- AUD

- CAD

- CHF

- EUR

- GBP

- HKD

- JPY

- NOK

- SEK

- USD

- NGN

Luxury Real Estate Europe

Exclusive Homes Sales Europe

Discover Timeless Luxury Across Europe’s Most Coveted Homes

Since 1999, EuropeanProperty.com has been a trusted leader in the luxury real estate market, offering discerning international buyers access to Europe’s most prestigious properties. Our platform blends over two decades of real estate excellence with cutting-edge digital experiences—making it your intelligent gateway to luxury European homes.

For Sellers: Precision Targeting, Premium Exposure

Selling a luxury home? Our platform is built for global visibility, with marketing strategies tailored to reach high-net-worth buyers across Europe, the Middle East, the US, and beyond. From professional staging tips to premium listing boosts, we support you throughout the journey.

Our Featured Exclusives

Explore our luxury homes for sale from all over Europe

Motivated Sale: Brand-New 2-Bedroom Villa Near Bingin Beach

- Beds: 4

- Baths: 2

- Garage: 1

- 1200 Sq Ft

Middle Floor Apartment in Nueva Andalucía, Costa del Sol, Spain

- Beds: 3

- Baths: 3

- 172 m²

Elegant 2-Bedroom Apartment in Marbella’s Prestigious Aloha Hill Club – Ideal for International Buyers

- Beds: 2

- Baths: 2

- 75 m²

Just Listed

Luxury properties from across Europe

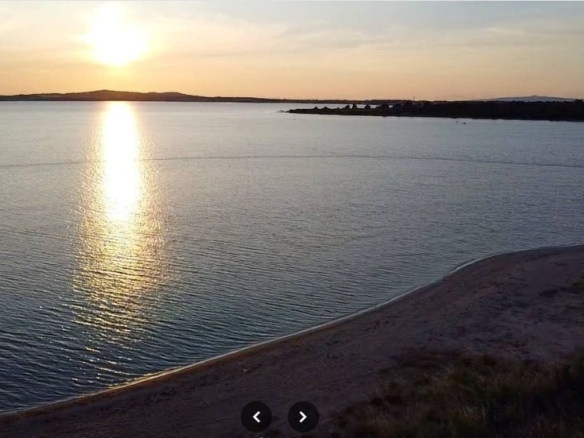

2 BED 2 BATH apartment with SEA VIEWS, in Garden of Eden*****, St. Vlas

- Beds: 2

- Garage: 0

- 105 sq meters

2 BED fully furnished apartment, 70 sq.m. in Cascadas, Sunny beach

- Beds: 2

- Garage: 0

- 70 sq meters

Luxury 2 BED 2 BATH apartment, 123 sq.m., in Omega Resort, Ravda, 100 m to the beach

- Beds: 2

- Garage: 0

- 123 sq meters

Superb 2 BED 2 BATH apartment, 150 sq.m., in Omega Resort, Ravda, 100 m to the beach

- Beds: 2

- Garage: 0

- 150 sq meters

3 BED penthouse with sea views and BBQ, 121 sq.m. in Old House, St. Vlas, 300 m to the sea

- Beds: 3

- Garage: 0

- 121 sq meters

2 BED pool view apartment, 115 sq.m., in Sun Gate, Sunny beach, 300 m to the sea

- Beds: 2

- Garage: 0

- 115 sq meters

Welcome to EuropeanProperty.com: Luxury Real Estate in Europe

At EuropeanProperty.com, we’re delighted to extend a warm welcome to all discerning real estate enthusiasts. If you’re in pursuit of Europe’s finest luxury real estate, prime properties, and high-end residences, you’ve arrived at the perfect destination.

Discover Europe’s Luxury Real Estate

Our exclusive listings showcase Europe’s most exquisite properties, including magnificent mansions, contemporary homes that define modern luxury living, and pristine land plots awaiting your vision. With a commitment to excellence, we bring you the crème de la crème of European real estate.

Explore a handpicked portfolio of exclusive properties across Europe—each selected for its architectural elegance, exceptional location, and unique lifestyle appeal. From historic French châteaux to modern Spanish penthouses and waterfront Algarve villas, EuropeanProperty.com connects you to luxury that transcends borders.

Why Choose EuropeanProperty.com?

- Over 25 years of luxury real estate experience

Trusted by top-tier agents & investors

50+ country-specific luxury collections

Mobile-optimised + AI search-friendly

Backed by intelligent property-matching tools

- Marketing enhances by our other platform Homesgofast.com

Discover Your Dream Luxury Home in Marbella

With its stunning beaches, exceptional restaurants, and world-class shopping, Marbella is the perfect place to call home for those seeking a luxurious lifestyle. And with so many incredible properties on offer, finding your dream luxury villa in Marbella is just a matter of time.

