Local Legal Advisor?

Yes. This is completely non-negotiable. Think of a local legal expert as your personal guardian angel for the entire transaction.

Whether it’s a notaire in France, a solicitor in the UK, or an abogado in Spain, their sole job is to protect your interests. They conduct the exhaustive due diligence that uncovers any hidden problems, they verify the property has a clean and unencumbered title, and they ensure every contract is watertight under local law. Trying to buy without one is like navigating a minefield blindfolded—they spot the costly pitfalls you’d never see coming.

Are Golden Visas Still a Good Route to Residency?

The Golden Visa landscape is changing, and fast. What was a solid strategy last year might be a dead end today. We’ve seen major players like Portugal and Ireland either scrap or completely overhaul their residency-by-investment programmes that were tied to real estate.

While some countries, like Spain and Greece, do still offer these schemes, the goalposts are always moving. Investment thresholds change, and rules get tighter. Before you even think about factoring a Golden Visa into your plans, you must speak with a specialist immigration lawyer to get the absolute latest information. Relying on old news is a risk you can’t afford to take.

About EuropeanProperty.com

EuropeanProperty.com is Europe’s longest-running luxury real estate platform, online since 1999. It connects luxury real estate agents, developers, and homeowners with high-net-worth buyers and international investors.

Looking for expert mortgage guidance? Get luxury property mortgage advice here:

👉 https://europeanproperty.com/luxury-overseas-mortgages/

Explore more overseas homes for sale at our global partner site:

👉 https://homesgofast.com/overseas-property/