At European Property, we specialise in luxury properties in Marbella and the surrounding areas. You can check the listing of luxury houses and villas on our website or contact us directly for personalised assistance in finding your perfect home. Don’t settle for anything less than the best – start your journey towards luxury living in Marbella today. So don’t wait any longer. Take the first step towards owning your dream luxury villa in Marbella now. Learn more

Stunning 1, 2 & 3 Bed Apartments in prime golf location Benahavis Marbella

Calle Chopo, Benahavis, Marbella, SpainStunning 1, 2 & 3 Bed Apartments in prime golf location, Benahavis Marbella SpainEsales Property ID: es5553699Property LocationChopo, s/n , Benahavís,Andalucía,29688SpainAny interested agents wanting to deal privately with the developer...

- Beds: 3

- Baths: 2

- Garage: 0

- 133 sq meters

- Apartment

Luxury 5 bed Villa For Sale in Monte Mayor Benahavis

Urbanización Monte Mayor, Oficina de ventas, Benahavis, Marbella, SpainLuxury 5 bed Villa For Sale in Monte Mayor Benahavis SpainEsales Property ID: es5553840Property LocationUrbanización Monte Mayor, Oficina de ventas,BenahavisMarbella29679SpainProperty DetailsWith its glorious natural scenery, excellent climate, welcoming culture and...

- Beds: 5

- Baths: 4

- Garages: 3

- 787 sq meters

- Villa

Luxury 4 Bed House For Sale in Marbella

Av. Virgen del Rocío, San Pedro de Alcántara, Marbella, SpainLuxury 4 Bed House For Sale in Marbella SpainEsales Property ID: es5554212Property LocationAv Virgen del RocioCasa 10San Pedro de AlcántaraMarbellaSpainProperty DetailsUnveiling Your Oasis in San Pedro de Alcántara: A Spacious...

- Beds: 4

- Baths: 4

- Garage: 0

- 220 sq meters

- House

Luxury Penthouses For Sale Costa Del Sol Spain

Costa del Sol boasts an exceptional range of luxury penthouses in top locations such as Marbella’s Golden Mile, known for its beachfront elegance, and Puerto Banús, offering vibrant marina life and high-end shopping. In Benahavís, including La Quinta and Los Arqueros, buyers enjoy panoramic views and modern living in tranquil settings. Nueva Andalucía is ideal for golf lovers, while Estepona’s New Golden Mile features sleek, beachfront developments. For ultimate privacy, Sierra Blanca, Cascada de Camoján, and La Zagaleta provide exclusive hillside residences. Sotogrande completes the list with luxury marina and golf-front penthouses in a quieter, upscale community.

Penthouse Duplex in Benahavís, Costa del Sol, Spain

Costa del Sol, SpainThis elegant duplex penthouse offers a perfect blend of modern design, comfort, and panoramic views. Located in the sought-after Paraiso Pueblo development, the property features three bedrooms and two bathrooms,...

- Beds: 3

- Baths: 2

- 223 m²

- Penthouse

Penthouse Duplex in Benalmadena, Costa del Sol, Spain

Costa del Sol, SpainContact us today Duplex Penthouse with Spectacular Sea Views in Stupa Hills Located next to the prestigious Reserva del Higuerón, this impressive 236m² duplex penthouse is the perfect opportunity to...

- Beds: 3

- Baths: 2

- 184 m²

- Penthouse

Penthouse in Benahavís, Costa del Sol, Spain

Costa del Sol, SpainDiscover the epitome of luxury living with this exceptional penthouse in Buenavista, La Quinta, perfectly situated to enjoy panoramic views of the sea, mountains and surrounding golf greens. This prime...

- Beds: 3

- Baths: 2

- 124 m²

- Penthouse

5 beds Penthouse Estepona, Malaga

Estepona, MalagaFabulous penthouse with panoramic sea views most luxurious in front of the sea in Estepona. The apartment includes 5 bedrooms and 6 bathrooms, a terraces of 470m2, a built of...

- Beds: 5

- Baths: 6

- Penthouse

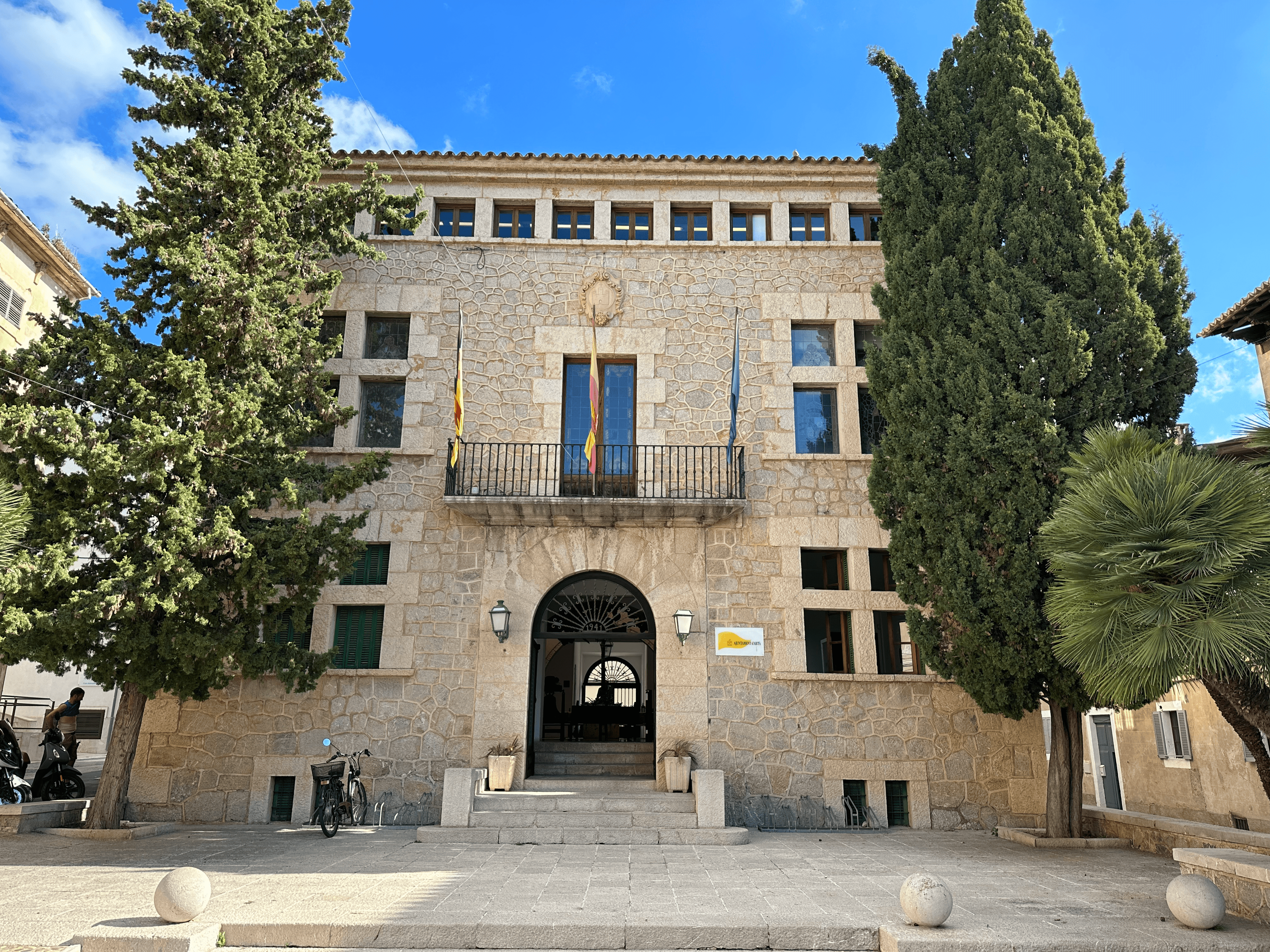

luxury Berlin real estate

Whether you seek to relocate, buy a second home, or make a sound investment in property in Berlin. Help is on hand to find, buy or sell luxury real estate in Berlin, Germany

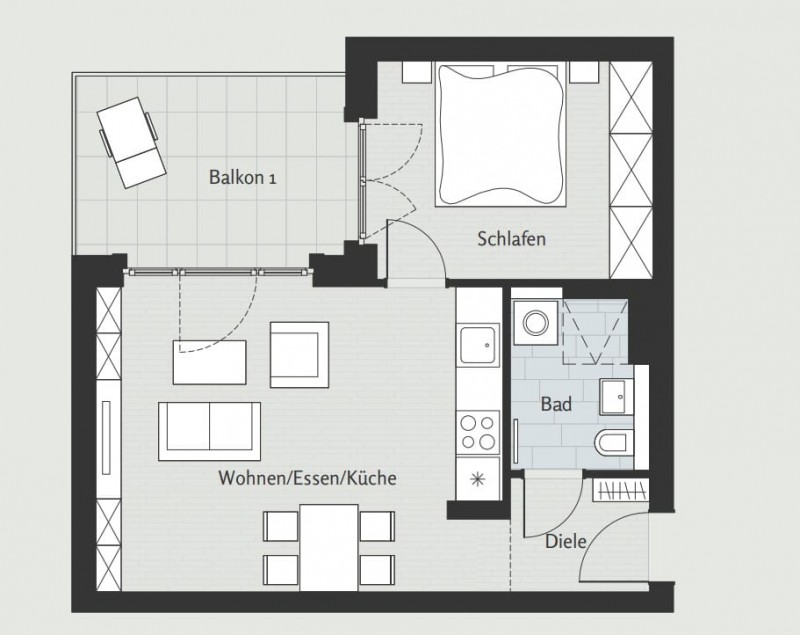

Brand-new Uspcale 2-room apartment for sale at Winterfeldtplatz in Schoneberg

Schoneberg, Berlin, 10781- Apartment

- 1 Bedroom

- 1 Bathroom

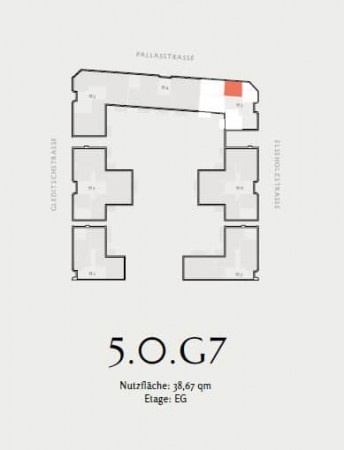

Trendy location next to KaDeWe – commercial unit for sale

Schoneberg, Berlin, 10781- Commercial

- 0 Bedroom

- 0 Bathroom

Close to Helmholtzplatz: Tenanted 2-room apartment with balcony in Prenzlauer Berg

Prenzlauer Berg, Berlin, 10437- Apartment

- 1 Bedroom

- 1 Bathroom

Luxury Property Finding Service

From period luxury homes to modern off plan developments. Speak to us about your purchase

Search for luxury real estate Europe

From a Mansion in London, a Penthouse in Berlin to a bolt hole in the Balearic Islands we specialise in luxury European real estate

Land For sale Europe

If you seeking land for the commercial or residential project you are in the right place. With a huge network of partners across Europe we can help you source land for sale.

Land for sale in Pythagorion Samos Island Greece

Pythagorion Samos Island Greece North Agean, , , Greece- Bed: 0

- Garage: 0

- Land

Excellent Plot of Land and Commercial Warehouse Units for Sale in Galati

str. Prelungirea Foltanului, nr. 73A, Galati, , Romania- Bed: 0

- Garage: 0

- Land

For those seeking land for sale in Europe, there are numerous enticing options to explore. Some good places to consider for land purchases include:

Algarve, Portugal: Algarve offers beautiful land plots for those looking to create their dream homes with scenic views of the Atlantic Ocean.

Tuscany, Italy: Tuscany’s countryside is a fantastic choice for investing in land for vineyards, olive groves, or building your Tuscan estate.

Costa del Sol, Spain: The picturesque landscapes of Costa del Sol provide opportunities for land investments, whether for development or private estates.

Santorini, Greece: The volcanic beauty of Santorini offers unique land plots with panoramic views, ideal for creating luxury retreats.

See: Land Sales Europe

Our services

Real Estate Blog

Find a host of articles about Luxury real estate, mortgage advice and buyers tips for high end real estate

Luxury Home Buyers & Sellers FAQs

1. What countries does EuropeanProperty.com cover?

EuropeanProperty.com features luxury real estate listings across all of Europe, including Spain, France, Italy, Portugal, Switzerland, and more.

Read full country list →

2. Can I advertise my luxury property on your site?

Yes, we offer premium listing options for sellers and agents looking to reach high-net-worth buyers.

Learn how to list your property →

3. Are listings on EuropeanProperty.com verified?

We work only with trusted agents, developers, and property professionals to maintain high-quality listings.

Read more about our verification process →

4. Do you offer property listings in English?

Yes — our listings and communications are in English to serve an international audience.

Find out more about international access →

5. Is there a fee to browse properties?

No. Browsing and inquiring about properties on EuropeanProperty.com is completely free.

Get details →

6. Can international buyers purchase property in Europe?

Yes, most European countries allow international property purchases.

Explore purchase rules by country →

7. What types of luxury properties do you list?

We list villas, estates, apartments, penthouses, and unique homes like châteaux and chalets.

See property types →

8. How do I contact an agent about a property?

Each listing includes direct contact options for the agent or developer.

More on how to inquire safely →

9. Can I get alerts for new luxury listings?

Yes — subscribe to receive updates on new properties that match your preferences.

Sign up here →

10. Is EuropeanProperty.com a real estate agency?

No — we are a platform that connects buyers with trusted agents and developers across Europe.

Learn about how we work →

Compare listings

CompareForgot Password

Please enter your username or email address. You will receive a link to create a new password via email.